如果你也在 怎样代写计量经济学Econometrics这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。

计量经济学是将统计方法应用于经济数据,以赋予经济关系以经验内容。

statistics-lab™ 为您的留学生涯保驾护航 在代写计量经济学Econometrics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写计量经济学Econometrics代写方面经验极为丰富,各种代写计量经济学Econometrics相关的作业也就用不着说。

我们提供的计量经济学Econometrics及其相关学科的代写,服务范围广, 其中包括但不限于:

- Statistical Inference 统计推断

- Statistical Computing 统计计算

- Advanced Probability Theory 高等楖率论

- Advanced Mathematical Statistics 高等数理统计学

- (Generalized) Linear Models 广义线性模型

- Statistical Machine Learning 统计机器学习

- Longitudinal Data Analysis 纵向数据分析

- Foundations of Data Science 数据科学基础

经济代写|计量经济学作业代写Econometrics代考|Further Reading and Conclusion

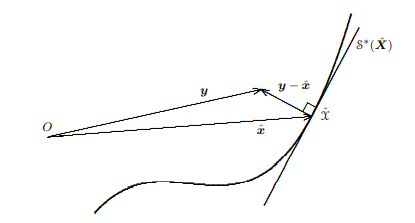

The use of geometry as an aid to the understanding of linear regression has a long history; see Herr (1980). Early and important papers include Fisher (1915), Durbin and Kendall (1951), Kruskal (1961, 1968, 1975), and Seber (1964). One valuable reference on linear models that takes the geometric approach is Seber $(1980)$, although that book may be too terse for many readers. A recent expository paper that is quite accessible is Bryant (1984). The approach has not been used as much in econometrics as it has in statistics, but a number of econometrics texts – notably Malinvaud (1970a) and also Madansky (1976), Pollock (1979), and Wonnacott and Wonnacott (1979) use it to a greater or lesser degree. Our approach could be termed semigeometric, since we have not emphasized the coordinate-free nature of the analysis quite as much as some authors; see Kruskal’s papers, the Seber book or, in econometrics, Fisher $(1981,1983)$ and Fisher and McAleer (1984).

In this chapter, we have entirely ignored statistical models. Linear regression has been treated purely as a computational device which has a geometrical interpretation, rather than as an estimation procedure for a family of statistical models. All the results discussed have been true numerically, as a consequence of how ordinary least squares estimates are computed, and have not depended in any way on how the data were actually generated. We emphasize this, because conventional treatments of the linear regression model often fail to distinguish between the numerical and statistical properties of least squares.

In the remainder of this book, we will move on to consider a variety of statistical models, some of them regression models and some of them not, which are of practical use to econometricians. For most of the book, we will focus on two classes of models: ones that can be treated as linear and nonlinear regression models and ones that can be estimated by the method of maximum likelihood (the latter being a very broad class of models indeed). As we will see, understanding the geometrical properties of linear regression turns out to be central to understanding both nonlinear regression models and the method of maximum likelihood. We will therefore assume throughout our discussion that readers are familiar with the basic results that were presented in this chapter.

经济代写|计量经济学作业代写Econometrics代考|Nonlinear Least Squares

In Chapter 1 , we discussed in some detail the geometry of ordinary least squares and its properties as a computational device. That material is important because many commonly used statistical models are usually estimated by some variant of least squares. Among these is the most commonly encountered class of models in econometrics, the class of regression models, of which we now begin our discussion. Instead of restricting ourselves to the familinr territory of lincar regression modcls, which can be cstimated dircetly by OLS, we will consider the much broader family of nonlinear regression models, which may be estimated by nonlinear least squares, or NLS. Occasionally we will specifically treat linear regression models if there are results which are true for them that do not generalize to the nonlinear case.

