如果你也在 怎样代写金融中的随机方法Stochastic Methods in Finance这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

随机建模是金融模型的一种形式,用于帮助做出投资决策。这种类型的模型使用随机变量预测不同条件下各种结果的概率。随着现代经济学、金融学实证研究的发展,金融中的随机方法Stochastic Methods in Finance作为一种数学工具具有越来越重要的应用价值。

statistics-lab™ 为您的留学生涯保驾护航 在代写金融中的随机方法Stochastic Methods in Finance方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写金融中的随机方法Stochastic Methods in Finance方面经验极为丰富,各种代写金融中的随机方法Stochastic Methods in Finance相关的作业也就用不着说。

我们提供的金融中的随机方法Stochastic Methods in Finance及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等楖率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Forward-Looking ALM Tests

From a strategic vantage point for an investor or pension sponsor, rule-based simulators are the instruments of choice for ongoing strategic risk control and management. These approaches allow for covering with very high degree of accuracy all aspects of the complex, individual situation in which strategic financial decisions are made. Realistic simulations of an investments vehicle’s stochastic behavior is a rich and reliable source for the information needed in ongoing strategic risk control activities as well for regularly revising decisions on risk optimal strategies allocation.

Most strategic decisions occur across a multi-periodic context, often with complex, path-dependent rules for rebalancing, contribution, and withdrawals. In most cases such conditional rebalancing rules can be found for each single asset; it is necessary to include them in order to represent each asset’s marginal contribution. Such rules are not only an essential aspect of asset allocation, but also the rules offer the opportunity to design and optimize them as an integral part of the strategy. In that sense one has to define strategic asset allocation not only as the composition of a portfolio, which would be sufficient if the world were a static one, but rather as an asset allocation strategy, which includes portfolio compositions and management rules. On the level of the strategy, these rules should not depend on exogenous conditions of single markets, but rather on the overall goal achievement compared to the individual preference structure, e.g., at a certain high funding level, a de-risking of the strategic portfolio happens, since no more risk taking is necessary to achieve the overall goals.

Such management rules always depend on additional sets of evaluation rules, internally or externally given, to evaluate the development of the results of the strategies, for example, under commercial law balance sheet and profit/loss calculations, taxation, or various other aspects. These rules produce incentives to favor one allocation strategy over another. Thus it is a basic requirement in order to find individually optimal strategies, to work with rule simulators, which represent relevant management and evaluation rules adequately and with the least level of simplification. This requirement is matched by modern rule simulators such as the PROTINUS Strategy Cockpit $^{\text {TM }}$ – described below and employed for the forward-looking tests.

When the multi-period environment is represented accurately, it becomes possible to design individually specific sets of objectives, constraints, and bounds. This is a major advantage of rule simulators, for which it is a condition qua sine non to have optimization and simulation in a single model setting. The necessity of optimizing strategies based on individual objective functions comes from the fact that any strategic investment is done to serve not a general common goal, but always to fulfill goals depending on individual conditions, rule sets, and preference structure. Systems like the PROTINUS Strategy Cockpit ” allow for setting up any objective functions derived from the variable of the rule set and perform desired calculation on them.

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|The PROTINUS Strategy CockpitTM

Protinus Strategy Cockpit is an integrated development environment for modeling multi-period stochastic planning problems in finance. It has been employed successfully as a strategic risk controlling and risk management tool over the past decade. It is a policy-rule simulator and optimizer, working in all MS Windows and MS Server ${ }^{\text {TM }}$ environments developed by the consulting firm PROTINUS in Munich, Germany. Ziemba and Mulvey (1998) described such systems in general, which they called decision rule approaches in comparison to alternative approaches, at a time when only very small number of implementations of such approaches existed. Predecessors of the PROTINUS Strategy Cockpit developed by the former Princeton-based organization Lattice Financial LLC were implemented, for example, as the first and, for several years, primary ALM system employed at the large German corporate Siemens.

