如果你也在 怎样代写兼并和收购Mergers and Acquisitions这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

兼并和收购是一个法律实践领域,主要是指旨在通过合并、购买资产、投标报价、敌意收购等法律业务整合两家或多家公司业务的国内和全球交易。

statistics-lab™ 为您的留学生涯保驾护航 在代写兼并和收购Mergers and Acquisitions方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写兼并和收购Mergers and Acquisitions代写方面经验极为丰富,各种代写兼并和收购Mergers and Acquisitions相关的作业也就用不着说。

我们提供的兼并和收购Mergers and Acquisitions及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等概率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|兼并和收购代写Mergers and Acquisitions代考|STRATEGY MATTERS IN TAKEOVER BATTLES

Good takeover strategies don’t always ensure success, especially when things turn hosti But a bad strategy dramatically increases the risk of calamity. This was aptly demonstrated the years following ConAgra Food’s (ConAgra) acquisition of Ralcorp Holdings (Ralcorp) early 2013. By mid-2015, ConAgra, under considerable pressure to divest or spin-off Ralco from activist investors, announced it would be seeking ways to do so.

The Ralcorp takeover made ConAgra one of the largest packaged food companies in Nor America. The transaction also positioned ConAgra as the largest private label packaged for business in North America. ${ }^1$ What ConAgra had hoped is that diversifying from its own cc sumer brands to faster-growing private label brands would provide a well-balanced bu ness portfolio allowing the firm to better weather cyclical downturns in the economy. Wr actually happened is that investors saw ConAgra as a hybrid company consisting of secon and third-tier branded products such as Hunt’s ketchup and Orville Redenbacher’s popco and private label foods sold under supermarket names. Other food companies selling eith branded products or private-label items were easier to value.

ConAgra, initially rebuffed in its all-cash $\$ 84$ bid in March 2011 to get a friendly deal, $\mathrm{c}$ cided to threaten to walk away if Ralcorp did not negotiate immediately. Normally, so-call hostile deals (i.e., those not supported by the target’s board and management) are difficu particularly when a target has strong takeover defenses. Ralcorp had both a staggered boa making it difficult to change the composition of the board and a poison pill that would if tri gered substantially raise the cost of the deal. Such deals are made even more difficult wh the acquirer lacks a coherent takeover strategy. Such strategies often involve an offer ma directly to the target’s shareholders (i.e., a hostile tender offer), a proxy contest to change t composition of the board (even though it could take several years because of the stagger board) to rescind the poison pill, and litigation to compel the board to remove the pill. The tactics in combination are intended to pressure the board to the negotiating table.

Despite its threat, ConAgra did not walk away and a year later announced a friendly de on November 27,2012 , with Ralcorp at $\$ 94$ per share, about $12 \%$ more than its initial bid. $T$

purchase price appeared at the time to be excessive especially since Ralcorp had spun off Post Cereals in early 2012 that at the time had a market value of $\$ 17.50$ per share. Since ConAgra was receiving fewer assets, the purchase price paid should have been lower reflecting the Post spin-off, possibly by as much as $\$ 17.50$ per share.

ConAgra’s misfortune showed when it failed to convince investors that its “hybrid” strategy could create shareholder value as its underperformance resulted in write-downs of the value of its Ralcorp acquisition by more than $\$ 2$ billion. The implication was clear: it had dramatically overpaid for Ralcorp. The legacy of overpaying has been that ConAgra shares since the closing in January 2013 have dropped by more than $3 \%$ while other food products companies showed average gains of more than $10 \%$. At the end of 2016, ConAgra shares traded at a $30 \%$ discount to the median multiple for similar-sized North American food manufacturers.

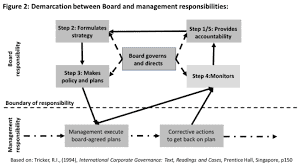

经济代写|兼并和收购代写Mergers and Acquisitions代考|The Board of Directors/Management

Corporate board structures differ among countries and have evolved into two basic types: unitary (single) and two-tier (dual) structures. A unitary board is composed of both company managers and independent directors, which make decisions as a group. An independent director (sometimes called an outside director) is someone brought to the board from outside the firm. Such directors have not worked for the firm in the past, are not a current manager, do not stand to benefit financially beyond what is paid to other board directors, and are not a captive of the firm’s current culture or way of doing business. A two-tier board consists of a management board composed only of company executives, including the chief executive officer, whose responsibilities are to run the firm’s operations and a separate supervisory board composed only of independent directors. Overseeing the management board, the supervisory board is responsible for strategic decisions and often contains other stakeholders such as employees and environmental groups.

