如果你也在 怎样代写宏观经济学Macroeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

宏观经济学,对国家或地区经济整体行为的研究。它关注的是了解整个经济的事件,如商品和服务的生产总量、失业水平和价格的一般行为。

statistics-lab™ 为您的留学生涯保驾护航 在代写宏观经济学Macroeconomics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写宏观经济学Macroeconomics代写方面经验极为丰富,各种代写宏观经济学Macroeconomics相关的作业也就用不着说。

我们提供的宏观经济学Macroeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|宏观经济学代写Macroeconomics代考|James Tobin and refinements to Keynesian theory

James Tobin was a Keynesian economist and winner of the Nobel Prize. His longterm project was to further and improve upon the Keynesian theory. The maverick Keynesian Hyman Minsky, whom we will meet later in this chapter, lamented (1975) that Keynes suffered a heart attack in 1937 and was unable to participate in the refinements to his theories. However, James Tobin was there to improve upon Keynes while remaining in the same spirit. This section examines Tobin’s theories of real investment and the demand for money.

Tobin’s theory of real investment (1969) is now the accepted theory and is known as the $\mathrm{Q}$ theory of investment. $\mathrm{Q}$ is defined as the ratio of the market value of a real investment to its cost. For example, real estate developers compare the cost of a project to the price at which it can be sold. A ratio greater than $1.0$ indicates an incentive to undertake the investment. It is understood that real estate projects take time to be completed, so a lag is built into the model. So where does $Q$ come from?

The value of $Q$ includes the present discounted value of the stream of outputs attributable to one unit of capital, divided by the cost of adding the unit of capital. It is assumed that capital has a rising supply price. Suppose the value of $Q$ for the first unit of additional capital is $1.2, \mathrm{Q}$ for the second unit is $1.15$ because of the cost of the second unit of capital is higher than for the first unit, $Q$ for the third unit is 1.1, etc. Investment will proceed until the last unit of capital added has a $Q$ of $1.0$. So the rate of investment depends upon $\mathrm{Q}$ for the first unit of additional capital and the (positive) slope of the supply curve of additional capital.

$Q$ theory has been extended to include investments made under conditions of risk. Risk refers to situations in which future values of key variables have known probability distributions. In this case, the present discounted value of output produced by adding a unit of capital is a random variable. In the case of risk, the discount rate is adjusted for market risk. Note two things about the theory. First, the theory has been worked out for risky situations but not for situations of uncertainty when the future is just about completely unknown. Second, the value of an investment depends upon expectations of the price of future outputs. So investment decisions depend critically upon opinions regarding future market values. What could go wrong here?

经济代写|宏观经济学代写Macroeconomics代考|New Keynesian economics

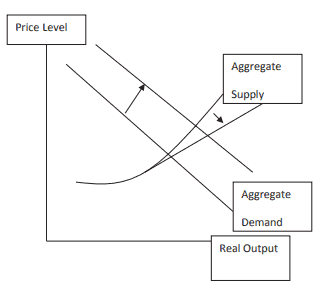

What is known as the new Keynesian economics started to develop during the 1970 s, the period of high unemployment and inflation – a combination inconsistent with the standard Keynesian model. Keynesians adapted their models to account for the events of the 1970 s, and these adaptations are described in Chapters 4 and 5 . Mankiw and Romer (1991) define new Keynesian models as having these features:

- The model violates the classical dichotomy between the real and money economies. In other words, changes in the supply of money have real economic effects.

- The model presumes that there are real imperfections in the economy that explain the nature of economic fluctuations.

New Keynesians devised a variety of models to explain the “real imperfections.”

An important part of that research agenda was providing microeconomic foundations for the stickiness of wages and prices that cause markets not to clear rapidly. In particular, the stickiness of wages leading to involuntary unemployment was a critical topic. Janet Yellen (1984) provided a good summary of the resulting theoretical research. She began (1984, p. 200) with:

Keynesian economists hold it to be self-evident that business cycles are characterized by involuntary unemployment. But construction of a model of the cycle with involuntary unemployment faces the obvious difficulty of explaining why the labor market does not clear. Involuntarily unemployed people, by definition, want to work at less than the going wage rate. Why don’t firms cut wages, thereby increasing profits?

The models she discussed are based on the efficiency wage hypothesis – the idea that labor productivity depends on the real wage paid. A firm will offer a wage rate that maximizes its profits, and that wage induces an efficient amount of “effort” on the part of the workers. The “real imperfection” idea is that worker effort cannot be monitored continuously (i.e., information is not complete), so workers are motivated by good wages. Unemployed workers would like to work at this efficient wage rate or even a lower wage, but the firm will not hire them. The firm has already set employment and the wage to maximize profits, so it will not hire more workers at that wage. Furthermore, they will not lower the wage and hire more workers because the lower wage will reduce labor productivity. In other words, the real wage rate is not flexible in the downward direction because labor productivity will fall.

