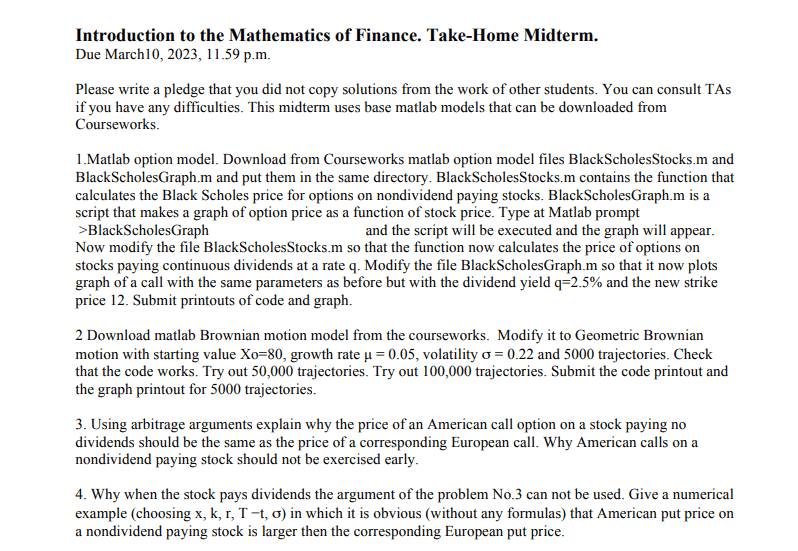

2 Download matlab Brownian motion model from the courseworks. Modify it to Geometric Brownian motion with starting value $X_o=80$, growth rate $\mu=0.05$, volatility $\sigma=0.22$ and 5000 trajectories. Check that the code works. Try out 50,000 trajectories. Try out 100,000 trajectories. Submit the code printout and the graph printout for 5000 trajectories.

To modify the Matlab code for Brownian motion to Geometric Brownian motion, we need to modify the formula for calculating the next value of the stock price. In Brownian motion, the change in the stock price is determined by a normal distribution with mean 0 and standard deviation σ times the square root of the time step Δt. In Geometric Brownian motion, the change in the stock price is determined by a normal distribution with mean (μ – σ^2/2) times Δt and standard deviation σ times the square root of Δt. The formula for calculating the next value of the stock price becomes:

$$ X_{t+1} = X_t * e^{( \mu – \frac{\sigma^2}{2} ) \Delta t + \sigma \sqrt{\Delta t} * Z} $$

where Z is a standard normal random variable.

Using arbitrage arguments explain why the price of an American call option on a stock paying no dividends should be the same as the price of a corresponding European call. Why American calls on a nondividend paying stock should not be exercised early.

An American call option gives the holder the right to buy an underlying stock at a strike price K at any time up to the expiration date T of the option. A European call option gives the holder the same right, but only at the expiration date T.

If we assume that the stock pays no dividends, then the stock price S follows a geometric Brownian motion with constant drift μ and volatility σ, and the risk-free interest rate is denoted by r. Let C and C_A denote the prices of a European call and an American call on the stock, respectively. We want to show that C = C_A.

Suppose for contradiction that C > C_A. Then, an arbitrage opportunity arises. Here’s how to exploit it:

- Buy the European call option for price C.

- Simultaneously, sell (short) the stock for price S and invest the proceeds at the risk-free rate r. This creates a cash inflow of S – C.

- At expiration T, the value of the European call option is max(S(T) – K, 0), which we can use to buy the stock if it’s in the money (S(T) > K), or keep the cash if it’s out of the money (S(T) ≤ K).

- If the European call option is exercised, we use the stock we bought at step 2 to fulfill our obligation and deliver it at the strike price K, receiving K in return. If the European call option is not exercised, we keep the stock we bought at step 2 and sell it for S(T) in the market, receiving S(T) in return.

- In either case, we end up with a profit of S(T) – C – (S – C)e^(rT), which is greater than or equal to zero by construction.

Therefore, the assumption that C > C_A leads to an arbitrage opportunity, which cannot exist in an efficient market. Therefore, we must have C = C_A.

Now, why should an American call option on a nondividend paying stock not be exercised early? Suppose that the option is in the money (S > K) and the holder exercises the option early. This means that the holder pays the strike price K and receives the stock, which is worth more than K. But this transaction can also be achieved by selling the option in the market, which is worth at least as much as the stock, and then buying the stock at the market price, which is less than or equal to S. Therefore, exercising the option early leads to a strictly lower payoff than selling the option in the market and buying the stock at the market price. Therefore, it’s never optimal to exercise an American call option on a nondividend paying stock early.

。