如果你也在 怎样代写公司金融学Corporate Finance 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。公司金融学Corporate Finance是金融的一个领域,涉及资金来源、公司的资本结构、管理者为增加公司对股东的价值而采取的行动,以及用于分配金融资源的工具和分析。公司金融的主要目标是最大化或增加股东价值。

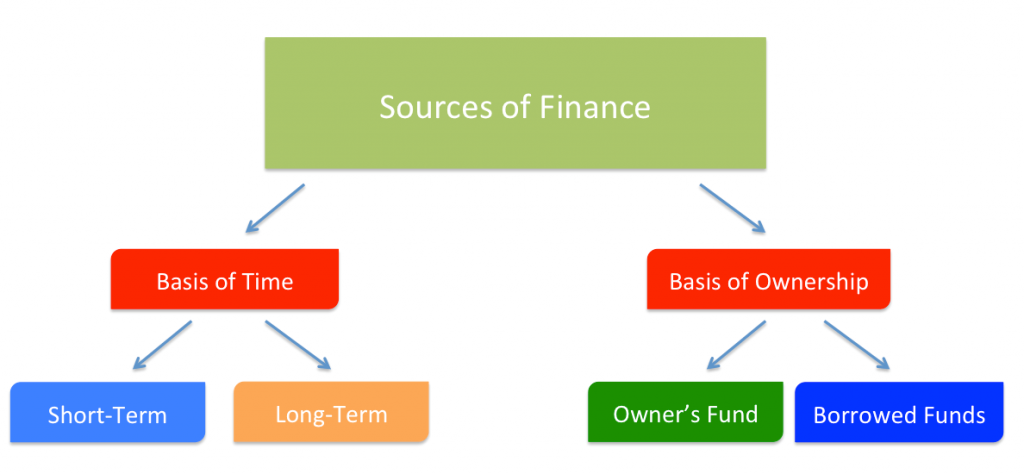

公司金融学Corporate Finance相应地,公司财务包括两个主要的分支学科。[引用]资本预算涉及到设定标准,以确定哪些增值项目应该获得投资资金,以及是否用股权或债务资本为该投资融资。营运资金管理是对公司货币资金的管理,涉及流动资产和流动负债的短期经营平衡;这里的重点是管理现金、存货和短期借贷(如提供给客户的信贷条件)。

statistics-lab™ 为您的留学生涯保驾护航 在代写公司金融学Corporate Finance方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写公司金融学Corporate Finance代写方面经验极为丰富,各种代写公司金融学Corporate Finance相关的作业也就用不着说。

经济代写|公司金融学代写Corporate Finance代考|Project Finance

Project finance is a structure used to finance infrastructure projects, such as roads, pipelines, prisons and hospitals, whereby the lenders are paid out of the income generated by the project. The debt finance (which may be provided by way of loans or securities or a mixture of both) is made available to an SPV (owned by one or more ‘sponsors’) which is a party to a concession agreement with the relevant government entitling it to build the infrastructure. The SPV contracts out the construction work (which is paid for by the borrowings) and, when the infrastructure is built, receives the revenues from its operation, which may come in the form of tolls (in the case of roads) or government payments (in the case of prisons or hospitals). The revenues are distributed according to a contractual clause, known as a waterfall clause, which provides for scheduled repayment of the debt finance. The SPV is usually highly leveraged, so that the debt to equity ratio is high, and the lenders take upon themselves a certain amount of the risk that the project will not be completed, or will not make money. Although the lenders will take what security they can, this will often largely consist of a charge over the revenue-generating contract, since the SPV will normally not own the item built, nor will the item have much independent value aside from its revenuegenerating value.

Lending to a company which is part of a group presents special problems for a lender, which may lead to complicated financing structures involving guarantees and also, maybe, set-offs or charge-backs. ${ }^{272}$ Despite being part of a group, each company is treated as a separate entity by the law, and each has limited liability, ${ }^{273}$ so that in order to have access to the assets of the group a lender will need to put in place contractual and proprietary protection by agreement. It will often be the case that the company that needs to borrow money does not have significant assets, since these are held by a parent company or another company in the group. In this situation, the lender may lend to the company that needs the money, and take a guarantee and security from the company with the assets (and probably all the other companies in the group). Alternatively, it may be another company in the group that has the ability to raise funds, for example by a bond issue or a loan, rather than the company which actually needs the funds. Here the company that can raise the money will on-lend the money to the other company, which will give a guarantee of the repayment obligations under the bonds or loan. ${ }^{274}$ Quite often the company that gives the guarantee will have a credit balance with the lender. The lender will seek to ensure that, if necessary, the obligation under the guarantee can be enforced by set-off, both outside and within insolvency, but may also seek to protect itself by taking a charge-back or using a flawed asset structure. ${ }^{275}$ Group companies may also lend to each other, or extend credit to each other, and external lenders usually insist that intergroup liabilities are subordinated to the debts to external lenders. ${ }^{276}$ It will be seen that the financing structure of a group can be very complicated, and can cause significant problems on insolvency. Further, the business is likely to be structured as a group for tax or some other cross-border purpose, in which case these issues will also impact on the financing structure.

经济代写|公司金融学代写Corporate Finance代考|Trade Finance

When goods are bought and sold internationally, there is a considerable period of time between shipping and receipt. The seller may well extend credit to the buyer, on retention of title terms, or the buyer may need to borrow in order to pay the seller, using the goods as security by way of a pledge of documents of title to the goods. The financing of international trade is a specialist area of the law, and is not dealt with further in this book.