The PROTINUS Strategy Cockpit ” generates user-specific rules by assembling a library of building block rules, ranging from simple arithmetic operations to complex accounting standards. The building blocks are put into the desired order via an execution schedule and where necessary a quantitative condition for their execution. PROTINUS Strategy Cockpit iM includes a powerful meta-heuristic, non-convex optimization algorithm based on early concepts of Glover’s Tabu search (Glover and Laguna 1997 ). The analyses are updated from past runs by saving solution information as templates and by grouping into reports. PROTINUS Strategy Cockpit ${ }^{\text {TM }}$ includes project management tools typically needed when working with large scenario spaces and complex rule sets and performing risk measurement and allocation studies. Figures $3.6$ and $3.7$ are screenshots from the financial engineers’ version. There is also a configuration available, which provides a fully automatic version, called PROTINUS Strategy Factory ${ }^{\text {TM }}$. Over the past several years, this system has been implemented to individually optimize on a quarterly basis, in a fully automatic fashion, several tens of thousands of portfolios for unit-linked insurance contracts provided by the Insurance Company Skandia in several countries in central Europe.

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Evaluating Several Versions of the Global DEO Strategy

This section has two purposes. First, it provides brief examples of how a rule simulator can help determine the effects of addition-specific investment products to a given asset universe, a question investors as well as providers of such products have

to answer regularly. Second, we will analyze specifically how the DEO strategies perform in a prospective context.

The overlay strategies are evaluated in PROTINUS Strategy Cockpit ${ }^{\text {TM }}$ with three case studies: an asset-only context, a pension plan with IFRS balance sheet calculations, and the same pension plan rule with an added conditional contribution rule. All three cases are based on scenarios for the DEO overlay strategies and a group of broad, standard markets, i.e., US and Euro-equity as well as Eurogovernment and Euro-corporate bonds. For the pension plan cases, IFRS liability scenarios are produced from the scenarios for inflation and discount rates of the economic model. The basic liability data representing the plan’s population with all its biometric characteristics come from a modified real data set. We choose to generate a 10 -year, 1000 -scenario space with a quarterly scaling, since all shorter time steps are not of the typical interest for the strategic investor. In addition, we employ a commodity overlay strategy, called the Princeton Index (Mulvey and Vural 2010), to provide additional diversification benefits.

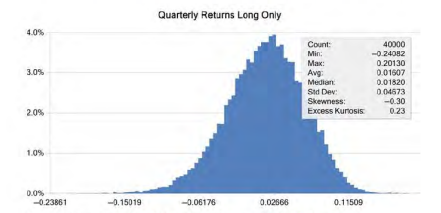

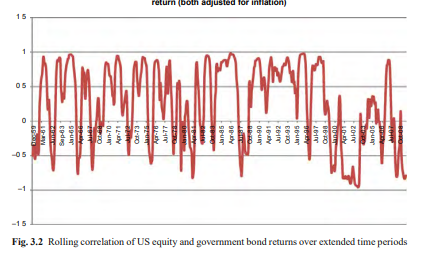

For these analyses, we apply a cascade structure economic model which allows for the generation of consistent scenario spaces for market returns and fundamentals and liabilities. The economic model is again made out of a group of simple building blocks. Early versions of such models are described by Mulvey (1996). The model includes basic equations with mean reverting assumptions and derives most returns processes implicitly from the cascade of fundamental processes. These return processes are either produced by functional dependencies or via advanced random number drawing techniques. For all processes the first four moments, including skewness and kurtosis, and the interactions among the variables can be defined explicitly. The cascade represents one core macroeconomic environment, typically representing the investor’s home region in order to include the local inflation and the rate, especially discount rate environment. These variables, along with scenarios for the liability variables such as IFRS defined benefit obligation (DBO), service cost, and pension payments are produced, so that a complete and fully consistent set of scenario spaces results, which represents accurately relevant exogenous risk factors.