The United States and the United Kingdom are examples of countries having mandated unitary board structures, while Germany and Austria use the two-tiered board structure. In other countries such as France, firms are permitted to switch between the two types of structures. Which structure a firm chooses seems to reflect the extent to which shareholders see potential significant conflicts with management as to how the firm should be managed.

What follows is more descriptive of a unitary board structure. For such boards, the primary responsibilities are to advise the Chief Executive Officer (CEO) and to monitor firm performance. The board hires, fires, and sets CEO pay and is expected to oversee management, corporate strategy, and the firm’s financial reports to shareholders. Some board members may be employees or founding family members; others may be affiliated with the firm through a banking relationship, a law firm retained by the firm, or someone who represents a customer or supplier. Such members may be subject to conflicts of interest causing them to act in ways not in the shareholders’ best interests. For example, boards with directors working for banks that have made loans to the firm may be prone to favor diversifying acquisitions that are financed with stock rather than cash. ${ }^2$ Such directors may believe that acquisitions that diversify the firm may smooth out fluctuations in consolidated cash flow and that using stock rather than cash to pay for them preserves the firm’s ability to meet interest and principal payments on its existing debt. However, the use of the stock may dilute the acquiring shareholders’ ownership interest in the combined firms.

Such potential conflicts of interest have led some observers to argue that boards should be composed primarily of independent directors and different individuals should hold the CEO and board chairman positions. The presumption is that independent directors improve firm performance due to their objectivity and outside experience. Boards with significant numbers of independent directors also are likely to be more attractive to foreign investors concerned about the challenges of monitoring firm performance from outside the country. The presen of the independent directors may reduce monitoring costs as they are viewed as better at to limit the self-serving actions of insiders. ${ }^3$ Moreover, the longer outside directors serve or board, the greater their contribution to improving firm performance, because they are betI able to understand the firm’s operations and to provide better-quality advice. ${ }^4$

兼并和收购代考

经济代写|兼并和收购代写Mergers and Acquisitions代考|STRATEGY MATTERS IN TAKEOVER BATTLES

好的接管策略并不总能确保成功,尤其是当事情变得不利时。但糟糕的策略会大大增加灾难的风险。这在康尼格拉食品 (ConAgra) 于 2013 年初收购 Ralcorp Holdings (Ralcorp) 之后的几年中得到了恰当的证明。到 2015 年年中,康尼格拉在从激进投资者手中剥离或分拆 Ralco 的巨大压力下,宣布将寻求方法来这样做。

对 Ralcorp 的收购使 ConAgra 成为北美最大的包装食品公司之一。该交易还将 ConAgra 定位为北美最大的商业包装自有品牌。1ConAgra 曾希望从自己的 cc sumer 品牌转向增长更快的自有品牌,从而提供均衡的业务组合,使公司能够更好地度过经济周期性低迷时期。事实上,投资者将 ConAgra 视为一家混合型公司,由二级和三级品牌产品组成,例如 Hunt 的番茄酱和 Orville Redenbacher 的 popco 以及以超市名称销售的自有品牌食品。其他销售品牌产品或自有品牌产品的食品公司更容易估值。

ConAgra,最初以全现金方式拒绝$842011年3月出价获得友好交易,C如果 Ralcorp 不立即谈判,他将威胁要离开。通常,所谓的敌意交易(即那些不受目标公司董事会和管理层支持的交易)很难进行,尤其是当目标公司具有强大的收购防御能力时。Ralcorp 既有一条交错的蟒蛇,很难改变董事会的组成,也有一颗毒丸,如果被触发,会大大提高交易成本。如果收购方缺乏连贯的收购策略,此类交易就会变得更加困难。此类策略通常涉及直接向目标公司股东提出要约(即恶意要约收购)、改变董事会组成的代理权竞争(尽管由于交错董事会可能需要数年时间)以取消毒丸计划和诉讼以迫使董事会取消药丸。

尽管受到威胁,ConAgra 并没有走开,一年后于 2012 年 11 月 27 日宣布友好合作,Ralcorp 在$94每股,约12%超过其最初的出价。吨

当时的收购价格似乎过高,特别是因为 Ralcorp 在 2012 年初剥离了 Post Cereals,当时的市值为$17.50每股。由于 ConAgra 收到的资产较少,因此支付的购买价格应该更低,以反映 Post 的分拆,可能高达$17.50每股。

