如果你也在 怎样代写计量经济学Econometrics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

计量经济学是将统计方法应用于经济数据,以赋予经济关系以经验内容。

statistics-lab™ 为您的留学生涯保驾护航 在代写计量经济学Econometrics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写计量经济学Econometrics代写方面经验极为丰富,各种代写计量经济学Econometrics相关的作业也就用不着说。

我们提供的计量经济学Econometrics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等楖率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等楖率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|计量经济学作业代写Econometrics代考|Models and Data-Generating Processes

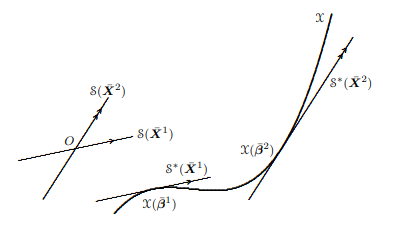

In economics, it is probably not often the case that a relationship like (2.01) actually represents the way in which a dependent variable is generated, as it might if $x_{t}(\beta)$ were a physical response function and $u_{t}$ merely represented errors in measuring $y_{t}$. Instead, it is usually a way of modeling how $y_{t}$ varies

with the values of certain variables. They may be the only variables about which we have information or the only ones that we are interested in for a particular purpose. If we had more information about potential explanatory variables, we might very well specify $x_{t}(\beta)$ differently so as to make use of that additional information.

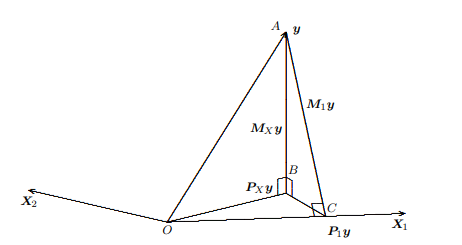

It is sometimes desirable to make explicit the fact that $x_{t}(\beta)$ represents the conditional mean of $y_{t}$, that is, the mean of $y_{t}$ conditional on the values of a number of other variables. The set of variables on which $y_{t}$ is conditioned is often referred to as an information set. If $\Omega_{t}$ denotes the information set on which the expectation of $y_{t}$ is to be conditioned, one could define $x_{t}(\boldsymbol{\beta})$ formally as $E\left(y_{t} \mid \Omega_{t}\right)$. There may be more than one such information set. Thus we might well have both

$$

x_{1 t}\left(\boldsymbol{\beta}{1}\right) \equiv E\left(y{t} \mid \Omega_{1 t}\right) \quad \text { and } \quad x_{2 t}\left(\boldsymbol{\beta}{2}\right) \equiv E\left(y{t} \mid \Omega_{2 t}\right)

$$

where $\Omega_{1 t}$ and $\Omega_{2 t}$ denote two different information sets. The functions $x_{1 t}\left(\boldsymbol{\beta}{1}\right)$ and $x{2 t}\left(\boldsymbol{\beta}{2}\right)$ might well be quite different, and we might want to estimate both of them for different purposes. There are many circumstances in which we might not want to condition on all available information. For example, if the ultimate purpose of specifying a regression function is to use it for forecasting, there may be no point in conditioning on information that will not be available at the time the forecast is to be made. Even when we do want to take account of all available information, the fact that a certain variable belongs to $\Omega{t}$ does not imply that it will appear in $x_{t}(\boldsymbol{\beta})$, since its value may tell us nothing useful about the conditional mean of $y_{t}$, and including it may impair our ability to estimate how other variables affect that conditional mean.

For any given dependent variable $y_{t}$ and information set $\Omega_{t}$, one is always at liberty to consider the difference $y_{t}-E\left(y_{t} \mid \Omega_{t}\right)$ as the error term associated with the $t^{\text {th }}$ observation. But for a regression model to be applicable, these differences must generally have the i.i.d. property. Actually, it is possible, when the sample size is large, to deal with cases in which the error terms are independent, but identically distributed only as regards their means, and not necessarily as regards their variances. We will discuss techniques for dealing with such cases in Chapters 16 and 17 , in the latter of which we will also relax the independence assumption. As we will see in Chapter 3, however, conventional techniques for making inferences from regression models are unreliable when models lack the i.i.d. property, even when the regression function $x_{t}(\boldsymbol{\beta})$ is “correctly” specified. Thus we are in general not at liberty to choose an arbitrary information set and estimate a properly specified regression function based on it if we want to make inferences using conventional procedures.

