如果你也在 怎样代写宏观经济学Macroeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

宏观经济学,对国家或地区经济整体行为的研究。它关注的是了解整个经济的事件,如商品和服务的生产总量、失业水平和价格的一般行为。

statistics-lab™ 为您的留学生涯保驾护航 在代写宏观经济学Macroeconomics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写宏观经济学Macroeconomics代写方面经验极为丰富,各种代写宏观经济学Macroeconomics相关的作业也就用不着说。

我们提供的宏观经济学Macroeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|宏观经济学代写Macroeconomics代考|Trade Can Make Everyone Better Off

You may have heard on the news that the Chinese are our competitors in the world economy. In some ways, this is true because American firms and Chinese firms produce many of the same goods. Companies in the United States and China compete for the same customers in the markets for clothing, toys, solar panels, automobile tires, and many other items.

Yet it is easy to be misled when thinking about competition among countries. Trade between the United States and China is not like a sports contest in which one side wins and the other side loses. The opposite is true: Trade between two countries can make each country better off.

To see why, consider how trade affects your family. When a member of your family looks for a job, she competes against members of other families who are looking for jobs. Families also compete against one another when they go shopping because each family wants to buy the best goods at the lowest prices. In a sense, each family in an economy competes with all other families.

Despite this competition, your family would not be better off isolating itself from all other families. If it did, your family would need to grow its own food, sew its own clothes, and build its own home. Clearly, your family gains much from being able to trade with others. Trade allows each person to specialize in the activities she does best, whether it is farming, sewing, or home building. By trading with others, people can buy a greater variety of goods and services at lower cost.

Like families, countries also benefit from being able to trade with one another. Trade allows countries to specialize in what they do best and to enjoy a greater variety of goods and services. The Chinese, as well as the French, Egyptians, and Brazilians, are as much our partners in the world economy as they are our competitors.

经济代写|宏观经济学代写Macroeconomics代考|Way to Organize Economic Activity

The collapse of communism in the Soviet Union and Eastern Europe in the late 1980 s and early 1990 s was one of the last century’s most transformative events. Communist countries operated on the premise that government officials were in the best position to allocate the economy’s scarce resources. These central planners decided what goods and services were produced, how much was produced, and who produced and consumed these goods and services. The theory behind central planning was that only the government could organize economic activity in a way that promoted well-being for the country as a whole.

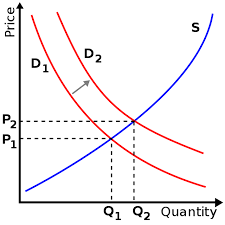

Most countries that once had centrally planned cconomies have abandoned the system and instead have adopted market economies. In a market economy, the decisions of a central planner are replaced by the decisions of millions of firms and households. Firms decide whom to hire and what to make. Households decide which firms to work for and what to buy with their incomes. These firms and households interact in the marketplace, where prices and self-interest guide their decisions.

At first glance, the success of market economies is puzzling. In a market economy, no one is looking out for the well-being of society as a whole. Free markets contain many buyers and sellers of numerous goods and services, and all of them are interested primarily in their own well-being. Yet despite decentralized decision making and self-interested decision makers, market economies have proven remarkably successful in organizing economic activity to promote overall prosperity.

In his 1776 book An Inquiry into the Nature and Causes of the Wealth of Nations, economist Adam Smith made the most famous observation in all of economics:

Households and firms interacting in markets act as if they are guided by an “invisible hand” that leads them to desirable market outcomes. One of our goals in this book is to understand how this invisible hand works its magic.

As you study economics, you will learn that prices are the instrument with which the invisible hand directs economic activity. In any market, buyers look at the price when deciding how much to demand, and sellers look at the price when deciding how much to supply. As a result of these decisions, market prices reflect both the value of a good to society and the cost to society of making the good. Smith’s great insight was that prices adjust to guide buyers and sellers to reach outcomes that, in many cases, maximize the well-being of society as a whole.

Smith’s insight has an important corollary: When a government prevents prices from adjusting naturally to supply and demand, it impedes the invisible hand’s ability to coordinate the decisions of the households and firms that make up an economy. This corollary explains why taxes adversely affect the allocation of resources: They distort prices and thus the decisions of households and firms. It also explains the problems caused by policies that control prices, such as rent control. And it explains the failure of communism. In communist countries, prices were not determined in the marketplace but were dictated by central planners. These planners lacked the necessary information about consumers’ tastes and producers’ costs, which in a market economy is reflected in prices. Central planners failed because they tried to run the economy with one hand tied behind their backs – the invisible hand of the marketplace.

