如果你也在 怎样代写金融中的随机方法Stochastic Methods in Finance这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

随机建模是金融模型的一种形式,用于帮助做出投资决策。这种类型的模型使用随机变量预测不同条件下各种结果的概率。随着现代经济学、金融学实证研究的发展,金融中的随机方法Stochastic Methods in Finance作为一种数学工具具有越来越重要的应用价值。

statistics-lab™ 为您的留学生涯保驾护航 在代写金融中的随机方法Stochastic Methods in Finance方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写金融中的随机方法Stochastic Methods in Finance方面经验极为丰富,各种代写金融中的随机方法Stochastic Methods in Finance相关的作业也就用不着说。

我们提供的金融中的随机方法Stochastic Methods in Finance及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等楖率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Defined Benefit Pension Plans

Traditional pension trusts, called defined benefit (DB) plans herein, are threatened by a number of forces. The factors include (1) the loss of funding surpluses occurring over the past 10 years and current underfunded ratios, (2) a demographic nightmare – long-lived retirees and a shrinking workforce, (3) changing regulations, (4) greater emphasis on individual responsibilities for managing personal affairs such as retirement, and $(\supset)$ inefficient financial planning. 1he days of someone working for a single organization-IBM for example-for their entire career and then retiring with comfort supported by the company’s contributions are largely gone (except for public sector employees in certain cases).

This chapter takes up the lack of effective risk management and financial planning by DB pension plans. The $2001 / 2002$ economic contraction showed that the ample pension plan surpluses that existed in 1999 could be lost during an equity market downturn and a commensurate drop in interest rates which raises

the market value of liabilities (Mulvey et al. 2005b; Ryan and Fabozzi 2003). The loss of surplus could have been largely avoided by applying modern asset and liability management models to the problem of DB pension plans. Boender et al. (1998), Bogentoft et al. (2001), Cariño et al. (1994), Dempster et al. (2003, 2006), Dert (1995), Hilli et al. (2003), Kouwenberg and Zenios (2001), Mulvey et al. (2000, 2008), Zenios and Ziemba (2006), and Ziemba and Mulvey (1998) describe the methodology and show examples of successful applications. The Kodak pension plan (Olson 2005), for example, implemented an established ALM system for pensions in 1999, protecting its surplus over the subsequent recession. The situation repeated itself during the 2008 crash when most pension plan funding ratios dropped further. Again, systematic risk management via ALM models would have largely protected the pension plans.

Over the past decade, there has been considerable debate regarding the appropriate level of risk for a DB pension plan. On one side, advocates of conservative investments, called liability-driven investing or LDI in this chapter, have proposed a portfolio tilted to fixed income securities, similar to the portfolio of an insurance company. These proponents argue that a pension plan must fulfill its obligations to the retirees over long-time horizons and accordingly should reduce risks to the maximum degree possible.

To minimize risks, pension liabilities are “immunized” by the purchase of assets with known (or predictable) cash flows which are “adequate” to pay future liabilities. The goal is to maintain a surplus for the pension plan: Surplus/deficit = value(assets) – PV(liabilities), where the liability discount rate is prescribed by regulations such as promulgated by the Department of Labor in the United States. To protect the pension surplus ${ }^{1}$ requires an analysis of the future liabilities for the pension plan, i.e., expected payments to the plan retirees throughout a long time period – 40 or 50 or even 60 years in the future. Clearly with an ongoing organization, these liabilities are uncertain due to longevity risks, to future inflation, to possible modifications of payments for changing policy, and to other contingencies. Importantly, interest rate uncertainty plays a major role since the value of the liabilities (and many assets) will depend directly on interest rate movements. For these reasons, the asset mix will need to be modified at frequent intervals under LDI, for example, as part of the annual valuation exercises conducted by qualified actuaries. Similar to an insurance company, the duration of assets and the duration of liabilities should be matched (approximately) at least if the pension plan is to ensure that the surplus does not disappear due to interest rate movements.

