如果你也在 怎样代写风险建模Financial risk modeling这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

风险建模是确定有多少风险存在于一个特定的企业、投资或一系列的现金流中。

statistics-lab™ 为您的留学生涯保驾护航 在代写风险建模Financial risk modeling方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写风险建模Financial risk modeling代写方面经验极为丰富,各种代写风险建模Financial risk modeling相关的作业也就用不着说。

我们提供的风险建模Financial risk modeling及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等楖率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

统计代写|风险建模代写Financial risk modeling代考|Activities during a day

The intraday patterns of foreign exchange transaction are anecdotally and instinctively known to bank dealers. However, only a few academic papers have statistically examined market activities so far. Ito and Hashimoto $(2004,2006)$ were one of the first teams to analyze the foreign exchange market using tick-by-tick deal data.

Following Ito and Hashimoto (2006), this section examines highfrequency data on foreign exchange market activities such as the “number of quotes,” the “number of deals,” “bid-ask spread” and the “relative volume share” in order to show the intraday patterns of the foreign exchange market. The sample period is from 1999 to 2001 . The number of quotes is calculated as the number of seconds where quotes are recorded, and the number of deals is the sum of bid-side deals and askside deals in each hour of the day. 12 The “relative volume” is defined as

hourly aggregated relative volumes: the percentage share of transaction volume in one minute relative to the total transaction volume in one day. The hourly transaction volumes, with each contract (transaction) being one million of the “base currency” (the first currency in the currency pair name), are divided by the total trading volume of the day. ${ }^{13}$ These indicators of market activities are calculated for one hour and then averaged over three years with a differentiation of the standard and daylight saving time. 14

Figure $3.2$ shows the intraday (Hour $0-23$ ) patterns of the numbers of deals, quotes and the bid-ask spread of the USDJPY and Figure $3.3$ shows those of the EURUSD. 15

统计代写|风险建模代写Financial risk modeling代考|Regional contribution

The above analysis based on counts of deals and quotes reveals that the transaction activities become exceptionally high during the overlapping business hours of the currency pair home markets – the Tokyo afternoon and London morning (the second peak) and the London afternoon and the US morning (the third peak). The next question is on the regional contribution to the surge in activities. For example, whether a surge in activities in the Tokyo mid-afternoon hours and London morning hours can be attributed to the activity of Tokyo participants or London participants. In the following section, we decompose the regional contributions to the activity surge by the relative trading volume shares which have the label of participants (regional names).

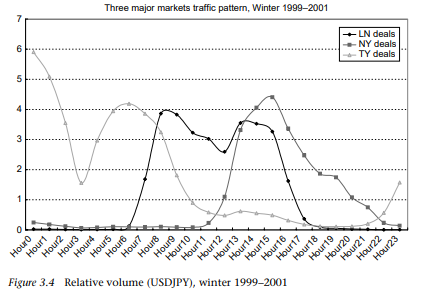

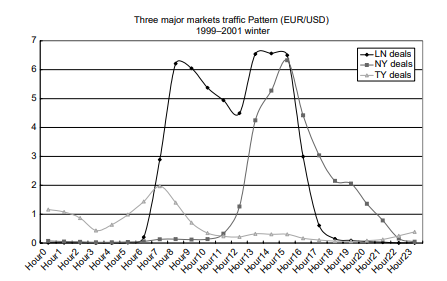

The regional contributions to the surge in trades for dollar/yen activities are shown in Figure $3.4$ and for euro/dollar in Figure $3.5^{17}$ The dollar/yen trades during the overlapping hours of the Tokyo afternoon and London morning are done by Tokyo (and Asian) participants (financial institutions in Japan and Asia region) and London (and European) participants (financial institutions in Europe) around GMT Hours 6-8,

with the majority of Tokyo participants at the beginning and then with the increasing share of London participants. During this time period, transactions from New York (the United States) participants (financial institutions in North America) are quite small and almost negligible. On the other hand, the dollar/yen trades during the overlapping hours of the London afternoon and the New York morning are mainly done by London and New York participants with some Tokyo participants.