经济代写|宏观经济学代写Macroeconomics代考|Adam Smith Would Have Loved Uber

( CASE STUDY $)$ You have probably never lived in a centrally planned economy, but STUDY if you have ever tried to hail a cab in a major city, you have likely experienced a highly regulated market. In many cities, the local government imposes strict controls in the market for taxis. The rules usually go well beyond regulation of insurance and safety. For example, the government may limit entry into the market by approving only a certain number of taxi medallions or permits. It may determine the prices that taxis are allowed to charge. The government uses its police powers-that is, the threat of fines or jail time-to keep unauthorized drivers off the streets and prevent drivers from charging unauthorized prices.

In 2009 , however, this highly controlled market was invaded by a disruptive force: Uber, a company that provides a smartphone app to connect passengers and drivers. Because Uber cars do not roam the streets looking for taxi-hailing pedestrians, they are technically not taxis and so are not subject to the same regulations. But they offer much the same service. Indeed, rides from Uber cars are often more convenient. On a cold and rainy day, who wants to stand on the side of the road waiting for an empty cab to drive by? It is more pleasant to remain inside, use your smartphone to arrange a ride, and stay warm and dry until the car arrives.

Uber cars often charge less than taxis, but not always. Uber’s prices rise significantly when there is a surge in demand, such as during a sudden rainstorm or late on New Year’s Eve, when numerous tipsy partiers are looking for a safe way to get home. By contrast, regulated taxis are typically prevented from surge pricing.

Not everyone is fond of Uber. Drivers of traditional taxis complain that this new competition cuts into their source of income. This is hardly a surprise: Suppliers of goods and services often dislike new competitors. But vigorous competition among producers makes a market work well for consumers.

That is why economists love Uber. A 2014 survey of several dozen prominent economists asked whether car services such as Uber increased consumer wellbeing. Every single economist said “Yes.” The economists were also asked whether surge pricing increased consumer well-being. “Yes,” said 85 percent of them. Surge pricing makes consumers pay more at times, but because Uber drivers respond to incentives, it also increases the quantity of car services supplied when they are most needed. Surge pricing also helps allocate the services to those consumers who value them most highly and reduces the costs of searching and waiting for a car.

If Adam Smith were alive today, he would surely have the Uber app on his phone.

宏观经济学代考

经济代写|宏观经济学代写Macroeconomics代考|Trade Can Make Everyone Better Off

你可能听说过,中国人是我们在世界经济中的竞争对手。在某些方面,这是正确的,因为美国公司和中国公司生产许多相同的商品。美国和中国的公司在服装、玩具、太阳能电池板、汽车轮胎和许多其他产品的市场上争夺相同的客户。

然而,在考虑国家之间的竞争时,很容易被误导。美中贸易不像一场比赛,一方赢一方输。事实恰恰相反:两国之间的贸易可以让每个国家都变得更好。

要了解原因,请考虑贸易如何影响您的家庭。当您的家庭成员找工作时,她会与正在寻找工作的其他家庭成员竞争。家庭购物时也会互相竞争,因为每个家庭都想以最低的价格购买最好的商品。从某种意义上说,一个经济体中的每个家庭都与所有其他家庭竞争。

尽管有这种竞争,但您的家庭最好将自己与所有其他家庭隔离开来。如果是这样,您的家人将需要自己种植食物,缝制自己的衣服,并建造自己的房屋。显然,您的家人从能够与他人交易中获益良多。贸易使每个人都可以专注于她最擅长的活动,无论是农业、缝纫还是房屋建筑。通过与他人交易,人们可以以更低的成本购买更多种类的商品和服务。

与家庭一样,国家也因能够相互贸易而受益。贸易使各国能够专注于他们最擅长的事情,并享受更多种类的商品和服务。中国人,以及法国人、埃及人和巴西人,在世界经济中既是我们的竞争对手,也是我们的合作伙伴。

经济代写|宏观经济学代写Macroeconomics代考|Way to Organize Economic Activity

1980 年代末和 1990 年代初苏联和东欧共产主义的崩溃是上个世纪最具变革性的事件之一。共产主义国家的运作前提是政府官员处于分配经济稀缺资源的最佳位置。这些中央计划者决定生产什么商品和服务,生产多少,以及谁生产和消费这些商品和服务。中央计划背后的理论是,只有政府才能以促进整个国家福祉的方式组织经济活动。