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|An Asset–Liability Management Model for DB Pension Plans

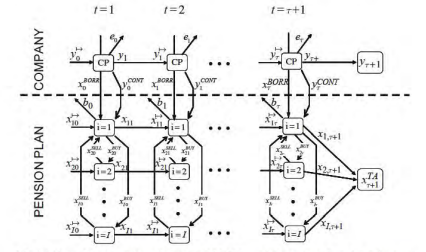

This section defines our asset and liability management (ALM) model for a defined benefit pension plan. We follow the framework established in Mulvey et al. (2005a, 2008) via multi-stage stochastic program. This framework allows for realistic conditions to be modeled such as the requirement for funding contributions when the pension deficit exceeds a specified limit and addressing transaction costs. However, as with any multi-stage stochastic optimization model, the number of decision variables grows exponentially with the number of stages and state variables. To compensate and to reduce the execution time to a manageable amount, we will apply a set of policy rules within a Monte Carlo simulation. The quality of the policy rules can be evaluated by means of an “equivalent” stochastic program. See Mulvey et al. (2008) and Section $3.5$ for further details.

To start, we establish a sequence of time stages for the model: $t=[1,2, \ldots, T]$. Typically, since a pension plan must maintain solvency and be able to pay its liabilities over long time periods, we generate a long-horizon model – over $10-40$ years with annual or quarterly time steps. To defend the pension plan over short time periods, we employ the DEO overlay strategies – which are dynamically adjusted over days or weeks. However, the target level of DEO is set by the strategic ALM model. In effect, the DEO provides a tactical rule for protecting the pension plan during turbulent conditions.

We define a set of generic asset categories ${A}$ for the pension plan. The categories must be well posed so that either a passive index can be invested in, or so that a benchmark can be established for an active manager. In the ALM model, the investment allocation is revised at the end of each time period with possible transaction costs. For convenience, dividends and interest payments are reinvested in the originating asset classes. Also, we assume that the variables depicting asset categories are non-negative. Accordingly, we include “investment strategies” in ${A}$, such as long-short equity or buy-write strategies in the definition of “asset categories.” The need for investment strategies in ${A}$ has become evident as standard long-only securities in 2008 became almost completely correlated (massive contagion). The investment strategies themselves may take action (revise their own investment allocations) more frequently and dynamically than as indicated by the strategy ALM model.

Next, a set of scenarios ${S}$ is generated as the basis of the forward-looking financial planning system. The scenarios should be built along several guiding principles. First, importantly, the time paths of economic variables should be plausible and should to the degree possible depict a comprehensive range of plausible outcomes. Second, the historical data should provide evidence of reasonable statistical properties, for example, the historical volatilities of the stock returns over the scenarios should be consistent with historical volatilities. Third, current market conditions should be considered when calibrating the model’s parameters. As an example, interest rate models ought to begin (time $=0$ ) with the current spot rate or forward rate curves. Third, as appropriate, expert judgment should be taken into account. The expected returns for each asset category should be evaluated by the

institution’s economists. There should be consistency among the various parties in a financial organization or at least the differences should be explainable. A number of scenario generators have been successfully applied over the past 25 years for asset and liability management models (Dempster et al. 2003; Heyland and Wallace 2001; Mulvey 1996).

For each $i \in{A}, t=[1,2, \ldots, T], s \in{S}$, we define the following parameters and decision variables in the basic ALM model:

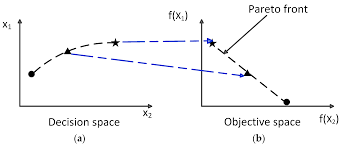

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Multi-objective Functions and Solution Strategies

Setting an investment strategy for a DB pension plan is complicated by conflicting requirements and the diverse goals of the stakeholders. Each of the interested groups is served by several of the defined $Z$-objective functions. Especially relevant is the relationship between the pension plan and the sponsoring organization. In the USA, DB pension plans fall under the auspices of the Departments of Labor and Tax, and the requirement of the 1974 Employee Retirement and Security Act ERISA (with ongoing modifications by changing regulations and Congressional action). Thus, a US-based DB pension plan must undergo annual valuations by certified actuaries, who compute the various ratios including the accumulated benefit obligations (ABO), the projected benefit obligations (PBO), and funding ratios. These valuation exercises help determine the requirements for contributions by the sponsoring organization and the fees to be paid to the quasi-governmental organization PBGC (whose job is to take over pensions from bankrupt companies).

We will employ the following five objective functions (Mulvey et al. 2005a, 2008).