In this and the next few chapters on regression models, we will restrict our attention to univariate models, meaning models in which there is a single dependent variable. These are a good deal simpler to deal with than multivariate models, in which there are several jointly dependent variables. Univariate models are far more commonly encountered in practice than are multivariate ones, and a good understanding of the former is essential to understanding the latter. Extending results for univariate models to the multivariate case is quite easy to do, as we will demonstrate in Chapter $9 .$

We begin by writing the univariate nonlinear regression model in its generic form as

$$

y_{t}=x_{t}(\boldsymbol{\beta})+u_{t}, \quad u_{t} \sim \operatorname{IID}\left(0, \sigma^{2}\right), \quad t=1, \ldots, n

$$

Here $y_{t}$ is the $t^{\text {th }}$ observation on the dependent variable, which is a scalar random variable, and $\boldsymbol{\beta}$ is a $k$-vector of (usually) unknown parameters. The scalar function $x_{t}(\beta)$ is a (generally nonlinear) regression function that determines the mean value of $y_{t}$ conditional on $\boldsymbol{\beta}$ and (usually) on certain independent variables. The latter have not been shown explicitly in (2.01), but the $t$ subscript of $x_{t}(\beta)$ does indicate that this function varies from observation to observation. In most cases, the reason for this is that $x_{t}(\boldsymbol{\beta})$ depends on one or more independent variables that do so. Thus $x_{t}(\beta)$ should be interpreted as the mean of $y_{t}$ conditional on the values of those independent variables. More precisely, as we will see in Section 2.4, it should be interpreted as the mean of $y_{t}$ conditional on some information set to which those independent variables belong.

经济代写|计量经济学作业代写Econometrics代考|Identification in Nonlinear Regression Models

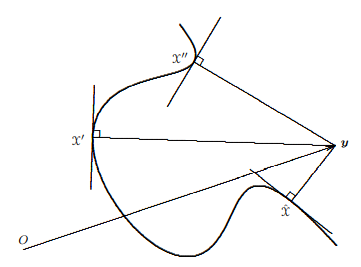

If we are to minimize $S S R(\boldsymbol{\beta})$ successfully, it is necessary that the model be identified. Identification is a geometrically simple concept that applies to a very wide variety of models and estimation techniques. Unfortunately, the term identification has come to be associated in the minds of many students of econometrics with the tedious algebra of the linear simultaneous equations model. Identification is indeed an issue in such models, and there are some special problems that arise for them (see Chapters 7 and 18), but the concept is applicable to every econometric model. Essentially, a nonlinear regression model is identified by a given data set if, for that data set, we can find a unique $\hat{\boldsymbol{\beta}}$ that minimizes $\operatorname{SSR}(\boldsymbol{\beta})$. If a model is not identified by the data being used, then there will be more than one $\hat{\boldsymbol{\beta}}$, perhaps even an infinite number of them. Some models may not be identifiable by any conceivable data set, while other models may be identified by some data sets but not by others.

There are two types of identification, local and global. The least squares estimate $\boldsymbol{\beta}$ will be locally identified if whenever $\hat{\beta}$ is perturbed slightly, the value of $\operatorname{SSR}(\boldsymbol{\beta})$ increases. This may be stated formally as the requirement that the function $S S R(\boldsymbol{\beta})$ be strictly convex at $\hat{\beta}$. Thus

$$

\operatorname{SSR}(\hat{\boldsymbol{\beta}})<\operatorname{SSR}(\hat{\boldsymbol{\beta}}+\boldsymbol{\delta})

$$

for all “small” perturbations $\boldsymbol{\delta}$. Recall that strict convexity is guaranteed if the Hessian matrix $\boldsymbol{H}(\boldsymbol{\beta})$, of which a typical element is

$$

H_{i j}(\boldsymbol{\beta}) \equiv \frac{\partial^{2} \operatorname{SSR}(\boldsymbol{\beta})}{\partial \beta_{i} \partial \beta_{j}}

$$

is positive definite at $\hat{\boldsymbol{\beta}}$. Strict convexity implies that $\operatorname{SSR}(\boldsymbol{\beta})$ is curved in every direction; no flat directions are allowed. If $\operatorname{SSR}(\boldsymbol{\beta})$ were flat in some direction near $\hat{\boldsymbol{\beta}}$, we could move away from $\hat{\boldsymbol{\beta}}$ in that direction without changing the value of the sum of squared residuals at all (remember that the first derivatives of $\operatorname{SSR}(\boldsymbol{\beta})$ are zero at $\hat{\boldsymbol{\beta}}$, which implies that $\operatorname{SSR}(\boldsymbol{\beta})$ must be equal to $\operatorname{SSR}(\hat{\boldsymbol{\beta}})$ everywhere in the flat region). Hence $\hat{\boldsymbol{\beta}}$ would not be the unique NLS estimator but merely one of an infinite number of points that all minimize $\operatorname{SSR}(\boldsymbol{\beta})$. Figure $2.5$ shows the contours of $\operatorname{SSR}(\boldsymbol{\beta})$ for the usual case in which $\hat{\boldsymbol{\beta}}$ is a unique local minimum, while Figure $2.6$ shows them for a case in which the model is not identified, because all points along the line $A B$ minimize $\operatorname{SSR}(\boldsymbol{\beta})$.