经济代写|宏观经济学代写Macroeconomics代考|The financial instability hypothesis

Keynes included an extended discussion of financial markets and the tendency to speculate on changes in asset prices. His conclusion $(1936$, p. 159):

Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes the by-product of the activities of a casino, the job is likely to be ill-done.

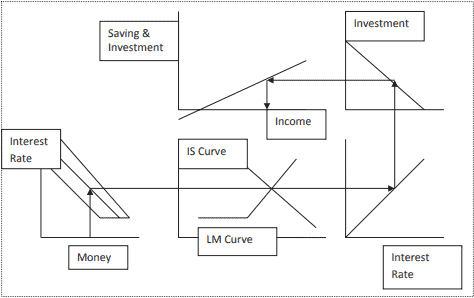

The late Hyman Minsky, a Keynesian who was ignored by most Keynesians in his lifetime, is now back in fashion. Minsky objected strenuously to the neoclassical synthesis of Hicks and Hansen. His chief objection is the much-too-simple model of investment spending in the Hicksian IS-LM model, in which investment is simply a function of the interest rate. He argued that Keynes without including the inherent instability of financial markets is akin to “Hamlet without the prince” – in other words, the play staged without the central character. Minsky (1975) supplemented the Keynesian approach by arguing that during a boom period, asset prices increase and, in order to take advantage of increasing values, the private sector will figure out ways and means of expanding credit and financial leverage that defeat attempts at regulation. “Animal spirits” take over. Financial bubbles can and do exist. This sounds familiar, does it not? Recall that the $\mathrm{Q}$ theory of investment includes the effect of expected changes in asset prices. Then, some event occurs that starts financial collapse and the process of deleveraging. In particular, increases in investment in assets such as real estate and durable equipment took place in response to the increase in their market values. Investors discover too late that they have created too many real assets. The annual incomes from those assets fall below expectations. Hedge investors (cash flow sufficient to cover all debt service) become speculative investors (cash flow covers only interest of debt, with no return to the investor), speculative investors become Ponzi investors (cash flow insufficient to cover interest payments), and Ponzi investors become zombies (walking dead). Investment collapses, and Keynesian remedies are needed. The process is inherent in the nature of a capitalist economy, according to Keynes as interpreted by Minsky.

Now let’s turn to Minsky’s intellectual heirs. The late Charles Kindleberger’s classic book Manias, Panics, and Crashes: A History of Financial Crises is based on Minsky’s model. This book is an encyclopedic account of financial crises through history. One can predict that Kindleberger’s coauthor, Robert Aliber, will update the book soon to include the recent crisis. Similarly, Robert Shiller has gained prominence from a series of books that argues that financial bubbles are the cause of financial crises. One of his latest is The Subprime Solution, in which he states that the housing market bubble began in 1997 (well before the U.S. Fed cut interest rates starting in 2001), and that the actions taken by the private sector can be explained by the existence of rising housing prices. Why not make loans to anyone when the price of the house will always go up? Who cares if the borrowers are not qualified? But housing suppliers responded and the bubble burst – as it always does.

宏观经济学代考

经济代写|宏观经济学代写Macroeconomics代考|James Tobin and refinements to Keynesian theory

詹姆斯·托宾是凯恩斯主义经济学家和诺贝尔奖获得者。他的长期计划是进一步完善凯恩斯理论。我们将在本章稍后会见的特立独行的凯恩斯主义者海曼·明斯基(Hyman Minsky)感叹(1975 年)凯恩斯在 1937 年心脏病发作,无法参与对他的理论的改进。然而,詹姆斯托宾在保持同样精神的同时,也在改进凯恩斯。本节考察托宾的实际投资和货币需求理论。

托宾的实际投资理论(1969)现在是公认的理论,被称为问投资理论。问定义为实际投资的市场价值与其成本的比率。例如,房地产开发商将项目的成本与可以出售的价格进行比较。比大于1.0表示进行投资的动机。据了解,房地产项目需要时间才能完成,因此模型中内置了滞后性。那么在哪里问来自?

的价值问包括归属于一个资本单位的产出流的当前贴现值除以增加该单位资本的成本。假设资本的供给价格上涨。假设值问对于第一单位的额外资本是1.2,问第二个单位是1.15因为第二单位资本的成本高于第一单位,问对于第三个单位是 1.1 等。投资将持续到最后一个增加的资本单位有问的1.0. 所以投资率取决于问对于第一单位额外资本和额外资本供给曲线的(正)斜率。

问理论已经扩展到包括在风险条件下进行的投资。风险是指关键变量的未来值具有已知概率分布的情况。在这种情况下,增加一单位资本所产生的当前贴现值是一个随机变量。在存在风险的情况下,贴现率会根据市场风险进行调整。请注意有关该理论的两件事。首先,该理论是针对风险情况制定的,但不适用于未来几乎完全未知的不确定情况。其次,投资的价值取决于对未来产出价格的预期。因此,投资决策主要取决于对未来市场价值的看法。这里有什么问题?

