如果你也在 怎样代写金融统计Financial Statistics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

金融统计是将经济物理学应用于金融市场。它没有采用金融学的规范性根源,而是采用实证主义框架。它包括统计物理学的典范,强调金融市场的突发或集体属性。经验观察到的风格化事实是这种理解金融市场的方法的出发点。

statistics-lab™ 为您的留学生涯保驾护航 在代写金融统计Financial Statistics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写金融统计Financial Statistics代写方面经验极为丰富,各种代写金融统计Financial Statistics相关的作业也就用不着说。

我们提供的金融统计Financial Statistics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

统计代写|金融统计代写Financial Statistics代考|Participants of insurance company’s business

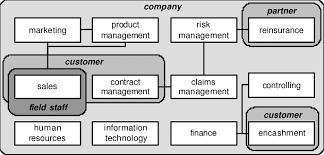

There are a number of participants involved in the insurance business. All of them have different functions, powers, responsibilities, and pursue their own specific business goals.

For policyholders who transfer their risk of loss to the insurer and pay for it a remuneration called a premium, the main objective is to obtain reliable insurance protection for the least possible price. Therefore, some policyholders seek to find a company that offers the lowest price. However, a proportion of those who are guided only by these mercantile considerations and change from company to company without having other considerations, is not so significant.

This observation is based on both old and recent surveys of policyholders which confirms a certain degree of reluctance amongst insureds toward switching insurers. In support of this idea, researchers (see, e.g., [189], p. 39) mention, e.g., a survey of 2462 policyholders conducted in [45], where $54 \%$ of respondents admitted that they never tried to understand the prices in auto insurance. To the question “what is the most significant factor for you when buying an insurance policy?”, $40 \%$ of them answered that it was a company, $29 \%$ said that it was an insurance agent, and only $27 \%$ said that it was a policy price. In a similar survey of two thousand and four German insureds (see [174]) it was found that, while $67 \%$ of the respondents knew about the significant difference in the prices of different automobile insurers, only $35 \%$ chose a company on the basis of their favorable premium. Based on this, it was assumed in [189] that if there is an opportunity to go to a company offering lower prices, only one third of the total number of policyholders will do so.

At the present time, the search of a company that offers the lowest price is greatly facilitated by the Internet. But the observation that there is no other product that the consumer would have known so little about (see [92], p. 51) remains valid. Many consumers generally do not realize that there are differences in the prices of various insurance companies. Comparison of prices is difficult for them because information on the difference in prices for comparable coverage is not easily available; asking a colleague in office on the price of his or her policy does not make much sense, since this colleague may be of a different risk class, lives elsewhere, and drives a different brand of car.

统计代写|金融统计代写Financial Statistics代考|Strategic interests of insurers

In the insurance market, there is a wide variety of companies. Experienced managers develop for their owners reasonable long-term strategies that can lead the companies to success. These strategies can be very different. They reckon with the peculiarities of both their companies and the market. But ultimately, it is the owner of the company who decides on its strategy.

Typically, the market is headed by a few large, or incumbent companies, possessing an established business. After the portfolio has already been formed, the main strategic goal for these companies is to get profit from insurance operations $^{19}$. Since on a profitable market ${ }^{20}$ each client brings in an average profit, the larger the company, the greater its cumulative annual profit. This situation changes dramatically when the market ceases to be profitable, and each customer brings in an average loss. On the unprofitable market, the larger the company, the more likely its ruin.

A profitable insurance market always attracts new participants. They may be subsidiaries of non-insurance corporations, which earn considerable funds and

seek to increase them by investing in a seemingly attractive insurance business. The immediate objective of newly established companies, as their portfolio is not yet formed, is gaining market share, or an increase in the volume of their newly started businesses. Having tools for strategic growth and wanting to attract customers from other companies, they engage in aggressive premium price cuts. The degree of aggressiveness may vary significantly between companies.

Companies which have been doing business for a long time, and which are focussed on acquiring profit from insurance operations, are not interested in lowering their prices groundlessly. But, as already mentioned, the primarily aim of a company that has recently entered the market, and has not yet formed a portfolio, is to increase the volume of its business. Therefore, in order to attract new customers, it lowers its premiums below the premiums of its competitors. Such a difference in aims of participants leads to a price competition. In some cases, as it will be discussed below, the competition may be fierce and even dangerous for the stability of the whole market.

统计代写|金融统计代写Financial Statistics代考|Some aspects of modern insurance regulation

Insurance companies do sometimes go bankrupt due to financial distress. Consequently, policyholders who have entrusted their insurance protection to them, also find themselves in a difficult position. It adversely affects the financial well-being of the society as a whole. To minimize the risk of the occurrence of bankruptcies, the insurance market is regulated by an authorized state body ${ }^{21}$. The society is interested in effective regulation. Its principal goals are to contribute to the stability and efficiency of the insurance system, and to protect the rights of policyholders.

Insurance regulation and supervision cover all aspects of a business: legal, financial, technical and economic, and includes the management of accounting documentation. Regulatory practice has developed a number of standards and principles $^{22}$. Each insurer is required to report on its financial position regularly, normally annually, or more often in case of troubles, and to obey recommendations and directives of the supervisory authorities. The latter has to undertake solvency assessments, and has statutory powers to rectify the situation. These include issuing a directive to increase capital and/or liquidity, a divestment order, or a directive requirement to sell the company’s assets, a direction of compliance, or instructions for eliminating deviations from legal requirements, and taking control of assets of the company (see [177], Paragraph 19).

