如果你也在 怎样代写宏观经济学Macroeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

宏观经济学,对国家或地区经济整体行为的研究。它关注的是了解整个经济的事件,如商品和服务的生产总量、失业水平和价格的一般行为。

statistics-lab™ 为您的留学生涯保驾护航 在代写宏观经济学Macroeconomics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写宏观经济学Macroeconomics代写方面经验极为丰富,各种代写宏观经济学Macroeconomics相关的作业也就用不着说。

我们提供的宏观经济学Macroeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|宏观经济学代写Macroeconomics代考|The propensity to consume and the inducement to invest

Keynes hypothesized that consumption (measured as real consumption in wage units, of course) is a relatively stable function of the income (also measured in wage units) that corresponds to a particular level of employment. Consumption could have been made a function of employment, but Keynes decided to switch the variable to income because he thought that it is a good approximation to regard income as determined uniquely by employment. We shall use the conventional notation of $\mathrm{C}$ for consumption and $\mathrm{Y}$ for income, both in real terms, so consumption is a function of income:

$$

C=c(Y)

$$

Keynes asserted (1936, p. 96) that this function followed a “fundamental psychological law … that men are disposed, as a rule and on the average, to increase their consumption as their income increases, but not by as much as the increase in their income.” For example, a linear function with a slope less than $1.0$ matches this psychological law:

$\mathrm{C}=\mathrm{a}+\mathrm{bY}, \quad$ with b less than $1.0$ and greater than $0 .$

An increase in $Y$ of 1 wage unit increases $C$ by $b$ wage units, a number less than $1.0$ that is known as the marginal propensity to consume.

In Keynesian theory, saving is just the income not spent on consumption, so

$$

S=Y-C=Y-(a+b Y)=Y(1-b)-a

$$

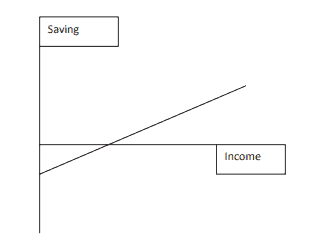

Figure $2.3$ depicts this saving function. Note that saving increases with income at the rate of $(1-b)$. In Figure $2.3$, if $\mathrm{Y}$ increases by $1.0$, saving increases by $0.25$, and therefore consumption increases by $0.75$.

Keynes recognized that the position of the consumption function can be altered by several factors, including:

- Windfall changes in capital values (such as the value of one’s house);

- Changes in the rate of interest, which is both the cost of consumer borrowing and the return to saving;

- Changes in income taxes – fiscal policy; and

- Social incentives for saving.

Keynes (1936, pp. 92-95) thought that the first and third of these factors are potentially important in the short run but that the effect of changes in the rate of interest on consumption is relatively unimportant and that the social incentives for saving change slowly over time. In the end, Keynes believed that the demand for consumption was a stable function of current income. This conclusion led him to emphasize the famous multiplier, which was first introduced by his colleague R. F. Kahn in $1931 .$

经济代写|宏观经济学代写Macroeconomics代考|Interest rate theory

The remaining piece of Keynesian theory is his theory of the interest rate, the rate at which funds are supplied to those who would demand investment goods. His basic point is that the interest rate is the price of holding a portion of one’s assets in the form of cash or checking deposits, i.e., money (which earned no interest in those days). He called the demand for money liquidity preference. The Keynesian world has two assets – those that earn interest and the one that does not earn interest, called money. He believed that liquidity preference consisted of three parts. Money was demanded because of:

- The transactions motive (need for cash to carry on current exchanges), which is the basic motive assumed in the Quantity Theory of Money;

- The precautionary motive (desire for cash for security); and

- The speculative motive (desire for cash because the individual thinks he/she can outguess the market and make a profit from buying assets later at a lower price).

