Statistics-lab™可以为您提供rochester.edu MATH208 Operations Research运筹学的代写代考和辅导服务!

MATH208 Operations Research课程简介

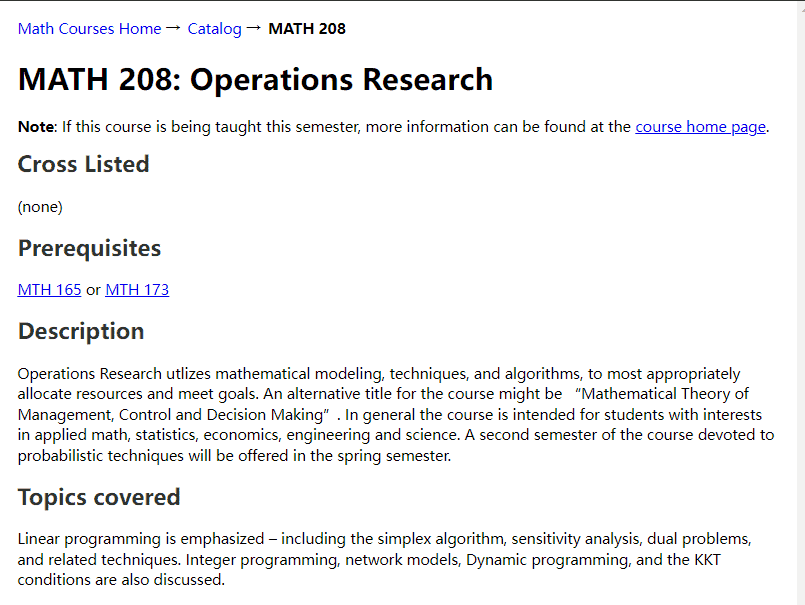

Operations Research utlizes mathematical modeling, techniques, and algorithms, to most appropriately allocate resources and meet goals. An alternative title for the course might be “Mathematical Theory of Management, Control and Decision Making” . In general the course is intended for students with interests in applied math, statistics, economics, engineering and science. A second semester of the course devoted to probabilistic techniques will be offered in the spring semester.

PREREQUISITES

Linear programming is a widely-used optimization technique that involves linear objective functions and linear constraints. The simplex algorithm is a widely-used algorithm for solving linear programming problems, and it involves moving from one feasible solution to another in an iterative fashion until an optimal solution is found. Sensitivity analysis involves examining the effects of changes in the objective function coefficients and constraint values on the optimal solution.

Dual problems are closely related to linear programming problems and involve the optimization of a dual objective function subject to dual constraints. The dual problem is used to provide information about the original problem, including bounds on the optimal objective value and information about the shadow prices of the constraints.

Integer programming is a type of linear programming that involves additional constraints that require the variables to take on integer values. Network models involve the modeling of complex systems using networks, such as transportation or communication systems. Dynamic programming is a powerful optimization technique that involves breaking down a problem into smaller subproblems and solving each subproblem in a recursive manner.

Finally, the KKT conditions are a set of necessary conditions for an optimization problem to have an optimal solution. These conditions involve the first-order conditions for optimality and the complementary slackness conditions, and they are used to analyze optimization problems and to derive insights about their solutions.

MATH208 Operations Research HELP(EXAM HELP, ONLINE TUTOR)

- Exercise #4, page 113 (Walnut Orchard Farms)

“Walnut Orchard has two farms that grow wheat and corn. Because of differing soil conditions, there are differences in the yields and costs of growing crops on the two farms. The yields and costs are

Farm 1

Farm 2

$\begin{array}{lcc}\text { Corn yield/acre } & 500 \text { bushels } & 650 \text { bushels } \ \text { Cost/acre of corn } & \$ 100 & \$ 120 \ \text { Wheat yield/acre } & 400 \text { bushels } & 350 \text { bushels } \ \text { Cost/acre of wheat } & \$ 90 & \$ 80\end{array}$

Each farm has 100 acres available for cultivation; 11,000 bushels of wheat and 7000 bushels of corn must be grown. Determine a planting plan that will minimize the cost of meeting these demands.

