如果你也在 怎样代写管理会计Management Accounting ACCT6001这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。管理会计Management Accounting为组织的内部管理部门、其雇员、经理和行政人员提供财务信息,以便为决策提供依据并提高绩效。换句话说,管理会计师是战略伙伴。在管理会计或管理会计中,管理人员在决策中使用会计信息,并协助管理和履行其控制职能。

管理会计 Management Accounting的一个简单定义是向管理人员提供财务和非财务决策信息。换句话说,管理会计帮助组织内部的董事进行决策。这也可以被称为成本会计。这是区分、检查、破译和向主管人员传授数据的方式,以帮助完成商业目标。收集的信息包括所有领域的会计,教育行政部门识别财务支出和组织决策的业务任务。会计师使用计划来衡量组织内的整体运营战略。

statistics-lab™ 为您的留学生涯保驾护航 在代写管理会计Management Accounting方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写管理会计Management Accounting代写方面经验极为丰富,各种代写管理会计Management Accounting相关的作业也就用不着说。

会计代写|管理会计代写Management Accounting代考|ASSIGNMENT OF DIRECT AND INDIRECT COSTS

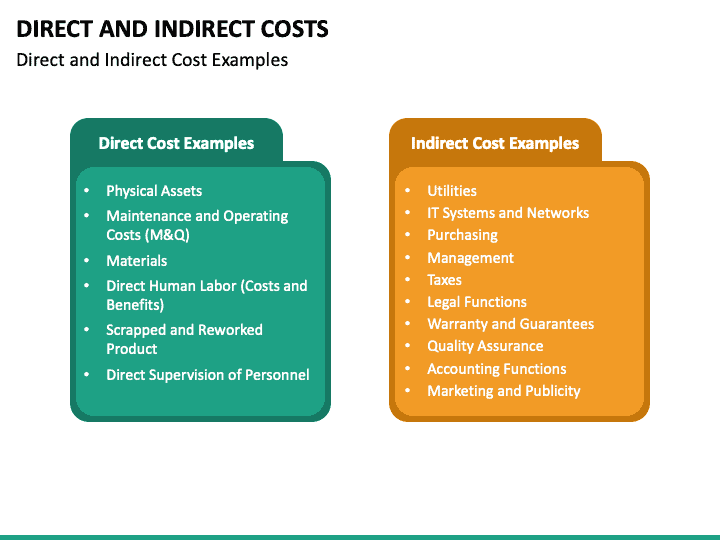

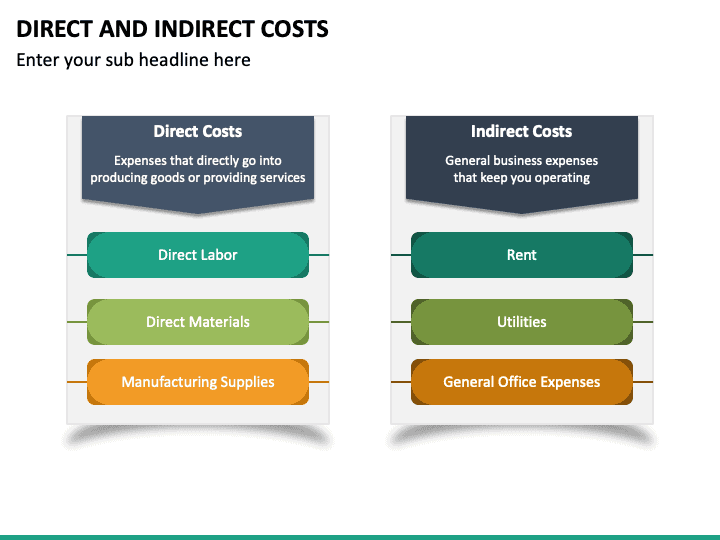

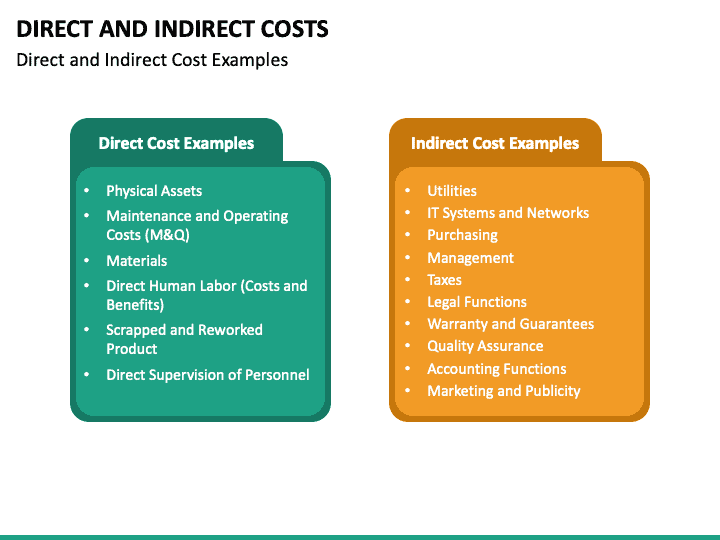

Costs that are assigned to cost objects can be divided into two categories – direct costs and indirect costs. Sometimes the term overheads is used instead of indirect costs. Direct costs can be accurately traced to cost objects because they can be specifically and exclusively traced to a particular cost object whereas indirect costs cannot. Where a cost can be directly assigned to a cost object the term direct cost tracing is used. In contrast, direct cost tracing cannot be applied to indirect costs because they are usually common to several cost objects. Indirect costs are therefore assigned to cost objects using cost allocations.