Consider this last motive, the speculative motive, a little more. People will hold money if they expect that the interest rate will increase (asset prices will fall). Why do asset prices fall when the interest rate rises? Suppose you own a $\$ 10,000$ bond that pays $\$ 300$ in interest per year ( 3 percent). Suppose the general interest rate rises to 4 percent. Now an investor can earn $\$ 300$ by investing less than $\$ 10,000(\$ 7,500$ actually), and so now that investor is not willing to pay $\$ 10,000$ for your bond.

Keynes thought that, at some very low rate of interest, nearly everyone would expect that the interest rate will rise, asset prices will fall, and nearly everyone would demand money for speculative purposes. In this situation, any increase in the supply of money will simply be held by the public for speculation. Monetary policy is ineffective in this case. As Keynes (1936, p. 207) expressed:

There is the possibility … that, after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers cash to holding a debt which yields so low a rate of interest. In this event the monetary authority would have lost effective control of the rate of interest.

经济代写|宏观经济学代写Macroeconomics代考|The Keynesian system according to Keynes

We now have all of the elements of the Keynesian system. Keynes restated the basic theory in Chapter 18 of the General Theory. As any good economist does, he began by stating his assumptions that the following elements of the economy were taken as given:

- The quantity and quality of labor and capital;

- The tastes and habits of the consumers;

- The degree of competition; and

- Other factors having to do with the nature of employment and how it is organized by firms.

So, now we are ready. Keynes’s first summary of the model is that the independent variables are the propensity to consume, the schedule of the marginal efficiency of capital, and the rate of interest. Given a rate of interest, the level of investment demand is determined by the schedule of the marginal efficiency of capital. The level of investment determines the level of income and employment through the propensity to consume by establishing the income level at which investment equals saving. A reduction in the interest rate causes an increase in investment and therefore an increase in income via the multiplier effect.

Keynes (1936, p. 246) went on to say that

the rate of interest depends partly on the state of liquidity-preference (i.e., on the liquidity function) and partly on the quantity of money measured in terms of wage-units. Thus we can sometimes regard our ultimate independent variables as consisting of the three fundamental psychological factors, namely, the psychological propensity to consume, the psychological attitude to liquidity, and the psychological expectation of future yield from capital-assets.

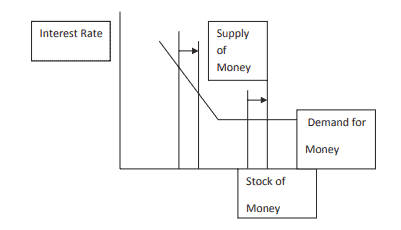

Note the word “sometimes” in this statement. Sometimes we can take the interest rate as given, and sometimes we work back to the demand for and supply of money to determine the interest rate. This version of the model is shown in Figure 2.5.

宏观经济学代考

经济代写|宏观经济学代写Macroeconomics代考|The propensity to consume and the inducement to invest

凯恩斯假设消费(当然是以工资单位衡量的实际消费)是与特定就业水平相对应的收入(也以工资单位衡量)的一个相对稳定的函数。消费本可以成为就业的函数,但凯恩斯决定将变量转换为收入,因为他认为将收入视为唯一由就业决定的一个很好的近似值。我们将使用传统的符号C用于消费和是对于收入,两者都是实值,所以消费是收入的函数:

C=C(是)

凯恩斯断言 (1936, p. 96),这一功能遵循“基本的心理规律……一般来说,平均而言,随着收入的增加,人们倾向于增加消费,但不会像收入增加那样多。他们的收入。” 例如,一个斜率小于的线性函数1.0符合这个心理规律:

C=一个+b是,b 小于1.0并且大于0.

增加是增加 1 个工资单位C经过b工资单位,小于1.0这被称为边际消费倾向。

在凯恩斯理论中,储蓄只是不用于消费的收入,所以

小号=是−C=是−(一个+b是)=是(1−b)−一个

数字2.3描述了这种保存功能。请注意,储蓄随着收入的增加而增加(1−b). 如图2.3, 如果是增加1.0, 储蓄增加0.25,因此消费增加了0.75.