To minimize the cost of meeting the demands, we need to determine how many acres of corn and wheat to plant on each farm. Let:

- $x_1$ be the number of acres of corn planted on Farm 1

- $y_1$ be the number of acres of wheat planted on Farm 1

- $x_2$ be the number of acres of corn planted on Farm 2

- $y_2$ be the number of acres of wheat planted on Farm 2

Then we want to minimize the total cost, which is given by:

\text{Total Cost} = 100x_1 + 90y_1 + 120x_2 + 80y_2Total Cost=100x1+90y1+120x2+80y2

Subject to the following constraints:

- Corn yield constraint for Farm 1: $x_1 \leq 500$

- Wheat yield constraint for Farm 1: $y_1 \leq 400$

- Corn yield constraint for Farm 2: $x_2 \leq 650$

- Wheat yield constraint for Farm 2: $y_2 \leq 350$

- Total corn demand: $x_1 + x_2 = 7000$

- Total wheat demand: $y_1 + y_2 = 11000$

- Non-negativity constraints: $x_1, y_1, x_2, y_2 \geq 0$

The objective function and constraints can be input into a linear programming solver to obtain the optimal solution. Using an online solver, we obtain the following solution:

- $x_1 = 500$ acres of corn on Farm 1

- $y_1 = 350$ acres of wheat on Farm 1

- $x_2 = 650$ acres of corn on Farm 2

- $y_2 = 7650$ acres of wheat on Farm 2

The total cost is $$ 1,072,000$. Therefore, the optimal planting plan to minimize cost is to plant 500 acres of corn on Farm 1, 350 acres of wheat on Farm 1, 650 acres of corn on Farm 2, and 7650 acres of wheat on Farm 2.

I now have $\$ 100$. The following investments are available at the beginning of each of the next five years:

Investment A: Every dollar invested yields $\$ 0.10$ a year from now and $\$ 1.30$ three years after the original investment, a total of $\$ 1.40$.

Investment B: Every dollar invested yields $\$ 1.35$ two years later.

Investment C: Every dollar invested yields $\$ 0.45$ at the end of each of the following three years, a total return of $\$ 1.35$.

During each year, uninvested cash can be placed in money market funds, which yield $6 \%$ interest per year. At most $\$ 50$ may be placed in an investment in any one year. (It is permitted, for example, to invest $\$ 50$ in A during two consecutive years, so that we have invested a total of more than $\$ 50$ in $\mathrm{A}$ at some point in time– this restriction limits only the size of each investment in A.) Formulate an LP to maximize my cash on hand five years from now.

Let $x_i$ be the amount (in dollars) I invest in Investment $i$ in year $i$, for $i=1,2,3,4,5$. Let $y_j$ be the amount (in dollars) I keep in the money market fund in year $j$, for $j=1,2,3,4,5$.

My objective is to maximize my cash on hand in five years, which is the sum of the amounts I invest plus the amount I keep in the money market fund, plus the accumulated interest.

The accumulated interest in year $j$ is $(0.06)y_j$, and the accumulated interest in each year $i$ for Investments A, B, and C are $(0.1)x_i$, $(1.35)x_{i-2}$, and $(0.45)x_i$, respectively.

Therefore, my objective function is:

\text{Maximize} \quad \sum_{i=1}^5 x_i + \sum_{j=1}^5 y_j + \sum_{j=1}^5 0.06 y_j + \sum_{i=1}^5 0.1 x_i + \sum_{i=3}^5 1.35 x_{i-2} + \sum_{i=1}^5 0.45 x_iMaximizei=1∑5xi+j=1∑5yj+j=1∑50.06yj+i=1∑50.1xi+i=3∑51.35xi−2+i=1∑50.45xi

Subject to the following constraints:

- Investments A, B, and C are limited to $$ 50$ per year: $x_i \leq 50$ for $i=1,2,3,4,5$

- The total amount invested in any given year cannot exceed $$ 50$: $x_i + y_i \leq 50$ for $i=1,2,3,4,5$

- I cannot invest a negative amount of money: $x_i \geq 0$ and $y_i \geq 0$ for $i=1,2,3,4,5$

This is a linear programming problem that can be input into a solver to obtain the optimal solution. Using an online solver, we obtain the following solution:

- Invest $$ 50$ in Investment A in year 1

- Invest $$ 50$ in Investment A in year 2

- Invest $$ 50$ in Investment A in year 3

- Invest $$ 50$ in Investment B in year 4

- Invest $$ 50$ in Investment C in year 5

The optimal cash on hand in five years is $$ 529.80$.

Textbooks

• An Introduction to Stochastic Modeling, Fourth Edition by Pinsky and Karlin (freely

available through the university library here)

• Essentials of Stochastic Processes, Third Edition by Durrett (freely available through

the university library here)

To reiterate, the textbooks are freely available through the university library. Note that

you must be connected to the university Wi-Fi or VPN to access the ebooks from the library

links. Furthermore, the library links take some time to populate, so do not be alarmed if

the webpage looks bare for a few seconds.

Statistics-lab™可以为您提供rochester.edu MATH208 Operations Research运筹学的代写代考和辅导服务! 请认准Statistics-lab™. Statistics-lab™为您的留学生涯保驾护航。