如果你也在 怎样代写金融计量经济学Financial Econometrics 这个学科遇到相关的难题,请随时右上角联系我们的24/7代写客服。金融计量经济学Financial Econometrics是使用统计方法来发展理论或检验经济学或金融学的现有假设。计量经济学依靠的是回归模型和无效假设检验等技术。计量经济学也可用于尝试预测未来的经济或金融趋势。

金融计量经济学Financial Econometrics的一个基本工具是多元线性回归模型。计量经济学理论使用统计理论和数理统计来评估和发展计量经济学方法。计量经济学家试图找到具有理想统计特性的估计器,包括无偏性、效率和一致性。应用计量经济学使用理论计量经济学和现实世界的数据来评估经济理论,开发计量经济学模型,分析经济历史和预测。

statistics-lab™ 为您的留学生涯保驾护航 在代写计量经济学Econometrics方面已经树立了自己的口碑, 保证靠谱, 高质且原创的统计Statistics代写服务。我们的专家在代写计量经济学Econometrics代写方面经验极为丰富,各种代写计量经济学Econometrics相关的作业也就用不着说。

经济代写|计量经济学代写Econometrics代考|Futures Prices and Hedging Demand

Most studies relating CIT trade positions to commodity prices presume that CIT (demand side) initiate the trades and Granger causes the futures price rises. However, CIT positions also reflect producers’ hedging needs (supply side). We need here an identification strategy designed to identify a CIT demand shock in view to assess the genuine contribution of CIT investors to the price evolution. Cheng et al. (2015) used fluctuations in the VIX to isolate trades initiated by CITs and found a positive correlation between CIT position changes and futures prices. Henderson et al. (2015) used commodity-linked note (CLN) issuances to similarly identify trade initiated by financial traders. They found that financial traders “have significantly positive and economically meaningful impacts on commodity futures prices around the pricing dates of the CLNs when the hedge trades are executed and significantly negative price impacts around the determination dates when the hedge trades are unwounded.”

4.4.2 Spot Prices and Macro-Driven Boom

If large inflows of institutional investors on commodity markets can affect the commodity futures prices, the reverse is also true. Indeed, rising commodity prices also attract institutional investors. Most papers based on correlation measures are subject to this endogeneity concern.

Tang and Xiong (2012) studied the correlation of non-energy commodity returns with oil returns and propose a solution. They analyze separately the commodities included in the S\&P GSCI and DJ-UBSCI (treatment group) and the commodities excluded from these indices (control group). They found that the commodities of the treatment group, which are presumed to be subject to commodity index traders’ purchases, had a rise in their correlation with oil returns significantly larger than the one of the commodities in the control group.

As an alternative, Kilian and Murphy (2014) deal with reverse causality by relying on structural VAR modelling and sign restrictions as identification strategy. They use monthly “the percent change in global oil production, a measure of cyclical variation in global real activity, the real price of crude oil, and the change in above-ground global crude oil inventories. The model is identified based on a combination of sign restrictions and bounds on the short-run price elasticities of oil demand and oil supply.”

经济代写|计量经济学代写Econometrics代考|De-Financialization

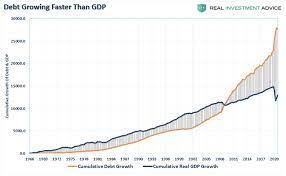

Weekly futures open interest as reported in CFTC’s CoT fell by $50 \%$ in 2008 but has then recovered and is currently far above its pre-crisis levels. However, all indicators do not support the belief of a constantly rising financialization. The BIS notional value of outstanding OTC commodity derivatives has collapsed from USD 14.1 trillion in 2008 to USD 2.1 trillion in 2019, now stable for more than five years. In addition, the composition of the open interest (in terms of producer, swap dealer, money managers, pother reportable) has remained remarkably stable since 2006 (see Fig. 9 in Bhardwaj et al. 2015).

Further, the presumed effects on financialization on inter-commodity correlation and equity-commodity correlations have vanished as documented via simple rolling correlations in Bhardwaj et al. (2015) and via the explanatory power of multifactor models in Christoffersen et al. (2019). Zhang et al. (2017) explicitly raise the question of “de-financialization,” measured as correlation between equity market and oil and gas markets. Based on a variance-threshold dynamic correlation model, they conclude that financialization persists since 2008.