A cost allocation is the process of assigning costs when the quantity of resources consumed by a particular cost object cannot be directly measured. Cost allocations involve the use of surrogate rather than direct measures. For example, consider an activity such as receiving incoming materials. Assuming that the cost of receiving materials is strongly influenced by the number of receipts, then costs can be allocated to products (i.e. the cost object) based on the number of material receipts each product requires. The basis that is used to allocate costs to cost objects (i.e. the number of material receipts in our example) is called an allocation base or cost driver. If 20 per cent of the total number of receipts for a period were required for a particular product then 20 per cent of the total costs of receiving incoming materials would be allocated to that product. Assuming that the product was discontinued, and not replaced, we would expect action to be taken to reduce the resources required for receiving materials by 20 per cent.

In the above illustration the allocation base is assumed to be a significant determinant of the cost of receiving incoming materials. Where allocation bases are significant determinants the terms cause-andeffect allocations or driver tracing are used. Where a cost allocation base is used that is not a significant determinant of its cost, the term arbitrary allocation is used. An example of an arbitrary allocation would be if direct labour hours were used as the allocation base to allocate the costs of materials receiving. If a labour intensive product required a large proportion of direct labour hours (say 30 per cent) but few material receipts, it would be allocated with a large proportion of the costs of material receiving. The allocation would be an inaccurate assignment of the resources consumed by the product. Furthermore, if the product were discontinued, and not replaced, the cost of the material receiving activity would not decline by 30 per cent because the allocation base is not a significant determinant of the costs of the materials receiving activity. Arbitrary allocations are therefore likely to result in inaccurate allocations of indirect costs to cost objects.

Figure 3.1 provides a summary of the three methods of assigning costs to cost objects. You can see that direct costs are assigned to cost objects using direct cost tracing whereas indirect costs are assigned using either cause-and-effect or arbitrary cost allocations. For accurate assignment of indirect costs to cost objects, cause-and-effect allocations should be used. Two types of systems can be used to assign costs to cost objects. They are direct and absorption costing systems. A direct costing system (also known as a marginal or variable costing system) assigns only direct costs to cost objects whereas an absorption costing system assigns both direct and indirect costs to cost objectives. Absorption costing systems can be sub-divided into traditional costing systems and activity-based-costing (ABC) systems. Traditional costing systems were developed in the early 1900 s and are still widely used today. They tend to use arbitrary cost allocations. ABC systems only emerged in the late 1980s. One of the major aims of $A B C$ systems is to use mainly cause-and-effect cost allocations and avoid arbitrary allocations. Both cost systems adopt identical approaches to assigning direct costs to cost objects. We shall look at traditional and $\mathrm{ABC}$ systems in more detail later in the chapter.

会计代写|管理会计代写Management Accounting代考|DIFFERENT COSTS FOR DIFFERENT PURPOSES

Manufacturing organizations assign costs to products for two purposes: first, for internal profit measurement and external financial accounting requirements in order to allocate the manufacturing costs incurred during a period between cost of goods sold and inventories; second, to provide useful information for managerial decision-making requirements. In order to meet financial accounting requirements, it may not be necessary to accurately trace costs to individual products. Consider a situation where a firm produces 1000 different products and the costs incurred during a period are $£ 10$ million. A well-designed product costing system should accurately analyze the $£ 10$ million costs incurred between cost of sales and inventories. Let us assume the true figures are $£ 7$ million and $£ 3$ million. Approximate but inaccurate individual product costs may provide a reasonable approximation of how much of the $£ 10$ million should be attributed to cost of sales and inventories. Some product costs may be overstated and others may be understated, but this would not matter for financial accounting purposes as long as the total of the individual product costs assigned to cost of sales and inventories was approximately $£ 7$ million and $£ 3$ million.

For decision-making purposes, however, more accurate product costs are required so that we can distinguish between profitable and unprofitable products. By more accurately measuring the resources consumed by products, or other cost objects, a firm can identify its sources of profits and losses. If the cost system does not capture sufficiently accurately the consumption of resources by products, the reported product costs will be distorted, and there is a danger that managers may drop profitable products or continue production of unprofitable products.

Besides different levels of accuracy, different cost information is required for different purposes. For meeting external financial accounting requirements, financial accounting regulations and legal requirements in most countries require that inventories should be valued at manufacturing cost. Therefore, only manufacturing costs are assigned to products for meeting external financial accounting requirements. For decision-making, non-manufacturing costs must be taken into account and assigned to products. Not all costs, however, may be relevant for decision-making. For example, depreciation of plant and machinery will not be affected by a decision to discontinue a product. Such costs were described in the previous chapter as irrelevant and sunk for decision-making. Thus, depreciation of plant must be assigned to products for inventory valuation but it should not be assigned for discontinuation decisions.

