如果你也在 怎样代写量化风险管理Quantitative Risk Management这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

项目管理中的定量风险管理是将风险对项目的影响转换为数字的过程。这种数字信息经常被用来确定项目的成本和时间应急措施。

statistics-lab™ 为您的留学生涯保驾护航 在代写量化风险管理Quantitative Risk Management方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写量化风险管理Quantitative Risk Management代写方面经验极为丰富,各种代写量化风险管理Quantitative Risk Management相关的作业也就用不着说。

我们提供的量化风险管理Quantitative Risk Management及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

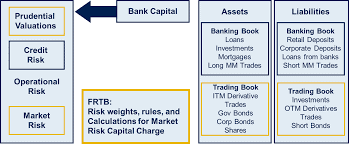

金融代写|量化风险管理代写Quantitative Risk Management代考|Market Risk

Market risk is risk associated with changing asset values. Market risk is most often associated with assets that trade in liquid financial markets, such as stocks and bonds. During trading hours, the prices of stocks and bonds constantly fluctuate. An asset’s price will change as new information becomes available and investors reassess the value of that asset. An asset’s value can also change due to changes in supply and demand.

All financial assets have market risk. Even if an asset is not traded on an exchange, its value can change over time. Firms that use mark-to-market accounting recognize this change explicitly. For these firms, the change in value of exchange-traded assets will be based on market prices. Other assets will either be marked to model -that is, their prices will be determined based on financial models with inputs that may include market prices-or their prices will be based on broker quotes – that is, their prices will be based on the price at which another party expresses their willingness to buy or sell the assets. Firms that use historical cost accounting, or book value accounting, will normally only realize a profit or a loss when an asset is sold. Even if the value of the asset is not being updated on a regular basis, the asset still has market risk. For this reason, most firms that employ historical cost accounting will reassess the value of their portfolios when they have reason to believe that there has been a significant change in the value of their assets.

For most financial instruments, we expect price changes to be relatively smooth and continuous most of the time, and large and discontinuous rarely. Because of this, market risk models often involve continuous distribution. Market risk models can also have a relatively high frequency (i.e., daily or even intraday). For many financial instruments, we will have a large amount of historical market data that we can use to evaluate market risk.

金融代写|量化风险管理代写Quantitative Risk Management代考|Credit Risk

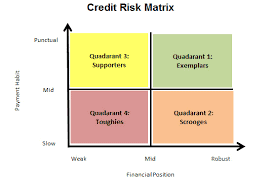

Credit risk is the risk that one party in a financial transaction will fail to pay the other party. Credit risk can arise in a number of different settings. Firms may extend credit to suppliers and customers. Credit card debt and home mortgages create credit risk. One of the most common forms of credit risk is the risk that a corporation or government will fail to make interest payments or to fully repay the principal on bonds they have issued. This type of risk is known as default risk, and in the case of national governments it is also referred to as sovereign risk. Defaults occur infrequently, and the simplest models of default risk are based on discrete distributions. Although bond markets are large and credit rating agencies have been in existence for a long time, default events are rare. Because of this, we have much less historical data to work with when developing credit models, compared to market risk models.

For financial firms, counterparty credit risk is another important source of credit risk. While credit risk always involves two counterparties, when risk managers talk about counterparty credit risk they are usually talking about the risk arising from a significant long-term relationship between two counterparties. Prime brokers will often provide loans to investment firms, provide them with access to emergency credit lines, and allow them to purchase securities on margin. Assessing the credit risk of a financial firm can be difficult, time consuming, and costly. Because of this, when credit risk is involved, financial firms often enter into long-term relationships based on complex legal contracts. Counterparty risk specialists help design these contracts and play a lead role in assessing and monitoring the risk of counterparties.

Derivatives contracts can also lead to credit risk. A derivative is essentially a contract between two parties, that specifies that certain payments be made based on the value of an underlying security or securities. Derivatives include futures, forwards, swaps, and options. As the value of the underlying asset changes, so too will the value of the derivative. As the value of the derivative changes, so too will the amount of money that the counterparties owe each other. This leads to credit risk.

金融代写|量化风险管理代写Quantitative Risk Management代考|Enterprise Risk

The enterprise risk management group of a firm, as the name suggests, is responsible for the risk of the entire firm. At large financial firms, this often means overseeing market, credit, liquidity, and operations risk groups, and combining information from those groups into summary reports. In addition to this aggregation role, enterprise risk management tends to look at overall business risk. Large financial companies will often have a number of business units (e.g., capital markets, corporate finance, commercial banking, retail banking, asset management, etc.). Some of these business units will work very closely with risk management (e.g. capital markets, asset management), while others may have very little day-to-day interaction with risk (e.g. corporate finance). Regardless, enterprise risk management would assess how each business unit contributes to the overall profitability of the firm in order to assess the overall risk to the firm’s revenue, income, and capital.

Operational risk is risk arising from all aspects of a firm’s business activities. Put simply, it is the risk that people will make mistakes and that systems will fail. Operational risk is a risk that all financial firms must deal with.

