如果你也在 怎样代写宏观经济学Macroeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

宏观经济学,对国家或地区经济整体行为的研究。它关注的是了解整个经济的事件,如商品和服务的生产总量、失业水平和价格的一般行为。

statistics-lab™ 为您的留学生涯保驾护航 在代写宏观经济学Macroeconomics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写宏观经济学Macroeconomics代写方面经验极为丰富,各种代写宏观经济学Macroeconomics相关的作业也就用不着说。

我们提供的宏观经济学Macroeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|宏观经济学代写Macroeconomics代考|how fiscal policy works

Fiscal policy involves making changes in government spending and taxation. Both the amounts of government spending and taxation change with overall economic activity. In a recession, tax revenues decline because households and firms have less taxable income. And expenditures increase because government programs for unemployment insurance and welfare payments rise. When the economy is booming, the reverse happens; tax revenues go up and these types of expenditures decline.

There is basic algebra for tax revenue that you need to understand. Tax revenue (Rev) equals the tax rate (T) times the tax base (B), or

$$

\operatorname{Rev}=\mathrm{T} \times \mathrm{B}

$$

So in a recession, the tax base declines and revenue falls unless the tax rate is increased. And if the tax rate is increased, revenue will rise as long as the increase in the tax rate does not cause the tax base to decline “too much.” Now comes the big idea. A reduction in the tax rate might cause the tax base to increase enough so that revenue will go up. Does this happen? With a lower tax rate, will workers and firms work more and increase their taxable incomes? After all, their efforts now pay off more. But will those increased efforts increase the tax base enough to make revenue increase? Or will workers and firms actually work less because they can make the same after-tax income with less effort? Or will there be no change in work effort? Under these last two scenarios, tax revenue definitely will fall. These questions will pop up later in the book, especially when we encounter what is called supply-side economics.

So let us get back to fiscal policy. There two basic types of fiscal policy: automatic stabilizers and discretionary policy. Automatic stabilizers are those policies built into the fiscal system that will increase expenditures during a macroeconomic downturn and decline during an upturn. Unemployment compensation and welfare programs are examples. On the taxation side, a progressive tax means that a taxpayer with a higher tax base pays a higher tax rate at the margin (the tax on an additional dollar or pound of income). For example, a household might face the following tax schedule:During an economic downturn, the household might experience a decline in taxable income from $\$ 90,000$ to $\$ 60,000$ that puts it in a lower “tax bracket.” The household sees a decline in its marginal tax rate from $22 \%$ to $12 \%$ – quite a decline. In fact, the tax payment falls from $\$ 18,486$ to $\$ 6,812$, a decline of $64 \%$ with a decline in income of $33 \%$. (I invite you to figure the taxes under both scenarios. Remember that the tax on the first $\$ 19,400$ is $\$ 1,940$.) With a progressive tax system, the household is somewhat cushioned in a downturn by a disproportional drop in its tax payment.

经济代写|宏观经济学代写Macroeconomics代考|How to compute percentage change

The appendix can be skipped upon the first reading of the book but will need to be studied when you begin to read chapters about the macroeconomic episodes that involve looking closely at data.

Very often, we shall examine percentage changes in many of the macroeconomics variables such as GDP, investment, prices, and money supply. You must get used to computing percentage changes, so here is a quick tutorial. You should have a calculator handy that includes the option of providing the natural logarithm of a number. We’ll use the GDP deflator index numbers seen earlier, which are

The basic computation for percentage change from one year to the next, in this case from 2010 to 2011 , is

$$

(103.31-101.22) / 101.22=.0206 \text {, or } 2.06 \text { percent } .

$$

Here is the quick way to do this one – one calculation instead of two:

$103.31 / 101.22=1.0206$, so the percentage change is $2.06$

If the change is negative, you still compute percentage change by subtracting the earlier number from the later number and dividing by the earlier number. For example, if investment falls from $\$ 70$ billion to $\$ 60$ billion, compute $(60-70) / 70$ $=-.143$, or $-14.3$ percent.