经济代写|宏观经济学代写Macroeconomics代考|New Keynesian economics

所谓的新凯恩斯主义经济学是在 1970 年代开始发展的,即高失业率和通货膨胀时期——与标准凯恩斯主义模型不一致的组合。凯恩斯主义者调整了他们的模型以解释 1970 年代的事件,这些调整在第 4 章和第 5 章中进行了描述。Mankiw 和 Romer (1991) 将新的凯恩斯模型定义为具有以下特征:

- 该模型违反了实体经济和货币经济之间的经典二分法。换句话说,货币供应量的变化具有实际的经济影响。

- 该模型假设经济中存在真正的不完美性来解释经济波动的性质。

新凯恩斯主义者设计了多种模型来解释“真正的缺陷”。

该研究议程的一个重要部分是为导致市场无法迅速出清的工资和价格粘性提供微观经济基础。特别是,导致非自愿失业的工资粘性是一个关键话题。Janet Yellen (1984) 很好地总结了由此产生的理论研究。她从(1984 年,第 200 页)开始:

凯恩斯主义经济学家认为,商业周期的特点是非自愿失业是不言而喻的。但构建非自愿失业周期模型面临着解释劳动力市场为何不清晰的明显困难。根据定义,非自愿失业者希望以低于现行工资率的价格工作。为什么企业不削减工资,从而增加利润?

她讨论的模型基于效率工资假设——劳动生产率取决于实际支付的工资。一家公司将提供一个使其利润最大化的工资率,并且该工资会引起工人的有效“努力”。“真正的不完美”的想法是工人的努力不能被持续监控(即信息不完整),所以工人的动机是好的工资。失业工人希望以这种有效的工资率甚至更低的工资工作,但公司不会雇用他们。该公司已经设定了就业和工资以实现利润最大化,因此它不会以该工资雇用更多的工人。此外,他们不会降低工资并雇用更多工人,因为较低的工资会降低劳动生产率。换句话说,

经济代写|宏观经济学代写Macroeconomics代考|The financial instability hypothesis

凯恩斯对金融市场和推测资产价格变化的趋势进行了扩展讨论。他的结论(1936,页。159):

投机者可能不会像企业源源不断的泡沫那样造成伤害。但当企业成为投机漩涡中的泡沫时,情况就很严重了。当一个国家的资本发展成为赌场活动的副产品时,这项工作很可能做得不好。

已故的海曼·明斯基(Hyman Minsky)是一位在其一生中被大多数凯恩斯主义者忽视的凯恩斯主义者,现在又重新流行起来。明斯基强烈反对希克斯和汉森的新古典主义综合。他的主要反对意见是希克斯 IS-LM 模型中过于简单的投资支出模型,其中投资只是利率的函数。他认为,不考虑金融市场固有的不稳定性的凯恩斯类似于“没有王子的哈姆雷特”——换句话说,这出戏是在没有中心人物的情况下上演的。Minsky (1975) 补充了凯恩斯主义的方法,他认为在繁荣时期,资产价格会上涨,为了利用价值上涨,私营部门会想办法扩大信贷和金融杠杆,从而挫败监管的尝试. “动物精神”接管。金融泡沫可以而且确实存在。这听起来很熟悉,不是吗?回想一下Q投资理论包括资产价格预期变化的影响。然后,发生了一些事件,开始了金融崩溃和去杠杆化的过程。特别是房地产和耐用设备等资产的投资增加,以应对其市场价值的增加。投资者发现他们创造了太多的实物资产为时已晚。这些资产的年收入低于预期。对冲投资者(现金流足以支付所有债务)成为投机投资者(现金流仅涵盖债务利息,不回报投资者),投机投资者成为庞氏投资者(现金流不足以支付利息)和庞氏投资者成为僵尸(行尸走肉)。投资崩溃,需要凯恩斯主义的补救措施。

现在让我们转向明斯基的知识继承人。已故查尔斯·金德尔伯格的经典著作《疯狂、恐慌和崩溃:金融危机的历史》是基于明斯基的模型。这本书是历史上金融危机的百科全书。可以预见,金德尔伯格的合著者罗伯特·阿利伯(Robert Aliber)将很快更新这本书,以纳入最近的危机。同样,罗伯特·席勒(Robert Shiller)也因一系列主张金融泡沫是金融危机原因的著作而声名鹊起。他的最新作品之一是次贷解决方案,其中他指出房地产市场泡沫始于 1997 年(远在美联储从 2001 年开始降息之前),私营部门采取的行动可以解释为存在的房价上涨。当房子的价格总是上涨时,为什么不向任何人贷款呢?谁在乎借款人是否不合格?但住房供应商做出了回应,泡沫破灭了——就像往常一样。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。