There is now a large market in Islamic finance-that is, finance which complies with Sharia law: this is the law that governs Islamic societies. ${ }^{279}$ There are three particular rules in Sharia law which relate to finance transactions: a prohibition on riba (interest), a requirement that uncertainty (gharar) should be avoided, and a requirement that the contract must not relate to immoral activities. ${ }^{280}$ The prohibition on riba stems from the view that a profit cannot be made from merely lending money to another: all profit must be from commercial activity. Thus, Sharia-compliant finance contracts are either in the form of some sort of profit sharing (such as the partnership contracts, musharaka and mudaraba), sale (such as the murabaha contract, ${ }^{281}$ which is a sale at a deferred price, which includes a profit markup for the seller to cover the cost of the deferred payment and is similar to a conditional sale) ${ }^{282}$ or lease (such as the ijarah, which is similar to an operating lease, since the lessor must retain all the risks and rewards of ownership). The latter two types of contract can apply to both real estate assets and tangible personal property. The finance for these transactions is either provided by a bank or other finance company, or can be raised on the capital markets by the issuance of securities, known as sukuk certificates. The benefit of the underlying contracts is converted into securities by a securitisation process called tawreeq. ${ }^{283}$ An SPV is created which owns the underlying assets. In a musharaka transaction, the SPV owns the shares in the musharaka; in a murabaha the SPV owns the tangible assets. The form of a sukuk based on ijarah can vary, but often the SPV owns the tangible asset that it leases to the originator, and the sukuk holders are paid the rent. In each case, if the structure is governed by English law, the SPV holds the asset on trust for the sukuk holders, and so the securities, rather than being debt securities, are similar to depositary receipts.

公司金融学代考

经济代写|公司金融学代写Corporate Finance代考|Project Finance

项目融资是一种用于为道路、管道、监狱和医院等基础设施项目融资的结构,通过这种结构,贷款人可以从项目产生的收入中获得报酬。债务融资(可以通过贷款或证券或两者的混合方式提供)提供给特殊目的公司(由一个或多个“发起人”拥有),该公司是与相关政府签订特许协议的一方,有权建设基础设施。特殊目的机构将建筑工程承包出去(由借款支付),在基础设施建成后,从其运营中获得收入,这些收入可能以过路费(在道路的情况下)或政府付款(在监狱或医院的情况下)的形式出现。这些收入是根据一项被称为瀑布条款的合同条款分配的,该条款规定了债务融资的定期偿还。特殊目的机构通常杠杆率很高,因此债务权益比很高,贷款人承担了一定的项目无法完成或无法赚钱的风险。尽管出借人会尽其所能获得担保,但这通常主要包括对创收合同的收费,因为SPV通常不拥有所建造的项目,除了创收价值之外,项目也没有多少独立价值。

贷款给一个集团的一部分的公司会给贷款人带来特殊的问题,这可能会导致复杂的融资结构,包括担保,也可能是抵销或冲销。${}^{272}$尽管是一个集团的一部分,每个公司都被法律视为一个独立的实体,每个公司都承担有限责任,${}^{273}$因此,为了获得集团的资产,贷款人需要通过协议实施合同和专有保护。通常情况下,需要借款的公司没有重大资产,因为这些资产由母公司或集团中的另一家公司持有。在这种情况下,贷款人可能会贷款给需要资金的公司,并从拥有资产的公司(可能还有集团中的所有其他公司)获得担保和安全。或者,它可能是集团中有能力筹集资金的另一家公司,例如通过发行债券或贷款,而不是实际需要资金的公司。在这种情况下,能够筹集资金的公司将把钱转借给另一家公司,后者将为债券或贷款下的偿还义务提供担保。${}^{274}$提供担保的公司通常在贷款人处有信用余额。如果有必要,贷款人将寻求确保担保下的义务可以通过抵销来执行,无论是在破产之外还是在破产范围内,但也可能寻求通过扣款或使用有缺陷的资产结构来保护自己。${}^{275}$集团公司也可以相互贷款,或相互提供信贷,外部贷方通常坚持集团间负债从属于外部贷方的债务。${}^{276}$可以看出,一个集团的融资结构可能非常复杂,并可能导致严重的破产问题。此外,出于税收或其他一些跨境目的,该业务可能被构建为一个集团,在这种情况下,这些问题也将影响融资结构。

经济代写|公司金融学代写Corporate Finance代考|Trade Finance

当货物在国际上买卖时,从装运到收货之间有相当长的一段时间。卖方很可能在保留所有权的条件下向买方提供信贷,或者买方可能需要借款才能向卖方付款,以货物作为担保,以货物所有权文件的质押方式。国际贸易融资是法律的一个专门领域,本书不作进一步讨论。

现在伊斯兰金融有一个很大的市场——也就是说,符合伊斯兰教法的金融:这是管理伊斯兰社会的法律。${}^{279}$伊斯兰教法中有三条与金融交易有关的特别规则:禁止利息(利息),要求避免不确定性(利息),要求合同不得涉及不道德的活动。对里巴的禁止源于这样一种观点,即不能仅仅从借钱给别人中获得利润:所有的利润都必须来自商业活动。因此,符合伊斯兰教法的金融合同要么是某种形式的利润分享(如合伙合同、musharaka和mudaraba),要么是销售(如murabaha合同,${}^{281}$,这是一种延期价格的销售,其中包括卖方支付延期付款成本的利润加价,类似于有条件的销售)${}^{282}$或租赁(如有条件的销售)

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。