Local identification is necessary but not sufficient for us to obtain unique estimates $\hat{\boldsymbol{\beta}}$. A more general requirement is global identification, which may be stated formally as

$$

\operatorname{SSR}(\hat{\boldsymbol{\beta}})<\operatorname{SSR}\left(\boldsymbol{\beta}^{}\right) \text { for all } \boldsymbol{\beta}^{} \neq \hat{\boldsymbol{\beta}}

$$

This definition of global identification is really just a restatement of the condition that $\hat{\boldsymbol{\beta}}$ be the unique minimizer of $\operatorname{SSR}(\hat{\boldsymbol{\beta}})$. Notice that even if a model is locally identified, it is quite possible for it to have two (or more) distinct estimates, say $\hat{\boldsymbol{\beta}}^{1}$ and $\hat{\boldsymbol{\beta}}^{2}$, with $\operatorname{SSR}\left(\hat{\boldsymbol{\beta}}^{1}\right)=\operatorname{SSR}\left(\hat{\boldsymbol{\beta}}^{2}\right)$. As an example, consider the model

$$

y_{t}=\beta \gamma+\gamma^{2} z_{t}+u_{t} .

$$

计量经济学代考

经济代写|计量经济学作业代写Econometrics代考|Further Reading and Conclusion

使用几何来帮助理解线性回归有着悠久的历史。见 Herr (1980)。早期和重要的论文包括 Fisher (1915)、Durbin 和 Kendall (1951)、Kruskal (1961、1968、1975) 和 Seber (1964)。采用几何方法的线性模型的一个有价值的参考是 Seber(1980),尽管这本书对许多读者来说可能过于简洁。Bryant (1984) 是最近一篇相当容易理解的说明性论文。该方法在计量经济学中的使用不如在统计学中使用得那么多,但许多计量经济学教科书——尤其是 Malinvaud (1970a) 和 Madansky (1976)、Pollock (1979) 以及 Wonnacott 和 Wonnacott (1979) 使用它来或多或少的程度。我们的方法可以称为半几何,因为我们没有像某些作者那样强调分析的无坐标性质;参见 Kruskal 的论文、Seber 的书或计量经济学中的 Fisher(1981,1983)和费舍尔和麦卡利尔(1984 年)。

在本章中,我们完全忽略了统计模型。线性回归纯粹被视为具有几何解释的计算设备,而不是作为统计模型族的估计程序。由于普通最小二乘估计的计算方式,所有讨论的结果在数值上都是正确的,并且与数据的实际生成方式没有任何关系。我们强调这一点,因为线性回归模型的常规处理通常无法区分最小二乘的数值和统计特性。

在本书的其余部分中,我们将继续考虑各种统计模型,其中一些是回归模型,而另一些则不是,它们对计量经济学家有实际用途。对于本书的大部分内容,我们将关注两类模型:一类可以被视为线性和非线性回归模型,另一类可以通过最大似然法进行估计(后者确实是一类非常广泛的模型) . 正如我们将看到的,理解线性回归的几何特性是理解非线性回归模型和最大似然法的核心。因此,我们将在整个讨论过程中假设读者熟悉本章介绍的基本结果。

经济代写|计量经济学作业代写Econometrics代考|Nonlinear Least Squares

在第 1 章中,我们详细讨论了普通最小二乘法的几何及其作为计算设备的属性。该材料很重要,因为许多常用的统计模型通常是通过一些最小二乘法的变体来估计的。其中包括计量经济学中最常见的一类模型,即回归模型类,我们现在开始讨论它。与其将自己限制在可以通过 OLS 直接估计的 lincar 回归模型的家族领域,我们将考虑可以通过非线性最小二乘或 NLS 估计的更广泛的非线性回归模型家族。有时我们会专门处理线性回归模型,如果有结果对它们来说是正确的,但不能推广到非线性情况。

在回归模型的这一章和接下来的几章中,我们将把注意力限制在单变量模型上,即只有一个因变量的模型。这些比多变量模型更容易处理,其中有几个联合因变量。单变量模型在实践中比多变量模型更常见,对前者的良好理解对于理解后者至关重要。将单变量模型的结果扩展到多变量情况非常容易,我们将在第 1 章中演示9.