Discussion

The literature on financialization of commodity markets is challenged by the difficulty to identify the exogenous contribution of financial investors to commodity prices. A clear rise of correlation among commodity prices and between commodity and equity prices has been documented by many from 2004 to around 2010, but only few papers were explicitly accounting for reverse causality (rising prices attract investors) or for hedging supply-demand determination (do financial investors go long because commodity hedgers are on the rise). Those that develop original identification strategy (Tang and Xiong (2012), Cheng et al. (2015), Henderson et al. (2015) among others) show that the debate on the persistent effects of financialization ten years after the financial crisis remains open.

计量经济学代考

经济代写|计量经济学代写Econometrics代考|Futures Prices and Hedging Demand

大多数关于CIT交易头寸与商品价格关系的研究都假设CIT(需求方)发起交易,格兰杰导致期货价格上涨。然而,CIT头寸也反映了生产商的对冲需求(供应方)。在这里,我们需要一个识别策略,旨在识别CIT需求冲击,以评估CIT投资者对价格演变的真正贡献。Cheng et al.(2015)利用VIX波动分离CIT发起的交易,发现CIT持仓变化与期货价格呈正相关。Henderson等人(2015)使用商品关联票据(CLN)发行来识别金融交易员发起的交易。他们发现,金融交易员“在对冲交易执行时,对cln定价日期前后的商品期货价格有显著的积极和经济意义上的影响,而在对冲交易未受损害的确定日期前后,对价格有显著的负面影响。”

4.4.2现货价格与宏观经济繁荣

如果说机构投资者大量流入大宗商品市场会影响大宗商品期货价格,那么反过来也是如此。事实上,不断上涨的大宗商品价格也吸引了机构投资者。大多数基于相关度量的论文都受到这种内生性的关注。

Tang and Xiong(2012)研究了非能源商品收益与石油收益的相关性,并提出了解决方案。他们分别分析了纳入S\&P GSCI和DJ-UBSCI的商品(治疗组)和未纳入这些指数的商品(对照组)。他们发现,假设受商品指数交易员购买影响的实验组的商品,其与石油收益的相关性上升幅度明显大于对照组的商品。

作为替代方案,Kilian和Murphy(2014)通过依赖结构性VAR模型和符号限制作为识别策略来处理反向因果关系。他们使用全球石油产量的月度变化百分比,这是衡量全球实际活动、原油实际价格和全球原油库存变化的周期性变化的指标。该模型是基于石油需求和石油供应的短期价格弹性的符号限制和界限的组合来确定的。”

经济代写|计量经济学代写Econometrics代考|De-Financialization

CFTC的CoT报告的每周期货未平仓合约在2008年下跌了50%,但随后有所回升,目前远高于危机前的水平。然而,并非所有指标都支持金融化持续上升的观点。国际清算银行未结算场外商品衍生品的名义价值已从2008年的14.1万亿美元暴跌至2019年的2.1万亿美元,目前已稳定五年多。此外,自2006年以来,未平仓合约的构成(就生产商、掉期交易商、资金经理、其他可报告方而言)保持了非常稳定(见Bhardwaj et al. 2015的图9)。

此外,Bhardwaj等人(2015)和Christoffersen等人(2019)通过简单滚动相关性和多因素模型的解释力证明,金融化对商品间相关性和股票-商品相关性的假设影响已经消失。Zhang等人(2017)明确提出了“去金融化”的问题,以股票市场与石油和天然气市场之间的相关性来衡量。基于方差-阈值动态相关模型,他们得出结论,金融化自2008年以来持续存在。

讨论

关于商品市场金融化的文献受到难以确定金融投资者对商品价格的外生贡献的挑战。从2004年到2010年左右,大宗商品价格之间以及大宗商品和股票价格之间的相关性明显上升,但只有少数论文明确说明了反向因果关系(价格上涨吸引投资者)或对冲供需决定(金融投资者是否因为大宗商品对冲者的数量上升而做多)。那些制定原始识别策略的人(Tang and Xiong (2012), Cheng et al. (2015), Henderson et al.(2015)等)表明,关于金融危机十年后金融化的持续影响的争论仍然存在。

统计代写请认准statistics-lab™. statistics-lab™为您的留学生涯保驾护航。