如果你也在 怎样代写微观经济学Microeconomics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

微观经济学是主流经济学的一个分支,研究个人和企业在做出有关稀缺资源分配的决策时的行为以及这些个人和企业之间的相互作用。

statistics-lab™ 为您的留学生涯保驾护航 在代写微观经济学Microeconomics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写微观经济学Microeconomics代写方面经验极为丰富,各种代写微观经济学Microeconomics相关的作业也就用不着说。

我们提供的微观经济学Microeconomics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|微观经济学代写Microeconomics代考|Public choice and government failure

If markets fail to allocate resources efficiently, government policy could potentially correct it. Our major examples were (i) a Pigouvian tax (or subsidy) to offset an external cost (or benefit); (ii) competition policy, regulation or public ownership to deal with monopoly power; and (iii) providing public goods if the private sector failed to do so adequately. Because the social costs of some market failures are smaller than the costs of government action, sometimes it’s better for government to do nothing.

Up to this point, we have implicitly assumed that governments will appropriately address such economic inefficiencies. But why couldn’t we also have government failures as well as market failures? These could occur if government policymakers fail to recognize the problem, if they don’t have the information to address it adequately, or if they choose inappropriate policies, perhaps creating greater inefficiencies. We need theories of the political marketplace, where policies are determined, to assess the likelihood of government success or failure.

In the same way that we assume that self-interested consumers maximize utility and firms maximize profits, we could assume that actors in the political marketplace also act in their own self-interest. Public choice theory uses this approach. It originated in the United States in the late 1950 and the 1960 with the work of economists including James Buchanan, winner of the 1986 Nobel Memorial Prize in Economics.

In this view, politicians, motivated by the desire for money, prestige and power, seek to gain and to keep public office by attracting the votes that are needed to do that. Bureaucrats are assumed to want to maximize the size of their bureaus and budgets, as this provides them with greater pay and status. People, in their role as voters, support those policies which most closely conform to their own economic interests. They can also further those interests by lobbying politicians, donating to political parties and so on.

What determines which policies will be chosen? Among other things, that depends on the nature of the political institutions and the way that people can express their preferences about policy choices.

The median voter model Let’s consider a simple example of this influential model that’s relevant to the subject of this chapter.

The policy in question is how much income to redistribute to reduce income inequality. This could involve setting income tax rates and providing certain cash transfers to households. Different people will have different preferences, depending upon their interests. Those with low incomes would prefer a significant reduction in income inequality (e.g. through progressive taxes and cash transfers of income to themselves), while at the other extreme those with high incomes would prefer that no inequality-reducing redistribution take place. Imagine voters lined up from left to right, those on the left preferring the largest reduction in inequality, those on the right preferring the least reduction.

经济代写|微观经济学代写Microeconomics代考|The costs of taxation

Taxation is costly not only because it is costly for government to collect the revenues and for individuals and business to comply with the tax law, but because it influences economic decisions. These include decisions by households about what and how much to buy and how much to save, and decisions by firms about what to produce and how and where to produce those things.

If the decisions of consumers and firms in the absence of taxes would lead to an efficient allocation of resources, then taxes must cause inefficiency if they change those decisions. We saw this in the analysis of an excise tax using the supply and demand framework in Chapter 3 . In that case, the result was a loss to society of producing less of the taxed good. This loss occurs because some mutually beneficial exchanges no longer take place. A similar analysis can be done for any kind of tax. As long as taxes influence choices that would otherwise be optimal, they create ‘efficiency losses’.

经济代写|微观经济学代写Microeconomics代考|The distribution of income and wealth

Countries are usually compared using per-person average income. Because of inequality, however, we need to know about the distribution of income and of wealth to judge how a society is doing in terms of equity. Inequality has been increasing in many countries in recent decades, leading to debate about why this has happened. It has also led to questions about what, if anything, to do about it.

The distribution of income The distribution of income can be measured in two ways. One is the functional distribution of income, breaking income down into its sources like wages and salaries, rent, and profits as we did in Chapter $8 .$ The Classical economists from Adam Smith to Karl Marx used this approach to think about the incomes of workers, landowners and capitalists. This distinction is now no longer as relevant, so economists now focus on the distribution of household incomes.