The figures also reveal that transactions by Tokyo participants and London participants exhibit a U-shape pattern, whereas the transactions by New York participants have a single-peak pattern. The monotonic decline in market activities, the number of deals and quotes, after the New York afternoon may be due to two reasons: there is no pickup effect in the New York afternoon (unlike the Tokyo or London markets) and the transactions after GMT 16 are mainly done by the New York participants (almost no participants from Tokyo and London). The very large trade volume among the Tokyo participants during the Tokyo business hours (except for lunch hours) implies that, for the dollar/yen trade, the Tokyo market has new information, inducing heterogeneous reactions to the news, thereby generating more trade.

统计代写|风险建模代写Financial risk modeling代考|Market opening hours

As seen in the analysis above, each market experiences a surge in transactions during the opening hours. When there are many participants in the market (the market is “deep”), trading volume tends to be higher and spreads tend to be narrower. The opening hour of the Tokyo market appears to have special characteristics because it follows a few hours of extremely low activity after the New York market closes. In particular, the Monday morning of the Tokyo market probably has some specific activity patterns because the Tokyo market is the first to open after a long weekend break, from Friday night to Monday morning. The first hour of Tokyo on Monday (Hour 0 in adjusted GMT) may be different because the volume of orders accumulated during the weekend (about 35 hours) is much larger than those accumulated during the overnight gap (2-3 hours between the New York close and Tokyo opening) resulting in much higher activity compared to the same hour on any other day of the week. Similarly, we expect the opening hours of the London and New York markets to show some special characteristics in trading activity.

Ito and Hashimoto (2006) examined the opening-hour effect of the three markets (Tokyo, London and New York), the Monday morning effect and the (lack of) U-shape pattern by testing the significance of dummy variables that take the value 1 when deals/quotes are recorded in the opening hours (or Monday opening hours). They found that, in general, the negative relationship between the number of deals (quotes) and the spread holds even for these opening hours. That is, when the market is deep (when the number of price [quotes] changes is large) the bid-ask spread tends to be narrower.

The Tokyo opening effect and Tokyo Monday opening effect are tested by examining the relationship between the spread and the number of deals/quotes with opening-hour dummies. 18 For the Tokyo opening effect in 1999 , it turns out that the spread becomes narrower as the number of deals/quotes increases during the opening hour, 9 am Tokyo time, for both the dollar/yen trade and the euro/dollar trade. On the other hand, as for the Monday opening effect, it is found that the number of deals significantly increases during the Monday opening hours for the dollar/yen trade in 1999 and 2000 , suggesting that the market participants carry out some orders accumulated over the weekend in the first hour of the week, the Monday Tokyo morning at GMT Hour 0 , despite the relatively wide bid-ask spread. The Monday Tokyo effect is not found for the euro/dollar trade.

风险建模代写

统计代写|风险建模代写Financial risk modeling代考|Activities during a day

外汇交易的日内模式对于银行交易商来说是轶事和本能地知道的。然而,到目前为止,只有少数学术论文对市场活动进行了统计研究。伊藤和桥本(2004,2006)是最早使用逐笔交易数据分析外汇市场的团队之一。

继 Ito 和 Hashimoto(2006 年)之后,本节研究了外汇市场活动的高频数据,例如“报价数量”、“交易数量”、“买卖价差”和“相对交易量份额”,以便显示外汇市场的盘中格局。样本期为 1999 年至 2001 年。报价数量计算为记录报价的秒数,成交数量是一天中每个小时的买入方成交和卖出方成交的总和。12 “相对体积”定义为

每小时总相对交易量:一分钟的交易量相对于一天的总交易量的百分比。每小时交易量,每份合约(交易)为一百万“基础货币”(货币对名称中的第一个货币),除以当天的总交易量。13这些市场活动指标按一小时计算,然后在三年内取平均值,区分标准时间和夏令时。14