经济代写|计量经济学作业代写Econometrics代考|Linear and Nonlinear Regression Functions

The general regression function $x_{t}(\beta)$ can be made specific in a very large number of ways. It is worthwhile to consider a number of special cases so as to get some idea of the variety of specific regression functions that are commonly used in practice.

The very simplest regression function is

$$

x_{t}(\boldsymbol{\beta})=\beta_{1} \iota_{t}=\beta_{1},

$$

where $\iota_{t}$ is the $t^{\text {th }}$ element of an $n$-vector $\iota$, each element of which is 1 . In this case, the model $(2.01)$ says that the conditional mean of $y_{t}$ is simply a constant. While this is a trivial example of a regression function, since $x_{t}(\boldsymbol{\beta})$ is the same for all $t$, it is nevertheless a good example to start with and to keep in mind. All regression functions are simply fancier versions of (2.10). And any regression function that cannot fit the data at least as well as (2.10) should be considered a highly unsatisfactory one.

The next-simplest regression function is the simple linear regression function

$$

x_{t}(\beta)=\beta_{1}+\beta_{2} z_{t},

$$

where $z_{t}$ is a single independent variable. Actually, an even simpler model would be one with a single independent variable and no constant term. However, in most applied problems it does not make sense to omit the constant term. Many linear regression functions are used as approximations to unknown conditional mean functions, and such approximations will rarely be accurate if they are constrained to pass through the origin. Equation (2.11) has two parameters, an intercept $\beta_{1}$ and a slope $\beta_{2}$. This function is linear in both variables ( $\iota_{t}$ and $z_{t}$, or just $z_{t}$ if one chooses not to call $\iota_{t}$ a variable) and parameters $\left(\beta_{1}\right.$ and $\beta_{2}$ ). Although this model is often too simple, it does have some advantages. Because it is very easy to graph $y_{t}$ against $z_{t}$, we can use such a graph to see what the regression function looks like, how well the model fits, and whether a linear relationship adequately describes the data. “Eyeballine” the data in this way is harder, and therefore much less often done, when a model involves more than one independent variable.

One ubvious generalization of (2.11) is the multiple linear regression function

$$

x_{t}(\boldsymbol{\beta})=\beta_{1} z_{t 1}+\beta_{2} z_{t 2}+\beta_{3} z_{t 3}+\cdots+\beta_{k} z_{t k}

$$

经济代写|计量经济学作业代写Econometrics代考|Error Terms

When we specify a regression model, we must specify two things: the regression function $x_{t}(\boldsymbol{\beta})$ and at least some of the properties of the error terms $u_{t}$. We have already seen how important the second of these can be. When we added errors with constant variance to the multiplicative regression function (2.13), we obtained a genuinely nonlinear regression model. But when we added errors that were proportional to the regression function, as in (2.15), and made use of the approximation $e^{w} \cong 1+w$, which is a very good one when $w$ is small, we obtained a loglinear regression model. It should be clear from this example that how we specify the error terms will have a major effect on the model which is actually estimated.

In (2.01) we specified that the error terms were independent with identical means of zero and variances $\sigma^{2}$, but we did not specify how they were actually distributed. Even these assumptions may often be too strong. They rule out any sort of dependence across observations and any type of variation over time or with the values of any of the independent variables. They also rule out distributions where the tails are so thick that the error terms do not have a finite variance. One such distribution is the Cauchy distribution. A random

variable that is distributed as Cauchy not only has no finite variance but no finite mean either. See Chapter 4 and Appendix B.

There are several meanings of the word independence in the literature on statistics and econometrics. Two random variables $z_{1}$ and $z_{2}$ are said to be stochastically independent if their joint probability distribution function $F\left(z_{1}, z_{2}\right)$ is equal to the product of their two marginal distribution functions $F\left(z_{1}, \infty\right)$ and $F\left(\infty, z_{2}\right)$. This is sometimes called independence in probability, but we will employ the former, more modern, terminology. Some authors say that two random variables $z_{1}$ and $z_{2}$ are linearly independent if $E\left(z_{1} z_{2}\right)=$ $E\left(z_{1}\right) E\left(z_{2}\right)$, a weaker condition, which is implied by stochastic independence but does not imply it. This terminology is unfortunate, because this meaning of “linearly independent” is not the same as its usual meaning in linear algebra, and we will therefore not use it. Instead, in this situation we will merely say that $z_{1}$ and $z_{2}$ are uncorrelated, or have zero covariance. If either $z_{1}$ or $z_{2}$ has mean zero and they are uncorrelated, $E\left(z_{1} z_{2}\right)=0$. There is a sense in which $z_{1}$ and $z_{2}$ are orthogonal in this situation, and we will sometimes use this terminology as well.