Incomes can be measured in different ways. ‘Market income’ includes wages and salaries and income from savings (dividends, interest, capital gains). Alternatively, ‘disposable income’ is market income plus cash transfers from government minus income taxes and other direct taxes on wages and salaries (e.g. premiums to national pension plans or for unemployment insurance). Comparing the two allows us to see some of the effects of government on the distribution of income.

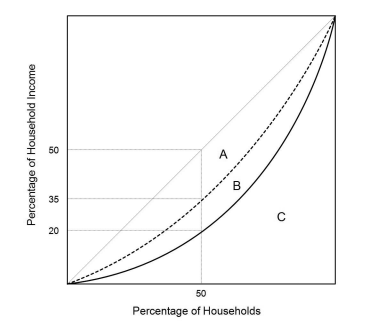

Suppose, as in Figure 9.1, households are lined up on the horizontal axis from the lowest income on the left to the highest income on the right. The vertical axis shows the percentage shares of total household income that various groupings of households have. In this example, the poorest 50 per cent of households have 20 per cent of total market income. If household incomes were equally distributed, those households would have 50 per cent of total

income, the amount shown on the 45 -degree line. The gap between the points showing actual household incomes (called the Lorenz curve) and this reference line indicates the nature and extent of market income inequality.

Income inequality can be summarized in a single number to aid in comparing inequality over time and across countries. The most widely used measure that summarizes the entire income distribution is the Gini coefficient. This is the ratio of the area between the Lorenz curve and the 45 -degree line and the entire area under the 45 -degree line. In Figure $9.1$, the Gini coefficient for market incomes is $(A+B) /(A+B+C)$. Its value ranges between zero and one. It’s zero if income is equally distributed; it’s 1 if one household has everything. This method is commonly used to measure both inequality in a country over time and to compare inequality in different countries.

The Gini coefficient can also show how taxation and government transfers of money to households change the distribution of income among households. If governments act to reduce inequality, the Lorenz curve shifts as shown in Figure 9.1. In the example, the half of households with the lowest incomes now have 35 percent of total disposable income compared with 20 percent before taxes and transfers. The Gini coefficient now falls to $A /(A+B+C)$. The extent of redistribution can be measured by the difference in the two Gini coefficients.

微观经济学代考

经济代写|微观经济学代写Microeconomics代考|Public choice and government failure

如果市场不能有效地分配资源,政府政策可能会纠正它。我们的主要例子是(i)庇古税(或补贴)以抵消外部成本(或收益);(ii) 处理垄断权力的竞争政策、法规或公有制;(iii) 如果私营部门未能充分提供公共产品。因为一些市场失灵的社会成本小于政府行动的成本,有时政府不采取行动会更好。

到目前为止,我们已经隐含地假设政府会适当地解决这种经济效率低下的问题。但是为什么我们不能同时有政府失灵和市场失灵呢?如果政府决策者未能认识到问题,如果他们没有充分解决问题的信息,或者如果他们选择不适当的政策,可能会造成更大的效率低下,就会发生这种情况。我们需要确定政策的政治市场理论来评估政府成功或失败的可能性。

就像我们假设自利的消费者最大化效用和企业最大化利润一样,我们可以假设政治市场中的参与者也为自己的利益行事。公共选择理论使用这种方法。它起源于 1950 年末和 1960 年的美国,由包括 1986 年诺贝尔经济学奖获得者詹姆斯·布坎南在内的经济学家所著。

在这种观点下,政治家出于对金钱、声望和权力的渴望,通过吸引所需的选票来谋求获得和保住公职。假定官僚希望最大化他们的局和预算的规模,因为这为他们提供了更高的薪水和地位。人们作为选民,支持那些最符合他们自身经济利益的政策。他们还可以通过游说政客、向政党捐款等方式促进这些利益。