Just as the number of activities that businesses carry out is extremely large, so too are the potential sources of operational risk. That said, there are broad categories on which risk managers tend to focus. These include legal risk (most often risk arising from contracts, which may be poorly specified or misinterpreted), systems risk (risk arising from computer systems) and model risk (risk arising from pricing and risk models, which may contain errors, or may be used inappropriately).

As with credit risk, operational risk tends to be concerned with rare but significant events. Operational risk presents additional challenges in that the sources of operational risk are often difficult to identify, define, and quantify.

量化风险管理代考

金融代写|量化风险管理代写Quantitative Risk Management代考|Market Risk

市场风险是与资产价值变化相关的风险。市场风险通常与在流动性金融市场交易的资产有关,例如股票和债券。在交易时间内,股票和债券的价格不断波动。随着新信息的出现和投资者重新评估该资产的价值,资产的价格将发生变化。资产的价值也可能因供需变化而发生变化。

所有金融资产都有市场风险。即使资产不在交易所交易,其价值也会随着时间而变化。使用盯市会计的公司明确认识到这一变化。对于这些公司,交易所交易资产的价值变化将基于市场价格。其他资产将被标记为模型 – 也就是说,它们的价格将基于可能包括市场价格的输入的金融模型确定 – 或者它们的价格将基于经纪人报价 – 也就是说,它们的价格将基于价格另一方表示愿意购买或出售资产。使用历史成本会计或账面价值会计的公司通常只会在出售资产时实现损益。即使资产的价值没有定期更新,该资产仍有市场风险。出于这个原因,大多数采用历史成本会计的公司会在有理由相信其资产价值发生重大变化时重新评估其投资组合的价值。

对于大多数金融工具,我们预计价格变化在大多数情况下是相对平稳和连续的,很少是大的和不连续的。因此,市场风险模型通常涉及连续分布。市场风险模型也可以具有相对较高的频率(即,每日甚至盘中)。对于许多金融工具,我们将拥有大量历史市场数据,可用于评估市场风险。

金融代写|量化风险管理代写Quantitative Risk Management代考|Credit Risk

信用风险是金融交易中一方无法向另一方付款的风险。信用风险可能出现在许多不同的环境中。公司可以向供应商和客户提供信贷。信用卡债务和房屋抵押贷款会产生信用风险。最常见的信用风险形式之一是公司或政府无法支付利息或完全偿还其已发行债券本金的风险。这种类型的风险被称为违约风险,在国家政府的情况下,它也被称为主权风险。违约很少发生,最简单的违约风险模型是基于离散分布的。尽管债券市场规模庞大,信用评级机构已经存在很长时间,但违约事件很少发生。因为这,

对于金融公司而言,交易对手信用风险是信用风险的另一个重要来源。虽然信用风险总是涉及两个交易对手,但当风险经理谈论交易对手信用风险时,他们通常谈论的是两个交易对手之间的重要长期关系所产生的风险。主要经纪人通常会向投资公司提供贷款,为他们提供紧急信贷额度,并允许他们以保证金购买证券。评估金融公司的信用风险可能很困难、耗时且成本高昂。正因为如此,当涉及信用风险时,金融公司往往会根据复杂的法律合同建立长期关系。交易对手风险专家帮助设计这些合约,并在评估和监控交易对手风险方面发挥主导作用。

衍生品合约也可能导致信用风险。衍生品本质上是两方之间的合同,规定根据基础证券或证券的价值进行某些支付。衍生品包括期货、远期、掉期和期权。随着基础资产价值的变化,衍生品的价值也会发生变化。随着衍生品价值的变化,交易对手彼此欠款的金额也会随之变化。这会导致信用风险。

金融代写|量化风险管理代写Quantitative Risk Management代考|Enterprise Risk

顾名思义,企业的企业风险管理小组对整个企业的风险负责。在大型金融公司,这通常意味着监督市场、信贷、流动性和运营风险组,并将这些组的信息组合成总结报告。除了这种聚合作用之外,企业风险管理还倾向于关注整体业务风险。大型金融公司通常会有多个业务部门(例如,资本市场、公司金融、商业银行、零售银行、资产管理等)。其中一些业务部门将与风险管理(例如资本市场、资产管理)密切合作,而其他业务部门可能与风险的日常互动很少(例如公司金融)。不管,

操作风险是指企业经营活动的各个方面产生的风险。简而言之,这是人们犯错误和系统失败的风险。操作风险是所有金融公司都必须应对的风险。

正如企业开展的活动数量非常庞大一样,潜在的运营风险来源也是如此。也就是说,风险管理人员倾向于关注广泛的类别。这些风险包括法律风险(通常是由合同引起的风险,可能没有明确说明或被误解)、系统风险(由计算机系统引起的风险)和模型风险(由定价和风险模型引起的风险,可能包含错误,或者可能是使用不当)。

与信用风险一样,操作风险往往与罕见但重大的事件有关。操作风险带来了额外的挑战,因为操作风险的来源通常难以识别、定义和量化。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。