计量经济学代考

经济代写|计量经济学作业代写Econometrics代考|Models and Data-Generating Processes

在经济学中,像 (2.01) 这样的关系实际上并不经常代表因变量的生成方式,如果X吨(b)是一种生理反应函数,并且在吨仅代表测量误差是吨. 相反,它通常是一种建模方式是吨变化

与某些变量的值。它们可能是我们掌握信息的唯一变量,或者是我们对特定目的感兴趣的唯一变量。如果我们有更多关于潜在解释变量的信息,我们可以很好地指定X吨(b)以不同的方式使用该附加信息。

有时需要明确说明以下事实:X吨(b)表示条件均值是吨, 也就是是吨以许多其他变量的值为条件。变量集是吨有条件的通常被称为信息集。如果Ω吨表示期望的信息集是吨是有条件的,可以定义X吨(b)正式地作为和(是吨∣Ω吨). 可能有不止一个这样的信息集。因此我们很可能同时拥有

X1吨(b1)≡和(是吨∣Ω1吨) 和 X2吨(b2)≡和(是吨∣Ω2吨)

在哪里Ω1吨和Ω2吨表示两个不同的信息集。功能X1吨(b1)和X2吨(b2)很可能完全不同,我们可能希望出于不同的目的对它们进行估计。在许多情况下,我们可能不想以所有可用信息为条件。例如,如果指定回归函数的最终目的是将其用于预测,则可能没有必要对在进行预测时不可用的信息进行调节。即使我们确实想考虑所有可用信息,某个变量属于Ω吨并不意味着它会出现在X吨(b),因为它的值可能不会告诉我们关于条件均值的任何有用信息是吨,并且包括它可能会损害我们估计其他变量如何影响该条件均值的能力。

对于任何给定的因变量是吨和信息集Ω吨, 人们总是可以自由地考虑差异是吨−和(是吨∣Ω吨)作为与相关的误差项吨th 观察。但是要使回归模型适用,这些差异通常必须具有 iid 属性。实际上,当样本量很大时,可以处理误差项独立但仅在均值上同分布的情况,而在方差方面不一定相同。我们将在第 16 章和第 17 章讨论处理这种情况的技术,在第 17 章中,我们还将放宽独立性假设。然而,正如我们将在第 3 章中看到的那样,当模型缺乏 iid 属性时,从回归模型进行推断的传统技术是不可靠的,即使回归函数是X吨(b)是“正确”指定的。因此,如果我们想使用常规程序进行推断,我们通常不能随意选择任意信息集并基于它估计适当指定的回归函数。

经济代写|计量经济学作业代写Econometrics代考|Linear and Nonlinear Regression Functions

一般回归函数X吨(b)可以通过多种方式具体化。值得考虑一些特殊情况,以便了解实践中常用的各种特定回归函数。

最简单的回归函数是

X吨(b)=b1我吨=b1,

在哪里我吨是个吨th 一个元素n-向量我,其中每个元素为 1 。在这种情况下,模型(2.01)表示条件均值是吨只是一个常数。虽然这是回归函数的一个简单示例,但由于X吨(b)所有人都一样吨,但它仍然是一个很好的例子,可以开始并牢记。所有回归函数都是 (2.10) 的更高级版本。并且任何不能至少与(2.10)一样拟合数据的回归函数都应该被认为是一个非常不令人满意的回归函数。

下一个最简单的回归函数是简单线性回归函数

X吨(b)=b1+b2和吨,

在哪里和吨是一个独立的变量。实际上,更简单的模型将是具有单个自变量且没有常数项的模型。然而,在大多数应用问题中,省略常数项是没有意义的。许多线性回归函数被用作未知条件均值函数的近似值,如果它们被限制为通过原点,这些近似值将很少准确。方程(2.11)有两个参数,一个截距b1和一个斜坡b2. 该函数在两个变量中都是线性的 (我吨和和吨, 要不就和吨如果一个人选择不打电话我吨变量)和参数(b1和b2)。虽然这个模型往往过于简单,但它确实有一些优势。因为它很容易绘制图表是吨反对和吨,我们可以使用这样的图来查看回归函数的样子、模型的拟合程度以及线性关系是否充分描述了数据。当模型涉及多个自变量时,以这种方式“观察”数据更难,因此很少这样做。