数字3.2显示盘中(小时0−23) 交易数量、报价和 USDJPY 的买卖差价的模式和图3.3显示 EURUSD 的那些。15

统计代写|风险建模代写Financial risk modeling代考|Regional contribution

上述基于成交和报价统计的分析表明,在货币对国内市场重叠营业时间——东京下午和伦敦上午(第二个高峰)以及伦敦下午和美国上午(第三高峰)。下一个问题是区域对活动激增的贡献。例如,东京午后时间和伦敦上午时间的活动激增是否可以归因于东京参与者或伦敦参与者的活动。在下一节中,我们将区域对活动激增的贡献分解为具有参与者(区域名称)标签的相对交易量份额。

区域对美元/日元活动交易激增的贡献如图所示3.4以及图中的欧元/美元3.517东京下午和伦敦上午重叠时段的美元/日元交易由东京(和亚洲)参与者(日本和亚洲地区的金融机构)和伦敦(和欧洲)参与者(欧洲的金融机构)在格林威治标准时间前后进行6-8,

一开始是东京的大多数参与者,然后是伦敦参与者的比例越来越高。在此期间,来自纽约(美国)参与者(北美金融机构)的交易非常小,几乎可以忽略不计。另一方面,伦敦下午和纽约上午重叠时段的美元/日元交易主要由伦敦和纽约参与者以及一些东京参与者完成。

数据还显示,东京参与者和伦敦参与者的交易呈现 U 形模式,而纽约参与者的交易呈现单峰模式。纽约下午之后市场活动、成交和报价数量单调下降可能是由于两个原因:纽约下午没有回升效应(与东京或伦敦市场不同)以及 GMT 16 之后的交易主要由纽约参与者完成(东京和伦敦几乎没有参与者)。在东京营业时间(午餐时间除外),东京参与者之间的巨大交易量意味着,对于美元/日元的交易,东京市场有新的信息,引起对新闻的不同反应,从而产生更多的交易。

统计代写|风险建模代写Financial risk modeling代考|Market opening hours

从上面的分析可以看出,每个市场在开放时间内的交易量都会激增。当市场参与者众多时(市场“深度”),交易量往往会更高,点差往往会更窄。东京市场的开市时间似乎具有特殊性,因为它是在纽约市场收盘后几个小时的极低活动之后。尤其是东京市场的周一早上可能有一些特定的活动模式,因为东京市场是在从周五晚上到周一早上的长周末休息后最先开市的。周一东京的第一个小时(调整后的格林威治标准时间为 0 小时)可能会有所不同,因为周末(约 35 小时)累积的订单量远大于隔夜间隔期间(纽约之间的 2-3 小时)累积的订单量关闭和东京开放)与一周中任何其他一天的同一小时相比,活动量要高得多。同样,我们预计伦敦和纽约市场的开市时间将在交易活动中表现出一些特殊特征。

Ito 和 Hashimoto(2006 年)通过检验取值的虚拟变量的显着性,检验了三个市场(东京、伦敦和纽约)的开市时间效应、周一早上效应和(缺乏)U 形模式1 当交易/报价记录在营业时间(或周一营业时间)时。他们发现,一般来说,交易数量(报价)与价差之间的负相关关系即使在这些开放时间也成立。也就是说,当市场深度时(当价格 [报价] 变化的数量很大时),买卖差价往往会更窄。

东京开盘效应和东京星期一开盘效应通过检查价差与开盘时间虚拟交易/报价数量之间的关系来测试。18 对于 1999 年的东京开市效应,事实证明,在东京时间上午 9 点的开市时间,无论是美元/日元交易还是欧元/美元交易,价差都随着交易/报价数量的增加而变窄。另一方面,关于周一开盘效应,发现1999年和2000年的美元/日元交易在周一开盘时间内成交数量明显增加,表明市场参与者进行了一些累积的订单。周末在一周的第一个小时,即周一东京早上 GMT 0 时,尽管买卖价差相对较大。