如果你也在 怎样代写金融统计Financial Statistics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

金融统计是将经济物理学应用于金融市场。它没有采用金融学的规范性根源,而是采用实证主义框架。它包括统计物理学的典范,强调金融市场的突发或集体属性。经验观察到的风格化事实是这种理解金融市场的方法的出发点。

statistics-lab™ 为您的留学生涯保驾护航 在代写金融统计Financial Statistics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写金融统计Financial Statistics代写方面经验极为丰富,各种代写金融统计Financial Statistics相关的作业也就用不着说。

我们提供的金融统计Financial Statistics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

统计代写|金融统计代写Financial Statistics代考|Reflexivity and regulation

It is generally untrue that a free market, whose inherent instability was called its fatal flaw (see [186], pp. 183,322 ), will regulate itself. Excessive instability ${ }^{51}$ can be avoided only by introducing market regulation. The regulator must clearly recognize the strategic dangers inherent in the very nature of the market which it regulates. But the regulator always remains merely a participant in the reflexive historical process; other participants include competing companies. The regulator’s understanding of this process is necessarily imperfect, and as a result its

actions could lead to unintended consequences.

Therefore, the relationship between regulator and economy is reflexive; it gives rise to a certain cyclic behavior. In order to prevent arbitrariness and abuse of power on the part of the regulator, the rules under which the regulation is carried out must be pre-defined and known to all participants. But, as we have seen in Section 1.4.2.2, it is very difficult to develop rules which are able to anticipate all possible scenarios.

The judgment of how excessive instability may be, is often subjective. Criteria used to determine stability are constantly evolving. Methods of control are also being changed, but long ago it has been observed that they are constantly following the crises and control errors with a delay.

Thus, bearing in mind the above description of the causes of underwriting cycles, it is clear that the insurance regulator has to fight not only against the aggressiveness of the insurers in reducing prices to attract customers, but against the lack of information and the irresponsible actions of a very large number of other participants of the insurance process. Also, it has to fight against the rash desire of insureds to receive services at a lower price ${ }^{52}$, and against their migration to enticing insurers, without paying due attention to their reliability. It has to fight against the desire of individual managers seeking to obtain personal benefits from risky underwriting and from lowering prices, which they regard as a simple and guaranteed means of achieving these benefits ${ }^{53}$. It has to fight against the desire of shareholders to get, notwithstanding the circumstances, an always stable and possibly ever growing stream of dividends.

Therefore, the answer to the problems that create “medium-sized companies entering the market with low rates and large amount of advertising”54 should be systematic and careful cultivation of the insurance market, which includes increasing the awareness and responsibility of all its participants ${ }^{55}$.

统计代写|金融统计代写Financial Statistics代考|The need for modeling

The problem of regulation and successful management in insurance is much more complicated than any academic theory. Therefore, a frequently asked question is: “can a theory be useful at all?”.

We agree with T. Pentikäinen (see [152], p. 30) who noted that too often, mere intuition has guided the decision-making process of the management. The attitude of many “experienced” managers toward theoretical considerations is often one of suspicion and condescension. They leave them out, believing that they have no practical value. However, the refusal to clearly articulate the tasks and principles of their actions does not mean that in these actions, there is no strategy. On the contrary, each method of decision-making, even the decision not to make any decision, is a variant of strategy. The only difference is that the strategy of such “practical men” can be a random mixture of inert traditions, old habits, more or less adequate intuition, and the like. It may lack clear understanding and analysis of various alternative strategies. A discussion on theoretical aspects and points of view can contribute to a multifaceted analysis of the situation and to a conscious consideration of the available facts and possibilities as opposed to a random mixture of inert traditions and inadequate intuition.

It is now generally accepted that if regulation and insurance management are not based on comprehensive insurance process models, that can provide insight into how a company may come to ruin, they will act blindly.

Due to the peculiarities of the insurance industry, it would be wise to start with a model for probability mechanism of insurance, i.e., of how a sequence of insurance claims appears within a time period, e.g., one insurance year. Having studied this mechanism, the regulator or manager of a company will be able to formulate the minimum solvency requirements for the company within one insurance year. The most significant thing here is that this will not be done in an arbitrary manner, but in accordance with the natural laws of large-scale random phenomena.

When implementing this program, one should resist the temptation to simplify the model. These simplifications may compromise on the model’s applicability under real-world conditions. If this simplification is nevertheless performed, as is often in the case of classical risk theory, then a warning of its restricted applicability – or non-applicability – should be clearly made.

统计代写|金融统计代写Financial Statistics代考|Central aspects of Lundberg’s model: collective risk

Lundberg’s model provides a reasonable, albeit simplified description of largescale random phenomena encountered in the work of any insurance company. Fundamental to this model is the concept of collective risk, which allows us to monitor the financial position of the company over time.

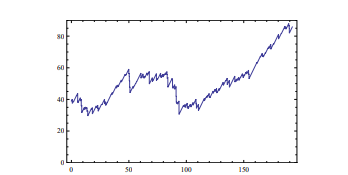

The concept of collective risk implies that there exists a random mechanism for generating successive claims; the company’s portfolio is considered as a whole, rather than as the sum of a known number of individual policies. To illustrate this point, let us assume that the insurance company receives information online about the time and severity of each claim just occurred. This information is presented in the form of a risk reserve process, which is the initial capital, plus the total premiums collected, minus the aggregate claim payments. By ruin within time $t$ we refer to the event that the risk reserve process, evolving with time, drops

below zero at least once within the time interval $(0, t]$. In this setting, the most important objectives are calculations of the aggregate claim payout distribution and of the probability of ruin.