金融中的随机方法代写

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Forward-Looking ALM Tests

从投资者或养老金发起人的战略角度来看,基于规则的模拟器是持续战略风险控制和管理的首选工具。这些方法可以非常准确地涵盖制定战略财务决策的复杂、个别情况的所有方面。投资工具随机行为的真实模拟是持续战略风险控制活动所需信息的丰富而可靠的来源,也可用于定期修订风险优化策略分配决策。

大多数战略决策发生在多周期环境中,通常具有复杂的、依赖路径的再平衡、贡献和退出规则。在大多数情况下,可以为每项资产找到此类有条件的再平衡规则;有必要将它们包括在内以代表每种资产的边际贡献。这些规则不仅是资产配置的一个重要方面,而且这些规则提供了设计和优化它们的机会,将其作为战略的一个组成部分。从这个意义上说,人们必须不仅将战略资产配置定义为投资组合的组成,如果世界是静态的就足够了,而是定义为一种资产配置策略,其中包括投资组合组成和管理规则。在战略层面,

此类管理规则总是依赖于内部或外部给出的附加评估规则集,以评估战略结果的发展,例如,根据商业法资产负债表和损益计算、税收或各种其他方面。这些规则产生了使一种分配策略优于另一种分配策略的激励。因此,为了找到单独的最优策略,使用规则模拟器是一项基本要求,它充分地代表了相关的管理和评估规则,并且简化程度最低。这一要求与现代规则模拟器相匹配,例如 PROTINUS Strategy CockpitTM值 – 如下所述并用于前瞻性测试。

当多周期环境被准确表示时,就可以单独设计一组特定的目标、约束和界限。这是规则模拟器的一个主要优势,因为在单个模型设置中进行优化和模拟是必不可少的条件。基于个体目标函数优化策略的必要性来自于这样一个事实,即任何战略投资都不是为了服务于一个普遍的共同目标,而是始终根据个体条件、规则集和偏好结构来实现目标。PROTINUS Strategy Cockpit 等系统允许设置从规则集变量派生的任何目标函数,并对它们执行所需的计算。

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|The PROTINUS Strategy CockpitTM

Protinus Strategy Cockpit 是一个集成开发环境,用于对金融领域的多期随机规划问题进行建模。在过去的十年中,它已成功地用作战略风险控制和风险管理工具。它是一个策略规则模拟器和优化器,适用于所有 MS Windows 和 MS ServerTM值 由德国慕尼黑的咨询公司 PROTINUS 开发的环境。Ziemba 和 Mulvey (1998) 概括地描述了这样的系统,他们将其称为与替代方法相比的决策规则方法,当时这种方法的实现数量很少。例如,由前普林斯顿组织 Lattice Financial LLC 开发的 PROTINUS Strategy Cockpit 的前身已被实施,作为德国大型企业西门子多年来使用的第一个 ALM 系统,也是多年来的主要 ALM 系统。

PROTINUS Strategy Cockpit”通过组装一个构建块规则库来生成用户特定的规则,范围从简单的算术运算到复杂的会计标准。构建块通过执行计划以及在必要时执行的定量条件被放入所需的顺序。PROTINUS Strategy Cockpit iM 包括一个强大的元启发式非凸优化算法,该算法基于 Glover 的禁忌搜索的早期概念(Glover 和 Laguna 1997)。通过将解决方案信息保存为模板并分组到报告中,可以从过去的运行中更新分析。PROTINUS 策略驾驶舱TM值 包括处理大型场景空间和复杂规则集以及执行风险测量和分配研究时通常需要的项目管理工具。数据3.6和3.7是金融工程师版本的截图。还有一个配置可用,它提供了一个全自动版本,称为 PROTINUS Strategy FactoryTM值 . 在过去的几年中,该系统已实施,以全自动方式按季度单独优化斯堪迪亚保险公司在中欧几个国家提供的数以万计的单位连结保险合同组合。