凯恩斯认识到,消费函数的位置可以被几个因素改变,包括:

- 资本价值的意外变化(如房屋价值);

- 利率的变化,既是消费者借贷的成本,也是储蓄的回报;

- 所得税的变化——财政政策;和

- 储蓄的社会激励。

Keynes (1936, pp. 92-95) 认为这些因素中的第一个和第三个因素在短期内可能很重要,但利率变化对消费的影响相对不重要,储蓄改变的社会激励随着时间的推移慢慢地。最后,凯恩斯认为消费需求是当前收入的稳定函数。这个结论使他强调了著名的乘数,这是由他的同事 RF Kahn 在1931.

经济代写|宏观经济学代写Macroeconomics代考|Interest rate theory

凯恩斯理论的其余部分是他的利率理论,即向那些需要投资商品的人提供资金的利率。他的基本观点是,利率是以现金或支票存款的形式持有一部分资产的价格,即货币(当时没有利息)。他把货币需求称为流动性偏好。凯恩斯主义世界有两种资产——一种能赚取利息的资产,一种不能赚取利息的资产,称为货币。他认为流动性偏好由三部分组成。之所以要钱,是因为:

- 交易动机(需要现金进行流通交易),这是货币数量论假设的基本动机;

- 预防动机(以现金换取安全);和

- 投机动机(渴望现金,因为个人认为他/她可以猜透市场并从以后以较低价格购买资产中获利)。

再考虑一下最后一个动机,即投机动机。如果人们预期利率会上升(资产价格会下跌),他们就会持有货币。为什么利率上升时资产价格会下跌?假设你拥有一个$10,000支付的债券$300年利息(3%)。假设一般利率上升到 4%。现在投资者可以赚取$300通过投资少于$10,000($7,500实际上),所以现在投资者不愿意支付$10,000为了你的债券。

凯恩斯认为,在利率非常低的情况下,几乎每个人都会预期利率会上升,资产价格会下跌,几乎每个人都会要求货币用于投机目的。在这种情况下,货币供应量的任何增加都将被公众持有用于投机。在这种情况下,货币政策是无效的。正如凯恩斯 (1936, p. 207) 所说:

有可能……在利率下降到一定水平后,流动性偏好可能变得几乎是绝对的,因为几乎每个人都更喜欢现金而不是持有收益率如此低的债务。在这种情况下,货币当局将失去对利率的有效控制。

经济代写|宏观经济学代写Macroeconomics代考|The Keynesian system according to Keynes

我们现在拥有凯恩斯系统的所有元素。凯恩斯在《通论》第 18 章中重申了基本理论。正如任何一位优秀的经济学家所做的那样,他首先陈述了他的假设,即认为以下经济要素是给定的:

- 劳动力和资本的数量和质量;

- 消费者的口味和习惯;

- 竞争程度;和

- 其他与就业性质和公司组织方式有关的因素。

所以,现在我们准备好了。凯恩斯对模型的第一个总结是,自变量是消费倾向、资本边际效率的时间表和利率。给定利率,投资需求的水平由资本的边际效率表决定。投资水平通过确定投资等于储蓄的收入水平,通过消费倾向来决定收入和就业水平。利率的降低导致投资增加,因此通过乘数效应增加收入。

凯恩斯 (1936, p. 246) 继续说

利率部分取决于流动性偏好状态(即流动性函数),部分取决于以工资单位衡量的货币数量。因此,我们有时可以将我们的最终自变量视为由三个基本心理因素组成,即消费心理倾向、对流动性的心理态度以及对资本资产未来收益率的心理预期。

请注意本声明中的“有时”一词。有时我们可以把利率当作给定的,有时我们会回到货币的需求和供应来确定利率。这个版本的模型如图 2.5 所示。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。