It is obvious that the percentage change from 2009 to 2013 is $6.73$ percent because the index for 2009 is $100.00$. In general, one would compute

$$

106.73 / 100.00=1.0673

$$

What is the average percentage change over the four years from 2009 to 2013 ? One method is simply to divide $6.73$ by 4 , or $1.68$ percent. This method can be inaccurate if the elapse of time is long or if the changes are large. Here is the technically correct way to do it. Write

$$

(1+i)(1+i)(1+i)(1+i)=(1+i)^{4}=1.0673

$$

Here, $i$ is the annual percentage change that produces an increase of $6.73$ percent over four years. This is the equation for compound interest from investing $\$ 1$ for four years at interest rate $i$. The trick is to solve for i. Clearly $(1+i)$ is equal to the fourth root of $1.0673$, but the higher roots are difficult to compute. Instead, take the natural logarithm of both sides of the equation, where ln stands for natural logarithm:

$$

4 \ln (1+i)=\ln (1.0673)

$$

经济代写|宏观经济学代写Macroeconomics代考|schools of thought in macroeconomics

The field of macroeconomics can be broken down into several schools of thought, and this book provides an introduction to each of them. No doubt the scholars who have spent their lives developing and refining a particular school of thought will find that I have simplified things too much. I submit that simplification cannot be avoided in an introductory treatment. That is what textbooks do. The purpose of the book is to provide a sensible introduction to each theory, and to see how each theory stacks up against the data for various episodes. Most textbooks cover only one theory, and do not systematically assess how well that theory accounts for what actually happened. One textbook by Snowdon and Vane (2005) covers all of the schools of thought up to 2005 and includes interviews with important scholars associated with each one. Some discussion of actual events is included here and there. But the book is over 700 pages in length and is more appropriate for graduate students.

The schools of thought presented in this book are as follows:

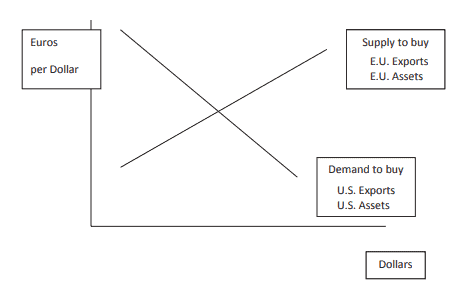

- Keynesian theory, with discussion of financial instability and other additions to basic Keynesian theory made over the years. Keynesians emphasize the role of aggregate demand and its components as the source of fluctuations in the economy. The shift in the demand curve in Figure $1.1$ gives the basic idea. They advocate the use of active monetary policy and fiscal policy (government spending and taxation) to influence aggregate demand and stabilize the economy.

- Monetarism associated with Milton Friedman and others, with extension to include rational expectations (the idea that people form realistic expectations that influence their current behavior). Monetarists see changes in the supply of money as a principal cause of the ups and downs of the economy. Changes in the supply of money are thought mainly to influence the demand side of the economy. They argue that activist monetary policy is dangerous and should be avoided. They think that the supply of money should be governed by a simple rule.

宏观经济学代考

经济代写|宏观经济学代写Macroeconomics代考|how fiscal policy works

财政政策涉及改变政府支出和税收。政府支出和税收的数额都随着整体经济活动而变化。在经济衰退中,税收收入下降,因为家庭和企业的应税收入减少。支出增加,因为政府的失业保险和福利支付计划增加。当经济繁荣时,情况正好相反;税收增加,这些类型的支出减少。

您需要了解税收的基本代数。税收收入 (Rev) 等于税率 (T) 乘以税基 (B),或

转=吨×乙

因此,在经济衰退中,除非提高税率,否则税基会下降,收入也会下降。如果提高税率,只要提高税率不会导致税基“下降太多”,收入就会增加。现在来了一个大主意。降低税率可能会导致税基增加到足以使收入增加。这会发生吗?税率越低,工人和公司会工作得更多并增加他们的应税收入吗?毕竟,他们的努力现在得到了更多回报。但这些增加的努力是否会增加税基足以增加收入?或者工人和公司实际上会更少工作,因为他们可以用更少的努力获得相同的税后收入?还是工作努力没有变化?在这最后两种情况下,税收肯定会下降。