ConAgra 的不幸表现在它未能让投资者相信其“混合”战略可以创造股东价值,因为其业绩不佳导致其收购 Ralcorp 的价值减记超过$2十亿。言下之意很明显:它为 Ralcorp 支付的价格过高。自 2013 年 1 月收盘以来,康尼格拉股价下跌超过3%而其他食品公司的平均收益超过10%. 2016 年底,ConAgra 股票的交易价格为30%低于类似规模的北美食品制造商的中位数倍数。

经济代写|兼并和收购代写Mergers and Acquisitions代考|The Board of Directors/Management

公司董事会结构因国家/地区而异,并已演变为两种基本类型:单一(单一)和两层(双重)结构。单一董事会由公司经理和独立董事组成,他们作为一个整体做出决策。独立董事(有时称为外部董事)是从公司外部引入董事会的人。这些董事过去没有为公司工作过,不是现任经理,除了支付给其他董事的报酬之外,不会获得经济利益,也不是公司当前文化或经营方式的俘虏。双层董事会由仅由公司高管组成的管理委员会组成,包括首席执行官、其职责是管理公司的运营和一个仅由独立董事组成的独立监事会。监督管理委员会,监事会负责战略决策,通常包括其他利益相关者,如员工和环保团体。

美国和英国是强制采用单一董事会结构的国家的例子,而德国和奥地利则使用两层董事会结构。在法国等其他国家,公司可以在这两种结构之间转换。公司选择哪种结构似乎反映了股东认为在公司应如何管理方面与管理层存在潜在重大冲突的程度。

以下是对单一董事会结构的更多描述。对于此类董事会,主要职责是向首席执行官 (CEO) 提供建议并监督公司业绩。董事会聘用、解雇 CEO 并设定其薪酬,并有望监督管理、公司战略以及公司向股东提交的财务报告。一些董事会成员可能是员工或创始家庭成员;其他人可能通过银行关系、公司聘请的律师事务所或代表客户或供应商的人与公司有关联。这些成员可能会受到利益冲突的影响,导致他们以不符合股东最佳利益的方式行事。例如,董事会的董事在为公司提供贷款的银行工作,可能倾向于支持以股票而非现金融资的多元化收购。2这些董事可能认为,使公司多元化的收购可以消除合并现金流量的波动,并且使用股票而不是现金来支付收购可以保持公司支付其现有债务的利息和本金的能力。但是,股票的使用可能会稀释收购方股东在合并后公司中的所有权权益。

这种潜在的利益冲突导致一些观察家认为,董事会应该主要由独立董事组成,并且不同的人应该担任首席执行官和董事会主席的职位。假设是独立董事由于其客观性和外部经验而改善了公司绩效。拥有大量独立董事的董事会也可能对担心从国外监督公司业绩的挑战的外国投资者更具吸引力。独立董事的存在可能会降低监督成本,因为他们被认为更善于限制内部人的利己行为。3此外,外部董事任职或担任董事的时间越长,他们对改善公司业绩的贡献就越大,因为他们更有可能了解公司的运营并提供更优质的建议。4

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

金融工程代写

金融工程是使用数学技术来解决金融问题。金融工程使用计算机科学、统计学、经济学和应用数学领域的工具和知识来解决当前的金融问题,以及设计新的和创新的金融产品。

非参数统计代写

非参数统计指的是一种统计方法,其中不假设数据来自于由少数参数决定的规定模型;这种模型的例子包括正态分布模型和线性回归模型。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

术语 广义线性模型(GLM)通常是指给定连续和/或分类预测因素的连续响应变量的常规线性回归模型。它包括多元线性回归,以及方差分析和方差分析(仅含固定效应)。

有限元方法代写

有限元方法(FEM)是一种流行的方法,用于数值解决工程和数学建模中出现的微分方程。典型的问题领域包括结构分析、传热、流体流动、质量运输和电磁势等传统领域。

有限元是一种通用的数值方法,用于解决两个或三个空间变量的偏微分方程(即一些边界值问题)。为了解决一个问题,有限元将一个大系统细分为更小、更简单的部分,称为有限元。这是通过在空间维度上的特定空间离散化来实现的,它是通过构建对象的网格来实现的:用于求解的数值域,它有有限数量的点。边界值问题的有限元方法表述最终导致一个代数方程组。该方法在域上对未知函数进行逼近。[1] 然后将模拟这些有限元的简单方程组合成一个更大的方程系统,以模拟整个问题。然后,有限元通过变化微积分使相关的误差函数最小化来逼近一个解决方案。

tatistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

随机分析代写

随机微积分是数学的一个分支,对随机过程进行操作。它允许为随机过程的积分定义一个关于随机过程的一致的积分理论。这个领域是由日本数学家伊藤清在第二次世界大战期间创建并开始的。

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。