如果你也在 怎样代写量化风险管理Quantitative Risk Management这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

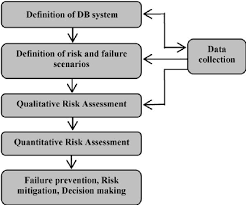

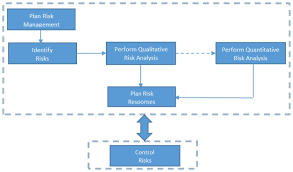

项目管理中的定量风险管理是将风险对项目的影响转换为数字的过程。这种数字信息经常被用来确定项目的成本和时间应急措施。

statistics-lab™ 为您的留学生涯保驾护航 在代写量化风险管理Quantitative Risk Management方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写量化风险管理Quantitative Risk Management代写方面经验极为丰富,各种代写量化风险管理Quantitative Risk Management相关的作业也就用不着说。

我们提供的量化风险管理Quantitative Risk Management及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

金融代写|量化风险管理代写Quantitative Risk Management代考|Herstatt Bank

As mentioned in the previous section, the collapse of the Bretton Woods System led to the implementation of a floating exchange rate system. This new system was at the root of the incident leading to the creation of the Basel Committee on Banking Supervision (Schenk 2014).

Indeed, on 26 June 1974 , German regulators decided to force the liquidation of the troubled Herstatt Bank. Unfortunately, that day, a number of banks had released payment of Deutsche Marks to Herstatt in Frankfurt in exchange for US Dollars that were to be delivered in New York. The bank was closed at 4:30 p.m. German time, which was equivalent to $10: 30$ a.m. in New York. Because of time zone differences, Herstatt ceased operations between the times of the respective payments and as a consequence the counterparty banks did not receive their USD payments. ${ }^{2}$

Responding to the cross-jurisdictional implications of the Herstatt issue, the G-10 introduced before joined by Luxembourg and Spain, formed a standing committee under the auspices of the Bank for International Settlements located in Basel, nowadays refereed to as the Basel Committee on Banking Supervision. This committee comprises representatives from central banks and regulatory authorities of the aforementioned countries.

The failure of the Herstatt Bank (Mourlon-Druol 2015) was the triggering factor that led to the worldwide implementation of real-time gross settlement systems, in order to ensure that payments between banks were executed in real-time and considered final and the works were coordinated by the Basel Committee on Banking Supervision. The continuous linked settlement platform was released 30 years later in 2002 . This payment versus payment process enables member banks to trade foreign currencies without assuming the settlement risk associated with the process, whereby a counterparty could fail before delivering their leg of the transaction.

Once the Basel Committee had been created to tackle issues, it was only a matter of time before a first set of rules were released.

金融代写|量化风险管理代写Quantitative Risk Management代考|Basel I

In 1988, the Basel Committee on Banking Supervision (BCBS) in Basel, Switzerland, published a set of minimum capital requirements for banks referred to as the 1988 Basel Accord or Basel I (BCBS 1988), and was enforced by law in the countries members of the G-10 in 1992. The accord primarily focused on credit risk and appropriate risk-weighting of assets. Assets of banks were grouped in five categories according to credit risk respectively carrying risk weights of $0 \%$ (for example, cash, bullion, home country debt like Treasuries), $20 \%$ (securitisations such as mortgage-backed securities (MBS) with the highest AAA rating), $50 \%$ (municipal revenue bonds, residential mortgages), 100\% (for example, most corporate debt), and some assets given no rating. Banks with an international presence are required to hold capital equal to $8 \%$ of their risk-weighted assets (RWA) (Cooke Ratio). The elements that banks have to take into account are: (1) The tier 1 capital ratio = tier 1 capital/all RWA; (2) The total capital ratio $=($ tier $1+$ tier $2+$ tier 3 capital)/all RWA; (3) Leverage ratio $=$ total capital/average total assets. It appears necessary here to define tiers 1,2 , and 3 capital. Tier 1 capital represents the core capital, i.e., common stock and disclosed reserves (or retained earnings), and non-redeemable non-cumulative preferred stock. Tier 2 capital represents the “supplementary capital”, i.e., undisclosed reserves, revaluation reserves, general loan-loss reserves, hybrid capital instruments, and subordinated debt. Tier 3 capital mainly consists of short-term subordinated debt.