金融中的随机方法代写

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Defined Benefit Pension Plans

传统的养老金信托,在此称为固定收益 (DB) 计划,受到多种力量的威胁。这些因素包括 (1) 过去 10 年出现的资金盈余损失和当前资金不足的比率,(2) 人口噩梦——长寿的退休人员和劳动力减少,(3) 不断变化的法规,(4) 更加重视管理个人事务(如退休)的个人责任,以及(⊃)财务规划效率低下。1 一个人在整个职业生涯中为一个组织(例如 IBM)工作,然后在公司贡献的支持下安然退休的日子已经一去不复返了(某些情况下公共部门的雇员除外)。

本章讨论了 DB 养老金计划缺乏有效的风险管理和财务规划。这2001/2002经济收缩表明,1999 年存在的充足的养老金计划盈余可能会在股市低迷和相应的利率下降导致

负债的市场价值(Mulvey 等 2005b;Ryan 和 Fabozzi 2003)。通过将现代资产和负债管理模型应用于 DB 养老金计划问题,可以在很大程度上避免盈余损失。邦德等人。(1998 年),博根托夫特等人。(2001 年),Cariño 等人。(1994 年),登普斯特等人。(2003, 2006), Dert (1995), Hilli 等人。(2003)、Kouwenberg 和 Zenios (2001)、Mulvey 等人。(2000, 2008)、Zenios 和 Ziemba (2006) 以及 Ziemba 和 Mulvey (1998) 描述了该方法并展示了成功应用的示例。例如,柯达养老金计划(Olson 2005)在 1999 年实施了已建立的养老金 ALM 系统,以保护其在随后的经济衰退中的盈余。这种情况在 2008 年崩盘期间重演,当时大多数养老金计划的资金比率进一步下降。再次,

在过去十年中,关于 DB 养老金计划的适当风险水平存在相当大的争论。一方面,保守投资(在本章中称为负债驱动投资或 LDI)的倡导者提出了一种倾向于固定收益证券的投资组合,类似于保险公司的投资组合。这些支持者认为,养老金计划必须长期履行其对退休人员的义务,因此应尽可能降低风险。

为了最大限度地降低风险,养老金负债通过购买具有“足以”支付未来负债的已知(或可预测)现金流的资产来“免疫”。目标是保持养老金计划的盈余:盈余/赤字=价值(资产)-PV(负债),其中负债贴现率由美国劳工部颁布的法规规定。保障养老金盈余1需要对养老金计划的未来负债进行分析,即在未来 40 年或 50 年甚至 60 年的很长一段时间内向计划退休人员支付的预期款项。显然,对于一个持续发展的组织,这些负债是不确定的,因为长寿风险、未来通货膨胀、政策变化支付的可能修改以及其他突发事件。重要的是,利率不确定性起着重要作用,因为负债(和许多资产)的价值将直接取决于利率变动。由于这些原因,在 LDI 下,资产组合需要经常修改,例如,作为合格精算师进行的年度估值活动的一部分。类似于保险公司,

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|An Asset–Liability Management Model for DB Pension Plans

本节定义了我们的固定收益养老金计划的资产和负债管理 (ALM) 模型。我们遵循 Mulvey 等人建立的框架。(2005a,2008)通过多阶段随机程序。该框架允许对现实条件进行建模,例如当养老金赤字超过特定限制时需要供资并解决交易成本问题。然而,与任何多阶段随机优化模型一样,决策变量的数量随着阶段和状态变量的数量呈指数增长。为了补偿并将执行时间减少到可管理的数量,我们将在蒙特卡洛模拟中应用一组策略规则。可以通过“等效”随机程序来评估策略规则的质量。参见 Mulvey 等人。(2008)和部分3.5了解更多详情。

首先,我们为模型建立一系列时间阶段:吨=[1,2,…,吨]. 通常,由于养老金计划必须保持偿付能力并能够在很长一段时间内支付其负债,因此我们生成了一个长期模型——超过10−40具有年度或季度时间步长的年份。为了在短时间内捍卫养老金计划,我们采用了 DEO 覆盖策略——这些策略会在数天或数周内动态调整。然而,DEO 的目标水平是由战略 ALM 模型设定的。实际上,DEO 提供了在动荡条件下保护养老金计划的战术规则。