(2.11) 的一个明显概括是多元线性回归函数

X吨(b)=b1和吨1+b2和吨2+b3和吨3+⋯+bķ和吨ķ

经济代写|计量经济学作业代写Econometrics代考|Error Terms

当我们指定回归模型时,我们必须指定两件事:回归函数X吨(b)以及至少一些误差项的性质在吨. 我们已经看到了其中第二个的重要性。当我们向乘法回归函数 (2.13) 添加具有恒定方差的误差时,我们得到了一个真正的非线性回归模型。但是当我们添加与回归函数成比例的误差时,如(2.15),并利用近似值和在≅1+在, 这是一个非常好的当在小,我们得到一个对数线性回归模型。从这个例子中应该清楚的是,我们如何指定误差项将对实际估计的模型产生重大影响。

在(2.01)中,我们指定误差项是独立的,具有相同的零均值和方差σ2,但我们没有具体说明它们的实际分布方式。即使是这些假设也可能常常过于强大。它们排除了对观察结果的任何依赖以及随时间的任何类型的变化或任何自变量的值。他们还排除了尾部太厚以至于误差项没有有限方差的分布。一种这样的分布是柯西分布。一个随机的

分布为柯西的变量不仅没有有限方差,也没有有限均值。参见第 4 章和附录 B。

在统计和计量经济学文献中,独立性一词有多种含义。两个随机变量和1和和2如果它们的联合概率分布函数被认为是随机独立的F(和1,和2)等于它们两个边际分布函数的乘积F(和1,∞)和F(∞,和2). 这有时被称为概率独立性,但我们将使用前者,更现代的术语。一些作者说两个随机变量和1和和2是线性独立的,如果和(和1和2)= 和(和1)和(和2),一个较弱的条件,它由随机独立性暗示,但并不暗示它。这个术语是不幸的,因为“线性独立”的这个含义与它在线性代数中的通常含义不同,因此我们不会使用它。相反,在这种情况下,我们只会说和1和和2不相关,或协方差为零。如果要么和1或者和2均值为零并且它们不相关,和(和1和2)=0. 有一种感觉和1和和2在这种情况下是正交的,我们有时也会使用这个术语。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

随机过程代考

在概率论概念中,随机过程是随机变量的集合。 若一随机系统的样本点是随机函数,则称此函数为样本函数,这一随机系统全部样本函数的集合是一个随机过程。 实际应用中,样本函数的一般定义在时间域或者空间域。 随机过程的实例如股票和汇率的波动、语音信号、视频信号、体温的变化,随机运动如布朗运动、随机徘徊等等。

贝叶斯方法代考

贝叶斯统计概念及数据分析表示使用概率陈述回答有关未知参数的研究问题以及统计范式。后验分布包括关于参数的先验分布,和基于观测数据提供关于参数的信息似然模型。根据选择的先验分布和似然模型,后验分布可以解析或近似,例如,马尔科夫链蒙特卡罗 (MCMC) 方法之一。贝叶斯统计概念及数据分析使用后验分布来形成模型参数的各种摘要,包括点估计,如后验平均值、中位数、百分位数和称为可信区间的区间估计。此外,所有关于模型参数的统计检验都可以表示为基于估计后验分布的概率报表。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

statistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

机器学习代写

随着AI的大潮到来,Machine Learning逐渐成为一个新的学习热点。同时与传统CS相比,Machine Learning在其他领域也有着广泛的应用,因此这门学科成为不仅折磨CS专业同学的“小恶魔”,也是折磨生物、化学、统计等其他学科留学生的“大魔王”。学习Machine learning的一大绊脚石在于使用语言众多,跨学科范围广,所以学习起来尤其困难。但是不管你在学习Machine Learning时遇到任何难题,StudyGate专业导师团队都能为你轻松解决。

多元统计分析代考

基础数据: $N$ 个样本, $P$ 个变量数的单样本,组成的横列的数据表

变量定性: 分类和顺序;变量定量:数值

数学公式的角度分为: 因变量与自变量

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。