大多数曾经实行中央计划经济的国家都放弃了这种体制,转而采用市场经济。在市场经济中,中央计划者的决策被数百万企业和家庭的决策所取代。公司决定雇用谁以及制造什么。家庭决定用他们的收入为哪些公司工作以及购买什么。这些公司和家庭在市场上互动,价格和自身利益指导他们的决策。

乍一看,市场经济的成功令人费解。在市场经济中,没有人关心整个社会的福祉。自由市场包含许多商品和服务的买家和卖家,他们都主要对自己的福祉感兴趣。然而,尽管分散的决策制定和自利的决策制定者,市场经济在组织经济活动以促进整体繁荣方面已被证明是非常成功的。

经济学家亚当·斯密在其 1776 年出版的《国富论的性质和原因的调查》一书中,提出了所有经济学中最著名的观察:

在市场上互动的家庭和公司的行为就像是由一只“看不见的手”引导着他们走向理想的市场结果。本书的目标之一是了解这只看不见的手是如何发挥它的魔力的。

当您学习经济学时,您将了解到价格是无形之手指导经济活动的工具。在任何市场中,买家在决定需求量时会看价格,而卖家在决定供应量时会看价格。作为这些决策的结果,市场价格既反映了一种商品对社会的价值,也反映了制造这种商品的社会成本。史密斯的伟大洞察力是价格调整以引导买卖双方达成在许多情况下最大化整个社会福祉的结果。

斯密的洞见有一个重要的推论:当政府阻止价格自然地适应供求关系时,它会阻碍看不见的手协调构成经济体的家庭和公司的决策的能力。这一推论解释了为什么税收会对资源配置产生不利影响:它们扭曲了价格,从而扭曲了家庭和企业的决策。它还解释了控制价格的政策带来的问题,例如租金控制。它解释了共产主义的失败。在共产主义国家,价格不是由市场决定的,而是由中央计划者决定的。这些计划者缺乏有关消费者口味和生产者成本的必要信息,而这些信息在市场经济中反映在价格中。

经济代写|宏观经济学代写Macroeconomics代考|Adam Smith Would Have Loved Uber

( 案例分析)您可能从未生活在中央计划经济中,但如果您曾尝试在大城市打车,那么您可能经历过一个高度监管的市场。在许多城市,当地政府对出租车市场实施严格控制。这些规则通常远远超出对保险和安全的监管。例如,政府可以通过仅批准一定数量的出租车牌照或许可证来限制进入市场。它可以决定允许出租车收取的价格。政府利用其警察权力——即以罚款或监禁时间为威胁——将未经授权的司机拒之门外,并防止司机收取未经授权的价格。

然而,在 2009 年,这个高度控制的市场被一股颠覆性力量入侵:优步,一家提供连接乘客和司机的智能手机应用程序的公司。因为优步汽车不会在街上寻找叫出租车的行人,所以从技术上讲,它们不是出租车,因此不受相同规定的约束。但他们提供的服务几乎相同。事实上,乘坐优步汽车通常更方便。在寒冷的雨天,谁愿意站在路边等一辆空出租车驶过?留在室内,使用智能手机安排行程,并保持温暖和干燥,直到汽车到达会更愉快。

优步汽车的收费通常低于出租车,但并非总是如此。当需求激增时,优步的价格会显着上涨,例如在突如其来的暴雨期间或新年前夜的末日,当时许多醉酒的人都在寻找安全的回家方式。相比之下,受监管的出租车通常会被阻止涨价。

不是每个人都喜欢优步。传统出租车司机抱怨这种新的竞争会削减他们的收入来源。这不足为奇:商品和服务供应商通常不喜欢新的竞争对手。但生产者之间的激烈竞争使市场对消费者有利。

这就是经济学家喜欢优步的原因。2014 年对数十位著名经济学家进行的一项调查询问了优步等汽车服务是否增加了消费者的幸福感。每个经济学家都说“是的”。经济学家还被问及激增定价是否增加了消费者的福祉。“是的,”其中 85% 的人说。激增的定价有时会让消费者支付更多费用,但由于优步司机对激励措施做出反应,它也增加了在最需要时提供的汽车服务数量。激增定价还有助于将服务分配给最重视它们的消费者,并降低搜索和等待汽车的成本。

如果亚当·斯密今天还活着,他的手机上肯定会有 Uber 应用程序。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。