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Evaluating Several Versions of the Global DEO Strategy

本节有两个目的。首先,它提供了一个简短的例子,说明规则模拟器如何帮助确定特定资产范围内的特定投资产品的影响,投资者以及此类产品的提供者所面临的问题

定期回答。其次,我们将具体分析 DEO 策略在预期背景下的表现。

叠加策略在 PROTINUS Strategy Cockpit 中进行评估TM值 包含三个案例研究:仅资产环境、具有 IFRS 资产负债表计算的养老金计划,以及具有附加条件供款规则的相同养老金计划规则。所有三个案例都基于 DEO 覆盖策略和一组广泛的标准市场,即美国和欧洲股票以及欧洲政府和欧洲公司债券的情景。对于养老金计划案例,IFRS 负债情景是根据经济模型的通货膨胀和贴现率情景产生的。代表计划人口及其所有生物特征的基本责任数据来自修改后的真实数据集。我们选择生成一个 10 年、1000 个场景并按季度缩放的空间,因为所有较短的时间步长都不是战略投资者的典型利益。此外,

对于这些分析,我们应用了级联结构经济模型,该模型允许为市场回报、基本面和负债生成一致的情景空间。经济模型再次由一组简单的构建块组成。Mulvey (1996) 描述了这种模型的早期版本。该模型包括具有均值回归假设的基本方程,并从基本过程的级联中隐含地得出大多数回报过程。这些返回过程要么是由函数依赖产生的,要么是通过高级随机数绘制技术产生的。对于所有过程,前四个矩,包括偏度和峰度,以及变量之间的相互作用可以明确定义。级联代表一个核心宏观经济环境,通常代表投资者的家乡地区,以包括当地的通货膨胀率和利率,尤其是贴现率环境。这些变量,连同负债变量的情景,如 IFRS 界定福利义务 (DBO)、服务成本和养老金支付,产生了一套完整且完全一致的情景空间,准确地代表了相关的外生风险因素。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。统计代写|python代写代考

随机过程代考

在概率论概念中,随机过程是随机变量的集合。 若一随机系统的样本点是随机函数,则称此函数为样本函数,这一随机系统全部样本函数的集合是一个随机过程。 实际应用中,样本函数的一般定义在时间域或者空间域。 随机过程的实例如股票和汇率的波动、语音信号、视频信号、体温的变化,随机运动如布朗运动、随机徘徊等等。

贝叶斯方法代考

贝叶斯统计概念及数据分析表示使用概率陈述回答有关未知参数的研究问题以及统计范式。后验分布包括关于参数的先验分布,和基于观测数据提供关于参数的信息似然模型。根据选择的先验分布和似然模型,后验分布可以解析或近似,例如,马尔科夫链蒙特卡罗 (MCMC) 方法之一。贝叶斯统计概念及数据分析使用后验分布来形成模型参数的各种摘要,包括点估计,如后验平均值、中位数、百分位数和称为可信区间的区间估计。此外,所有关于模型参数的统计检验都可以表示为基于估计后验分布的概率报表。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

statistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

机器学习代写

随着AI的大潮到来,Machine Learning逐渐成为一个新的学习热点。同时与传统CS相比,Machine Learning在其他领域也有着广泛的应用,因此这门学科成为不仅折磨CS专业同学的“小恶魔”,也是折磨生物、化学、统计等其他学科留学生的“大魔王”。学习Machine learning的一大绊脚石在于使用语言众多,跨学科范围广,所以学习起来尤其困难。但是不管你在学习Machine Learning时遇到任何难题,StudyGate专业导师团队都能为你轻松解决。

多元统计分析代考

基础数据: $N$ 个样本, $P$ 个变量数的单样本,组成的横列的数据表

变量定性: 分类和顺序;变量定量:数值

数学公式的角度分为: 因变量与自变量

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。