我们定义了一组通用资产类别一种为养老金计划。类别必须合理,以便可以投资被动指数,或者可以为主动经理建立基准。在 ALM 模型中,投资分配在每个时间段结束时会根据可能的交易成本进行修改。为方便起见,股息和利息支付再投资于原始资产类别。此外,我们假设描述资产类别的变量是非负的。因此,我们将“投资策略”纳入一种,例如“资产类别”定义中的多空股票或买入卖出策略。投资策略的必要性一种随着 2008 年标准多头证券变得几乎完全相关(大规模传染),这一点变得很明显。与策略 ALM 模型所指示的相比,投资策略本身可能会更频繁、更动态地采取行动(修改自己的投资分配)。

接下来一组场景小号是作为前瞻性财务规划系统的基础而产生的。这些场景应该按照几个指导原则来构建。首先,重要的是,经济变量的时间路径应该是合理的,并且应该尽可能地描绘出一系列合理的结果。其次,历史数据应提供合理统计特性的证据,例如,不同情景下股票收益的历史波动率应与历史波动率一致。第三,在校准模型参数时应考虑当前的市场状况。例如,利率模型应该开始(时间=0) 与当前的即期汇率或远期汇率曲线。第三,酌情考虑专家判断。每个资产类别的预期回报应由

机构的经济学家。金融组织的各方之间应该保持一致,或者至少应该可以解释差异。在过去的 25 年中,许多情景生成器已成功应用于资产和负债管理模型(Dempster 等人 2003;Heyland 和 Wallace 2001;Mulvey 1996)。

对于每个一世∈一种,吨=[1,2,…,吨],s∈小号,我们在基本 ALM 模型中定义了以下参数和决策变量:

统计代写|金融中的随机方法作业代写Stochastic Methods in Finance代考|Multi-objective Functions and Solution Strategies

由于相互冲突的要求和利益相关者的不同目标,为 DB 养老金计划制定投资策略变得复杂。每个感兴趣的群体都由几个定义的从-目标函数。尤其相关的是养老金计划和发起机构之间的关系。在美国,DB 养老金计划由劳工和税务部主持,并符合 1974 年雇员退休和安全法案 ERISA 的要求(通过不断变化的法规和国会行动进行修改)。因此,美国的 DB 养老金计划必须由经过认证的精算师进行年度估值,他们计算各种比率,包括累积福利义务 (ABO)、预计福利义务 (PBO) 和资金比率。这些估值活动有助于确定发起组织的供款要求以及向准政府组织 PBGC(其工作是从破产公司接管养老金)支付的费用。

我们将采用以下五个目标函数(Mulvey et al. 2005a, 2008)。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。统计代写|python代写代考

随机过程代考

在概率论概念中,随机过程是随机变量的集合。 若一随机系统的样本点是随机函数,则称此函数为样本函数,这一随机系统全部样本函数的集合是一个随机过程。 实际应用中,样本函数的一般定义在时间域或者空间域。 随机过程的实例如股票和汇率的波动、语音信号、视频信号、体温的变化,随机运动如布朗运动、随机徘徊等等。

贝叶斯方法代考

贝叶斯统计概念及数据分析表示使用概率陈述回答有关未知参数的研究问题以及统计范式。后验分布包括关于参数的先验分布,和基于观测数据提供关于参数的信息似然模型。根据选择的先验分布和似然模型,后验分布可以解析或近似,例如,马尔科夫链蒙特卡罗 (MCMC) 方法之一。贝叶斯统计概念及数据分析使用后验分布来形成模型参数的各种摘要,包括点估计,如后验平均值、中位数、百分位数和称为可信区间的区间估计。此外,所有关于模型参数的统计检验都可以表示为基于估计后验分布的概率报表。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

statistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

机器学习代写

随着AI的大潮到来,Machine Learning逐渐成为一个新的学习热点。同时与传统CS相比,Machine Learning在其他领域也有着广泛的应用,因此这门学科成为不仅折磨CS专业同学的“小恶魔”,也是折磨生物、化学、统计等其他学科留学生的“大魔王”。学习Machine learning的一大绊脚石在于使用语言众多,跨学科范围广,所以学习起来尤其困难。但是不管你在学习Machine Learning时遇到任何难题,StudyGate专业导师团队都能为你轻松解决。

多元统计分析代考

基础数据: $N$ 个样本, $P$ 个变量数的单样本,组成的横列的数据表

变量定性: 分类和顺序;变量定量:数值

数学公式的角度分为: 因变量与自变量

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。