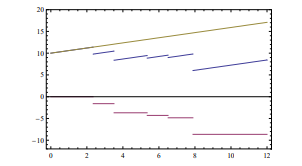

Formalizing Lundberg’s model, we address the intervals between claims and the corresponding claim severities. We model these by means of two sequences of positive random variables $T_{i}, i=1,2, \ldots$, and $Y_{i}, i=1,2, \ldots$ Together, these two sequences may be called the fundamental risk and denoted by $\mathcal{K}$ for brevity.

Within a multi-year control model of the insurance process of a company operating on a competitive market, Lundberg’s model will be built anew for each consecutive insurance year. Therefore, the fundamental risk may be referred to as annual fundamental risk pertaining to any individual company considered. The sequence of these annual risks is the basis of multi-year probabilistic modeling, i.e., the modeling of how claims occur over time and cause cumulative damage each consecutive year.

金融统计代考

统计代写|金融统计代写Financial Statistics代考|Reflexivity and regulation

一个固有的不稳定性被称为致命缺陷的自由市场(见 [186],第 183,322 页)会自我调节,这通常是不真实的。过度不稳定51只有引入市场监管才能避免。监管者必须清楚地认识到其监管的市场本质所固有的战略危险。但监管者始终只是反思性历史过程的参与者;其他参与者包括竞争公司。监管者对这一过程的理解必然是不完善的,因此其

行动可能会导致意想不到的后果。

因此,监管者与经济的关系是自反的;它会产生一定的循环行为。为了防止监管者的任意性和滥用权力,必须预先定义并为所有参与者所知的监管规则。但是,正如我们在第 1.4.2.2 节中看到的那样,制定能够预测所有可能场景的规则是非常困难的。

对过度不稳定程度的判断通常是主观的。用于确定稳定性的标准在不断发展。控制方法也在发生变化,但很久以前就观察到它们不断地跟踪危机并延迟控制错误。

因此,考虑到上述对承保周期原因的描述,很明显,保险监管机构不仅要打击保险公司为吸引客户而降低价格的激进行为,还要打击缺乏信息和不负责任的行为。保险过程的大量其他参与者。此外,它必须与被保险人以较低价格接受服务的轻率愿望作斗争52,并反对他们转向诱人的保险公司,而没有适当注意他们的可靠性。它必须与个别经理人寻求从风险承保和降低价格中获得个人利益的愿望作斗争,他们认为这是实现这些利益的一种简单而有保证的手段53. 它必须与股东的愿望作斗争,尽管情况如此,但仍能获得始终稳定且可能不断增长的股息流。

因此,对于造成“中型公司进入市场,低费率和大量广告”54的问题的答案应该是对保险市场进行系统和精心的培育,包括提高所有参与者的意识和责任感。55.

统计代写|金融统计代写Financial Statistics代考|The need for modeling

保险的监管和成功管理问题比任何学术理论都要复杂得多。因此,一个经常被问到的问题是:“一个理论真的有用吗?”。

我们同意 T. Pentikäinen(参见 [152],第 30 页)的观点,他经常指出,仅仅凭直觉就指导了管理层的决策过程。许多“经验丰富的”管理者对理论考虑的态度往往是怀疑和屈尊的态度。他们把它们排除在外,认为它们没有实用价值。但是,拒绝明确阐述其行动的任务和原则,并不意味着在这些行动中没有战略。相反,每一种决策方法,甚至是不做任何决定的决定,都是战略的变体。唯一的区别是,这些“务实的人”的策略可以是惰性传统、旧习惯、或多或少足够的直觉等的随机混合。它可能缺乏对各种替代策略的清晰理解和分析。

现在普遍认为,如果监管和保险管理不是基于全面的保险流程模型,可以洞察公司如何破产,他们将盲目行事。

由于保险业的特殊性,明智的做法是从保险概率机制模型开始,即保险索赔序列如何在一个时间段内出现,例如一个保险年度。研究了这一机制后,公司的监管者或经理将能够在一个保险年度内制定公司的最低偿付能力要求。这里最重要的是,这不会以任意方式进行,而是按照大规模随机现象的自然规律进行。

在实施这个程序时,应该抵制简化模型的诱惑。这些简化可能会影响模型在现实条件下的适用性。如果仍然执行这种简化,就像在经典风险理论的情况下经常发生的那样,那么应该清楚地警告其限制适用性或不适用性。

统计代写|金融统计代写Financial Statistics代考|Central aspects of Lundberg’s model: collective risk

Lundberg 的模型提供了对任何保险公司工作中遇到的大规模随机现象的合理但简化的描述。该模型的基础是集体风险的概念,它使我们能够随着时间的推移监控公司的财务状况。

集体风险的概念意味着存在产生连续索赔的随机机制;公司的投资组合被视为一个整体,而不是已知数量的单个保单的总和。为了说明这一点,让我们假设保险公司在线收到有关刚刚发生的每项索赔的时间和严重程度的信息。该信息以风险准备金过程的形式呈现,即初始资本加上收取的总保费减去总索赔付款。在时间之内毁灭吨我们指的是风险准备金过程随着时间的推移而下降的事件

在时间间隔内至少一次低于零(0,吨]. 在这种情况下,最重要的目标是计算总索赔支付分布和破产概率。

形式化 Lundberg 的模型,我们解决索赔之间的间隔和相应的索赔严重性。我们通过两个正随机变量序列对它们进行建模吨一世,一世=1,2,…, 和是一世,一世=1,2,…这两个序列一起可以称为基本风险,并表示为ķ为简洁起见。

在竞争市场上运营的公司的保险过程的多年控制模型中,Lundberg 的模型将在每个连续的保险年度重新构建。因此,基本风险可称为与所考虑的任何单个公司有关的年度基本风险。这些年度风险的顺序是多年概率建模的基础,即对索赔如何随着时间的推移发生并连续每年造成累积损害的建模。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。