Leading businessmen and scientists recognize (see, e.g., [186], pp. 183, 322) that the most important drawback of the free market system in general, not only that of the insurance market, is the inherent instability of the system. Excessive instability can be prevented only by some sort of regulation; it is a prerequisite for the smooth operation of the market mechanism. Undulation on the free market is not necessarily harmful; if it is the result of a dynamic adaptation of the system to changing economic realities, its role may be positive. But fluctuations with extremely large amplitudes are undesirable because they can lead to disastrous consequences for the market.

金融统计代考

统计代写|金融统计代写Financial Statistics代考|Participants of insurance company’s business

保险业有很多参与者。他们都有不同的职能、权力、责任,并追求各自的特定业务目标。

对于将损失风险转移给保险公司并为其支付称为保费的报酬的投保人,主要目标是以尽可能低的价格获得可靠的保险保障。因此,一些投保人寻求寻找价格最低的公司。但是,仅以这些商业考虑为导向,并在没有其他考虑的情况下从一家公司换到另一家公司的人中,比例并不那么重要。

这一观察是基于对投保人的旧的和最近的调查,这些调查证实了被保险人在一定程度上不愿意更换保险公司。为了支持这一想法,研究人员(例如,参见 [189],第 39 页)提到,例如,在 [45] 中对 2462 名投保人进行的一项调查,其中54%的受访者承认他们从未尝试了解汽车保险的价格。对于“购买保险单对您来说最重要的因素是什么?”的问题,40%他们中的一个回答说这是一家公司,29%说是保险代理人,只有27%说是政策价格。在对 204 名德国被保险人进行的类似调查中(参见 [174])发现,虽然67%的受访者知道不同汽车保险公司的价格存在显着差异,只有35%根据他们有利的溢价选择一家公司。基于此,在 [189] 中假设如果有机会去一家提供更低价格的公司,那么只有三分之一的投保人会这样做。

目前,互联网极大地方便了寻找提供最低价格的公司。但是,消费者对其他产品知之甚少(参见 [92],第 51 页)的观察仍然有效。许多消费者普遍没有意识到各个保险公司的价格存在差异。他们很难进行价格比较,因为不容易获得可比覆盖范围的价格差异信息;向办公室的同事询问他或她的保单价格没有多大意义,因为这位同事可能属于不同的风险等级,住在其他地方,开着不同品牌的汽车。

统计代写|金融统计代写Financial Statistics代考|Strategic interests of insurers

在保险市场,有各种各样的公司。经验丰富的管理者会为他们的所有者制定合理的长期战略,以引导公司走向成功。这些策略可能非常不同。他们考虑到他们公司和市场的特点。但最终,决定其战略的是公司的所有者。

通常,市场由几家拥有成熟业务的大型或现有公司领导。在组合已经形成之后,这些公司的主要战略目标是从保险业务中获得利润19. 由于在有利可图的市场上20每个客户带来平均利润,公司越大,其累计年利润就越大。当市场不再盈利时,这种情况会发生巨大变化,每个客户都会带来平均损失。在无利可图的市场上,公司越大,破产的可能性就越大。

有利可图的保险市场总是会吸引新的参与者。他们可能是非保险公司的子公司,这些公司赚取大量资金和

寻求通过投资看似有吸引力的保险业务来增加他们。由于尚未形成投资组合,新成立公司的近期目标是获得市场份额,或增加新成立的业务量。拥有战略增长工具并希望吸引其他公司的客户,他们积极降价。不同公司的激进程度可能会有很大差异。

经营时间长、专注于从保险业务中获取利润的公司,对无端降价不感兴趣。但是,如前所述,最近进入市场但尚未形成投资组合的公司的主要目标是增加其业务量。因此,为了吸引新客户,它会将保费降低到低于竞争对手的保费。参与者的这种目标差异导致了价格竞争。在某些情况下,正如下面将要讨论的那样,竞争可能非常激烈,甚至危及整个市场的稳定。

统计代写|金融统计代写Financial Statistics代考|Some aspects of modern insurance regulation

保险公司有时会因财务困难而破产。因此,将保险保障委托给他们的投保人也发现自己处于困境。它对整个社会的财务状况产生不利影响。为了最大限度地降低破产风险,保险市场由授权的国家机构监管21. 社会对有效监管感兴趣。其主要目标是促进保险系统的稳定性和效率,并保护投保人的权利。

保险监管涵盖企业的所有方面:法律、财务、技术和经济,包括会计文件的管理。监管实践已经制定了许多标准和原则22. 每家保险公司都必须定期报告其财务状况,通常是每年一次,或者在出现问题时更频繁地报告,并遵守监管机构的建议和指示。后者必须进行偿付能力评估,并具有纠正这种情况的法定权力。其中包括发布增加资本和/或流动性的指令、撤资令或出售公司资产的指令要求、合规指示或消除违反法律要求的指令以及控制公司资产(见 [177],第 19 段)。

主要的商人和科学家认识到(参见,例如,[186],第 183、322 页),自由市场体系的最重要的缺点,不仅是保险市场的缺点,是该系统固有的不稳定性。只有通过某种监管才能防止过度不稳定;这是市场机制顺利运行的前提。自由市场的波动不一定有害;如果它是系统动态适应不断变化的经济现实的结果,它的作用可能是积极的。但幅度极大的波动是不可取的,因为它们可能给市场带来灾难性的后果。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。