管理会计代考

会计代写|管理会计代写Management Accounting代考|ASSIGNMENT OF DIRECT AND INDIRECT COSTS

分配给成本对象的成本可分为两类——直接成本和间接成本。有时使用间接费用一词代替间接成本。直接成本可以准确地追溯到成本对象,因为它们可以具体地、排他性地追溯到特定的成本对象,而间接成本则不能。如果成本可以直接分配给成本对象,则使用“直接成本追踪”一词。相反,直接成本追踪不能应用于间接成本,因为间接成本通常是几个成本对象的共同成本。因此,使用成本分配将间接成本分配给成本对象。

成本分配是指当某一特定成本对象所消耗的资源量不能直接测量时,分配成本的过程。成本分配涉及使用替代方法而不是直接方法。例如,考虑一个活动,例如接收来料。假设接收材料的成本受到收据数量的强烈影响,则可以根据每个产品所需的材料收据数量将成本分配给产品(即成本对象)。用于将成本分配给成本对象的基础(即本例中材料收据的数量)称为分配基础或成本驱动因素。如果某一特定产品需要在一段期间内收据总数的20%,那么接收来料总费用的20%将分配给该产品。假设该产品已停产,而不是更换,我们预计将采取行动,将接收材料所需的资源减少20%。

在上图中,假定分配基数是接收来料成本的重要决定因素。当分配基数是重要的决定因素时,使用术语因果分配或驱动程序跟踪。如果使用的成本分配基数不是成本的重要决定因素,则使用术语“任意分配”。任意分配的一个例子是,如果使用直接劳动时间作为分配基础来分配接收材料的成本。如果一种劳动密集型产品需要很大比例的直接劳动时间(例如30%),但材料收入很少,那么它将被分配很大比例的材料接收成本。分配将是对产品消耗的资源的不准确分配。此外,如果产品停产而不更换,材料接收活动的费用不会下降30%,因为分配基数不是材料接收活动费用的重要决定因素。因此,武断的分配很可能导致不准确地将间接成本分配给成本对象。

图3.1总结了将成本分配给成本对象的三种方法。您可以看到,使用直接成本跟踪将直接成本分配给成本对象,而使用因果关系或任意成本分配来分配间接成本。为了准确地将间接成本分配给成本对象,应该使用因果分配。两种类型的系统可用于将成本分配给成本对象。它们是直接成本核算和吸收成本核算。直接成本核算系统(也称为边际成本核算系统或可变成本核算系统)只将直接成本分配给成本对象,而吸收成本核算系统将直接和间接成本分配给成本目标。吸收成本法可分为传统成本法和作业成本法。传统的成本核算系统是在20世纪初发展起来的,至今仍被广泛使用。他们倾向于使用任意的成本分配。ABC系统在20世纪80年代末才出现。$A B C$系统的主要目标之一是主要使用因果成本分配,避免任意分配。两种成本系统采用相同的方法将直接成本分配给成本对象。我们将在本章后面更详细地讨论传统和$\ mathm {ABC}$系统。

会计代写|管理会计代写Management Accounting代考|DIFFERENT COSTS FOR DIFFERENT PURPOSES

制造组织为产品分配成本有两个目的:第一,为了内部利润计量和外部财务会计要求,以便分配在销售成本和库存之间的一段时间内发生的制造成本;第二,为管理决策的需要提供有用的信息。为了满足财务会计要求,可能没有必要准确地追踪单个产品的成本。考虑这样一个情况,一家公司生产1000种不同的产品,在一段时间内产生的成本是1000万美元。一个设计良好的产品成本系统应该准确地分析在销售成本和库存成本之间产生的1000万美元的成本。让我们假设真实的数字是700万英镑和300万英镑。近似但不准确的单个产品成本可能会提供一个合理的近似,说明1000万英镑中有多少应该归因于销售成本和库存成本。一些产品成本可能被高估,而另一些可能被低估,但只要分配给销售成本和库存成本的单个产品成本总额约为700万英镑和300万英镑,就财务会计目的而言,这无关紧要。

然而,为了做出决策,需要更准确的产品成本,以便我们能够区分有利可图和无利可图的产品。通过更准确地测量产品或其他成本对象所消耗的资源,企业可以确定其利润和损失的来源。如果成本系统不能充分准确地捕捉产品对资源的消耗,那么所报告的产品成本就会被扭曲,并且存在管理者可能放弃盈利产品或继续生产无利可图产品的危险。

除了准确性不同,不同的目的需要不同的成本信息。为了满足外部财务会计要求,大多数国家的财务会计条例和法律要求要求存货应按制造成本计价。因此,为了满足外部财务会计要求,只将制造成本分配给产品。在决策时,必须考虑非制造成本并将其分配给产品。然而,并非所有成本都与决策有关。例如,工厂和机器的折旧不会受到停产决定的影响。在前一章中,这些成本被描述为无关的,并为决策而沉没。因此,工厂的折旧必须分配给库存评估的产品,但不应该分配给停产决定。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。