Furthermore, banks were also required to report off-balance sheet items such as letters of credit, unused commitments, and derivatives. These assets were all supposed to factor into the risk weighted assets. Then the reports were submitted to the pertaining regulatory body for supervisory purposes.

Since 1988 this framework has been progressively introduced in G-10 countries, comprising 13 countries as of 2013: Belgium, Canada, France, Germany, Italy, Japan, Luxembourg, Netherlands, Spain, Sweden, Switzerland, United Kingdom, and the USA. Eventually, most countries adopted the principles prescribed under Basel I, though the enforcement level of these principles was varying from an implementing country to another. During the period of Basel I enforcement the various market and operational risk incident led the various stakeholders to question the extend of the relevance of the accord. The thoughtful process led to the release of a subsequent accord, usually referred to as Basel II.

金融代写|量化风险管理代写Quantitative Risk Management代考|Basel II

Basel II is the second of the Basel Accords which were recommendations on financial regulations issued by the Basel Committee on Banking Supervision. Initially released in June 2004 (Decamps et al. 2004), Basel II intended to amend international standards that controlled how much capital banks were required to

hold to survive the occurrence of financial and operational risks. These rules were supposed to ensure that the amount of capital banks needed to hold was consistent with the exposure faced by the regulated financial institutions in order to safeguard their solvency and economic stability. Therefore, Basel II established risk management and capital requirements to ensure that banks had appropriate risk controls and adequate capital amount for the risk the banks expose themselves to through their lending, investment, and trading activities. The renewed accords were also supposed to bring some consistency between the various pieces of regulation to limit competitive inequality and regulatory arbitrage among and between internationally active banks.

Basel II was supposed to be implemented in the years prior to 2008 though the large number of measures required to be compliant with the regulation delayed the roll-out, and consequently the subprime crisis hit the banks before Basel II could be fully effective.

Basel II accord objectives are as follows:

- Ensuring that capital allocation is more risk sensitive;

- Enhancing disclosure requirements which would allow market participants to assess the capital adequacy of an institution;

- Ensuring that credit risk, operational risk, and market risk are quantified based on data and formal techniques;

- Attempting to align economic and regulatory capital more closely to reduce the scope for regulatory arbitrage. ${ }^{3}$

量化风险管理代考

金融代写|量化风险管理代写Quantitative Risk Management代考|Herstatt Bank

如上节所述,布雷顿森林体系的崩溃导致了浮动汇率制度的实施。这个新系统是导致巴塞尔银行监管委员会成立的事件的根源(Schenk 2014)。

事实上,1974 年 6 月 26 日,德国监管机构决定强制清算陷入困境的赫斯塔特银行。不幸的是,当天,多家银行已将德国马克支付给法兰克福的赫斯塔特,以换取将在纽约交付的美元。银行于德国时间下午 4:30 关闭,相当于10:30我在纽约。由于时区差异,Herstatt 在两次付款之间停止运营,因此交易对手银行没有收到美元付款。2

为应对赫斯塔特问题的跨司法管辖区影响,在卢森堡和西班牙加入之前引入的 10 国集团成立了一个常设委员会,由位于巴塞尔的国际清算银行主持,现在被称为巴塞尔银行委员会监督。该委员会由来自上述国家的中央银行和监管机构的代表组成。