所以让我们回到财政政策。财政政策有两种基本类型:自动稳定器和酌情政策。自动稳定器是那些内置于财政体系中的政策,这些政策将在宏观经济低迷时增加支出,在经济好转时减少支出。失业补偿和福利计划就是例子。在税收方面,累进税意味着具有较高税基的纳税人在边际上支付较高的税率(对额外的美元或英镑收入征税)。例如,一个家庭可能面临以下税收计划:在经济低迷时期,家庭可能会经历应税收入的下降$90,000至$60,000这使其处于较低的“税级”中。家庭的边际税率从22%至12%- 相当下降。事实上,纳税额从$18,486至$6,812, 下降64%随着收入的下降33%. (我邀请您计算两种情况下的税收。请记住,第一种情况下的税收$19,400是$1,940.) 在累进税制的情况下,家庭在经济低迷时期由于其纳税额的不成比例下降而受到一定程度的缓冲。

经济代写|宏观经济学代写Macroeconomics代考|How to compute percentage change

第一次阅读本书时可以跳过附录,但当您开始阅读涉及密切关注数据的宏观经济事件的章节时,需要研究该附录。

很多时候,我们会检查许多宏观经济学变量的百分比变化,例如 GDP、投资、价格和货币供应量。您必须习惯于计算百分比变化,所以这里有一个快速教程。您应该有一个方便的计算器,其中包括提供数字自然对数的选项。我们将使用前面看到的 GDP 平减指数,即

从一年到下一年的百分比变化的基本计算,在这种情况下是从 2010 到 2011 ,是

(103.31−101.22)/101.22=.0206, 或者 2.06 百分 .

这是执行此操作的快速方法 – 一次计算而不是两次:

103.31/101.22=1.0206,所以百分比变化是2.06

如果变化是负数,您仍然可以通过从较晚的数字中减去较早的数字并除以较早的数字来计算百分比变化。例如,如果投资从$70亿到$60十亿,计算(60−70)/70 =−.143, 或者−14.3百分。

很明显,从 2009 年到 2013 年的百分比变化是6.73百分比,因为 2009 年的指数是100.00. 一般来说,人们会计算

106.73/100.00=1.0673

从 2009 年到 2013 年这四年的平均百分比变化是多少?一种方法是简单地划分6.73由 4 或1.68百分。如果经过的时间很长或变化很大,则此方法可能不准确。这是技术上正确的方法。写

(1+一世)(1+一世)(1+一世)(1+一世)=(1+一世)4=1.0673

这里,一世是产生增加的年度百分比变化6.73超过四年的百分比。这是投资复利的方程式$1四年利率一世. 诀窍是解决 i。清楚地(1+一世)等于的第四个根1.0673,但较高的根很难计算。相反,取等式两边的自然对数,其中 ln 代表自然对数:

4ln(1+一世)=ln(1.0673)

经济代写|宏观经济学代写Macroeconomics代考|schools of thought in macroeconomics

宏观经济学领域可以分为几个思想流派,本书对它们分别进行了介绍。毫无疑问,那些毕生致力于发展和完善特定学派的学者会发现我把事情简化得太多了。我认为在介绍性治疗中不能避免简化。这就是教科书的作用。本书的目的是对每种理论进行合理的介绍,并了解每种理论如何与不同事件的数据相比较。大多数教科书只涵盖一种理论,并没有系统地评估该理论对实际发生的事情的解释程度。Snowdon 和 Vane(2005 年)的一本教科书涵盖了截至 2005 年的所有思想流派,并包括对与每个思想流派相关的重要学者的采访。这里和那里都包含一些对实际事件的讨论。但这本书有700多页,更适合研究生。

本书介绍的思想流派如下:

- 凯恩斯理论,讨论了金融不稳定和多年来对基本凯恩斯理论的其他补充。凯恩斯主义者强调总需求及其组成部分作为经济波动来源的作用。图中需求曲线的移动1.1给出了基本思路。他们主张使用积极的货币政策和财政政策(政府支出和税收)来影响总需求并稳定经济。

- 与米尔顿弗里德曼和其他人相关的货币主义,延伸到包括理性期望(人们形成影响他们当前行为的现实期望的想法)。货币主义者将货币供应的变化视为经济起伏的主要原因。人们认为货币供应的变化主要影响经济的需求方面。他们认为激进的货币政策是危险的,应该避免。他们认为货币供应应该遵循一个简单的规则。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。