我们首先将单变量非线性回归模型以其一般形式编写为

是吨=X吨(b)+在吨,在吨∼独立身份证(0,σ2),吨=1,…,n

这里是吨是个吨th 观察因变量,这是一个标量随机变量,以及b是一个ķ-(通常)未知参数的向量。标量函数X吨(b)是一个(通常是非线性的)回归函数,用于确定是吨有条件的b和(通常)在某些自变量上。后者在 (2.01) 中没有明确显示,但是吨的下标X吨(b)确实表明此功能因观察而异。在大多数情况下,这样做的原因是X吨(b)取决于这样做的一个或多个自变量。因此X吨(b)应该解释为是吨以这些自变量的值为条件。更准确地说,正如我们将在 2.4 节中看到的,它应该被解释为是吨以这些自变量所属的某些信息集为条件。

经济代写|计量经济学作业代写Econometrics代考|Identification in Nonlinear Regression Models

如果我们要最小化小号小号R(b)成功,有必要识别模型。识别是一个几何简单的概念,适用于非常广泛的模型和估计技术。不幸的是,在许多计量经济学学生的头脑中,识别这个术语已经与线性联立方程模型的繁琐代数联系在一起。识别确实是此类模型中的一个问题,并且它们会出现一些特殊问题(参见第 7 章和第 18 章),但该概念适用于每个计量经济模型。本质上,非线性回归模型由给定的数据集确定,如果对于该数据集,我们可以找到唯一的b^最小化固态继电器(b). 如果一个模型没有被正在使用的数据识别,那么将会有多个b^,甚至可能有无数个。一些模型可能无法被任何可以想象的数据集识别,而其他模型可能被一些数据集识别,但不能被其他数据集识别。

有两种类型的标识,本地和全局。最小二乘估计b将在本地识别,如果任何时候b^略有扰动,值固态继电器(b)增加。这可以正式地表述为函数的要求小号小号R(b)严格凸于b^. 因此

固态继电器(b^)<固态继电器(b^+d)

对于所有“小”扰动d. 回想一下,如果 Hessian 矩阵可以保证严格的凸性H(b), 其中一个典型的元素是

H一世j(b)≡∂2固态继电器(b)∂b一世∂bj

是正定的b^. 严格凸性意味着固态继电器(b)向各个方向弯曲;不允许平面方向。如果固态继电器(b)在附近的某个方向上是平坦的b^,我们可以远离b^在这个方向上,完全不改变残差平方和的值(请记住,固态继电器(b)为零时b^,这意味着固态继电器(b)必须等于固态继电器(b^)平原地区的任何地方)。因此b^不会是唯一的 NLS 估计量,而只是所有最小化的无限数量的点之一固态继电器(b). 数字2.5显示轮廓固态继电器(b)对于通常的情况b^是唯一的局部最小值,而图2.6在未识别模型的情况下显示它们,因为沿线的所有点一种乙最小化固态继电器(b).

本地识别是必要的,但不足以让我们获得唯一的估计b^. 更一般的要求是全局标识,可以正式表述为

固态继电器(b^)<固态继电器(b) 对全部 b≠b^

全局识别的这个定义实际上只是对以下条件的重述:b^是唯一的最小化器固态继电器(b^). 请注意,即使一个模型是本地识别的,它也很可能有两个(或更多)不同的估计,比如说b^1和b^2, 和固态继电器(b^1)=固态继电器(b^2). 例如,考虑模型

是吨=bC+C2和吨+在吨.

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。

随机过程代考

在概率论概念中,随机过程是随机变量的集合。 若一随机系统的样本点是随机函数,则称此函数为样本函数,这一随机系统全部样本函数的集合是一个随机过程。 实际应用中,样本函数的一般定义在时间域或者空间域。 随机过程的实例如股票和汇率的波动、语音信号、视频信号、体温的变化,随机运动如布朗运动、随机徘徊等等。