Herstatt 银行的失败 (Mourlon-Druol 2015) 是导致全球实施实时全额结算系统的触发因素,以确保银行之间的支付实时执行并被视为最终和工程由巴塞尔银行监管委员会协调。连续联动结算平台于30年后的2002年发布。这种付款对付款流程使成员银行能够在不承担与流程相关的结算风险的情况下进行外币交易,因此交易对手可能在交付交易之前失败。

一旦巴塞尔委员会成立以解决问题,发布第一套规则只是时间问题。

金融代写|量化风险管理代写Quantitative Risk Management代考|Basel I

1988 年,位于瑞士巴塞尔的巴塞尔银行监管委员会 (BCBS) 发布了一套被称为 1988 年巴塞尔协议或巴塞尔 I (BCBS 1988) 的银行最低资本要求,并在成员国法律中得到执行1992 年的 G-10。该协议主要关注信用风险和适当的资产风险加权。银行资产按信用风险分为五类,分别承担风险权重0%(例如,现金、金条、国库券等本国债务),20%(证券化,例如具有最高 AAA 评级的抵押贷款支持证券 (MBS)),50%(市政收入债券、住宅抵押贷款)、100%(例如,大多数公司债务),以及一些没有评级的资产。拥有国际业务的银行必须持有相等于8%他们的风险加权资产(RWA)(库克比率)。银行必须考虑的要素有: (1) 一级资本比率=一级资本/所有风险加权资产;(二)总资本比例=(等级1+等级2+三级资本)/所有风险加权资产;(3) 杠杆率=总资本/平均总资产。这里似乎有必要定义层 1,2 和 3 资本。一级资本代表核心资本,即普通股和披露储备(或留存收益),以及不可赎回的非累积优先股。二级资本代表“补充资本”,即未披露准备金、重估准备金、一般贷款损失准备金、混合资本工具和次级债务。三级资本主要包括短期次级债。

此外,银行还需要报告表外项目,例如信用证、未使用的承诺和衍生品。这些资产都应该计入风险加权资产。然后将报告提交给相关监管机构进行监管。

自 1988 年以来,该框架已逐步在 10 国集团国家中引入,截至 2013 年包括 13 个国家:比利时、加拿大、法国、德国、意大利、日本、卢森堡、荷兰、西班牙、瑞典、瑞士、英国和美国。最终,大多数国家采用了巴塞尔 I 中规定的原则,尽管这些原则的执行水平因实施国而异。在巴塞尔协议 I 执行期间,各种市场和操作风险事件导致各种利益相关者质疑该协议的相关性的扩展。经过深思熟虑的过程导致了随后的协议的发布,通常称为巴塞尔协议 II。

金融代写|量化风险管理代写Quantitative Risk Management代考|Basel II

巴塞尔协议 II 是巴塞尔协议中的第二个,是巴塞尔银行监管委员会发布的关于金融监管的建议。巴塞尔协议 II 最初于 2004 年 6 月发布(Decamps 等人,2004 年),旨在修改控制银行需要多少资本金的国际标准。

坚持在财务和经营风险的发生中生存。这些规则旨在确保银行需要持有的资本金额与受监管金融机构面临的风险敞口一致,以保障其偿付能力和经济稳定性。因此,巴塞尔协议 II 制定了风险管理和资本要求,以确保银行对银行通过贷款、投资和交易活动所面临的风险进行适当的风险控制和充足的资本金额。更新后的协议还应该在各种监管之间带来一定的一致性,以限制国际活跃银行之间的竞争不平等和监管套利。

巴塞尔协议 II 原应在 2008 年之前实施,但由于需要遵守法规的大量措施延迟了推出,因此在巴塞尔协议 II 完全生效之前,次贷危机袭击了银行。

巴塞尔协议 II 的目标如下:

- 确保资本配置对风险更加敏感;

- 加强披露要求,使市场参与者能够评估机构的资本充足率;

- 确保基于数据和形式化技术对信用风险、操作风险和市场风险进行量化;

- 试图更紧密地协调经济和监管资本,以减少监管套利的范围。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。