什么决定了选择哪些政策?除其他外,这取决于政治机构的性质以及人们表达他们对政策选择的偏好的方式。

中值选民模型 让我们考虑一个与本章主题相关的有影响力模型的简单示例。

有问题的政策是重新分配多少收入以减少收入不平等。这可能涉及设定所得税税率并向家庭提供某些现金转移。不同的人会有不同的偏好,这取决于他们的兴趣。低收入者希望显着减少收入不平等(例如,通过累进税和将收入现金转移给他们自己),而在另一个极端,高收入者希望不进行减少不平等的再分配。想象一下选民从左到右排列,左边的人更喜欢不平等程度的最大减少,右边的人更喜欢减少最少的不平等。

经济代写|微观经济学代写Microeconomics代考|The costs of taxation

税收成本高昂,不仅因为政府收取税收以及个人和企业遵守税法的成本很高,而且因为它影响经济决策。其中包括家庭关于购买什么、购买多少以及储蓄多少的决定,以及公司关于生产什么以及如何以及在哪里生产这些东西的决定。

如果消费者和企业在没有税收的情况下做出的决定会导致资源的有效配置,那么如果税收改变了这些决定,它们就会导致效率低下。我们在第 3 章使用供需框架分析消费税时看到了这一点。在这种情况下,结果是社会损失了生产更少的应税商品。这种损失的发生是因为一些互利的交换不再发生。可以对任何类型的税收进行类似的分析。只要税收影响本来可能是最优的选择,它们就会造成“效率损失”。

经济代写|微观经济学代写Microeconomics代考|The distribution of income and wealth

各国通常使用人均收入进行比较。然而,由于不平等,我们需要了解收入和财富的分配,以判断一个社会在公平方面的表现。近几十年来,许多国家的不平等现象不断加剧,引发了关于为什么会发生这种情况的争论。它还引发了关于如何处理的问题,如果有的话。

收入分配 收入分配可以用两种方式来衡量。一是收入的功能分配,将收入分解为工资和薪水、租金和利润等来源,就像我们在本章中所做的那样8.从亚当·斯密到卡尔·马克思的古典经济学家使用这种方法来思考工人、地主和资本家的收入。这种区别现在不再那么重要,因此经济学家现在关注家庭收入的分配。

收入可以用不同的方式来衡量。“市场收入”包括工资和薪水以及储蓄收入(股息、利息、资本收益)。或者,“可支配收入”是市场收入加上来自政府的现金转移减去所得税和其他对工资和薪金的直接税(例如国家养老金计划或失业保险的保费)。比较两者可以让我们看到政府对收入分配的一些影响。

假设,如图 9.1 所示,家庭在水平轴上从左侧的最低收入到右侧的最高收入排列。纵轴显示不同家庭组别占家庭总收入的百分比。在这个例子中,最贫困的 50% 家庭拥有市场总收入的 20%。如果家庭收入平均分配,这些家庭将拥有总收入的 50%

收入,显示在 45 度线上的金额。显示实际家庭收入的点(称为洛伦兹曲线)与这条参考线之间的差距表明了市场收入不平等的性质和程度。

收入不平等可以用一个数字来概括,以帮助比较不同时间和不同国家之间的不平等。总结整个收入分配的最广泛使用的衡量标准是基尼系数。这是洛伦兹曲线和 45 度线之间的面积与 45 度线下的整个面积之比。如图9.1,市场收入的基尼系数为(一个+乙)/(一个+乙+C). 它的值介于零和一之间。如果收入平均分配,则为零;如果一个家庭拥有一切,则为 1。这种方法通常用于衡量一个国家在一段时间内的不平等,并比较不同国家的不平等。

基尼系数还可以显示税收和政府对家庭的货币转移如何改变家庭之间的收入分配。如果政府采取行动减少不平等,洛伦兹曲线就会移动,如图 9.1 所示。在这个例子中,收入最低的一半家庭现在拥有总可支配收入的 35%,而税前和转移支付前这一比例为 20%。基尼系数现在下降到一个/(一个+乙+C). 再分配的程度可以通过两个基尼系数的差异来衡量。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。