贝叶斯方法代考

贝叶斯统计概念及数据分析表示使用概率陈述回答有关未知参数的研究问题以及统计范式。后验分布包括关于参数的先验分布,和基于观测数据提供关于参数的信息似然模型。根据选择的先验分布和似然模型,后验分布可以解析或近似,例如,马尔科夫链蒙特卡罗 (MCMC) 方法之一。贝叶斯统计概念及数据分析使用后验分布来形成模型参数的各种摘要,包括点估计,如后验平均值、中位数、百分位数和称为可信区间的区间估计。此外,所有关于模型参数的统计检验都可以表示为基于估计后验分布的概率报表。

广义线性模型代考

广义线性模型(GLM)归属统计学领域,是一种应用灵活的线性回归模型。该模型允许因变量的偏差分布有除了正态分布之外的其它分布。

statistics-lab作为专业的留学生服务机构,多年来已为美国、英国、加拿大、澳洲等留学热门地的学生提供专业的学术服务,包括但不限于Essay代写,Assignment代写,Dissertation代写,Report代写,小组作业代写,Proposal代写,Paper代写,Presentation代写,计算机作业代写,论文修改和润色,网课代做,exam代考等等。写作范围涵盖高中,本科,研究生等海外留学全阶段,辐射金融,经济学,会计学,审计学,管理学等全球99%专业科目。写作团队既有专业英语母语作者,也有海外名校硕博留学生,每位写作老师都拥有过硬的语言能力,专业的学科背景和学术写作经验。我们承诺100%原创,100%专业,100%准时,100%满意。

机器学习代写

随着AI的大潮到来,Machine Learning逐渐成为一个新的学习热点。同时与传统CS相比,Machine Learning在其他领域也有着广泛的应用,因此这门学科成为不仅折磨CS专业同学的“小恶魔”,也是折磨生物、化学、统计等其他学科留学生的“大魔王”。学习Machine learning的一大绊脚石在于使用语言众多,跨学科范围广,所以学习起来尤其困难。但是不管你在学习Machine Learning时遇到任何难题,StudyGate专业导师团队都能为你轻松解决。

多元统计分析代考

基础数据: $N$ 个样本, $P$ 个变量数的单样本,组成的横列的数据表

变量定性: 分类和顺序;变量定量:数值

数学公式的角度分为: 因变量与自变量

时间序列分析代写

随机过程,是依赖于参数的一组随机变量的全体,参数通常是时间。 随机变量是随机现象的数量表现,其时间序列是一组按照时间发生先后顺序进行排列的数据点序列。通常一组时间序列的时间间隔为一恒定值(如1秒,5分钟,12小时,7天,1年),因此时间序列可以作为离散时间数据进行分析处理。研究时间序列数据的意义在于现实中,往往需要研究某个事物其随时间发展变化的规律。这就需要通过研究该事物过去发展的历史记录,以得到其自身发展的规律。

回归分析代写

多元回归分析渐进(Multiple Regression Analysis Asymptotics)属于计量经济学领域,主要是一种数学上的统计分析方法,可以分析复杂情况下各影响因素的数学关系,在自然科学、社会和经济学等多个领域内应用广泛。

MATLAB代写

MATLAB 是一种用于技术计算的高性能语言。它将计算、可视化和编程集成在一个易于使用的环境中,其中问题和解决方案以熟悉的数学符号表示。典型用途包括:数学和计算算法开发建模、仿真和原型制作数据分析、探索和可视化科学和工程图形应用程序开发,包括图形用户界面构建MATLAB 是一个交互式系统,其基本数据元素是一个不需要维度的数组。这使您可以解决许多技术计算问题,尤其是那些具有矩阵和向量公式的问题,而只需用 C 或 Fortran 等标量非交互式语言编写程序所需的时间的一小部分。MATLAB 名称代表矩阵实验室。MATLAB 最初的编写目的是提供对由 LINPACK 和 EISPACK 项目开发的矩阵软件的轻松访问,这两个项目共同代表了矩阵计算软件的最新技术。MATLAB 经过多年的发展,得到了许多用户的投入。在大学环境中,它是数学、工程和科学入门和高级课程的标准教学工具。在工业领域,MATLAB 是高效研究、开发和分析的首选工具。MATLAB 具有一系列称为工具箱的特定于应用程序的解决方案。对于大多数 MATLAB 用户来说非常重要,工具箱允许您学习和应用专业技术。工具箱是 MATLAB 函数(M 文件)的综合集合,可扩展 MATLAB 环境以解决特定类别的问题。可用工具箱的领域包括信号处理、控制系统、神经网络、模糊逻辑、小波、仿真等。